FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

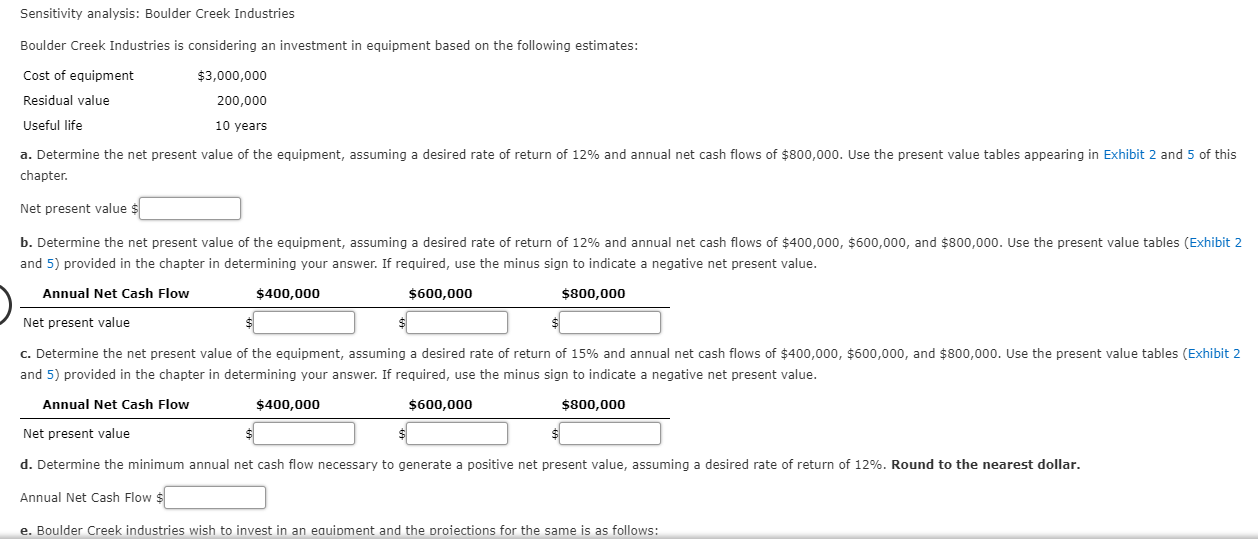

Transcribed Image Text:Sensitivity analysis: Boulder Creek Industries

Boulder Creek Industries is considering an investment in equipment based on the following estimates:

Cost of equipment

$3,000,000

Residual value

200,000

Useful life

10 years

a. Determine the net present value of the equipment, assuming a desired rate of return of 12% and annual net cash flows of $800,000. Use the present value tables appearing in Exhibit 2 and 5 of this

chapter.

Net present val ue $

b. Determine the net present value of the equipment, assuming a desired rate of return of 12% and annual net cash flows of $400,000, $600,000, and $800,000. Use the present value tables (Exhibit 2

and 5) provided in the chapter in determining your answer. If required, use the minus sign to indicate a negative net present value.

Annual Net Cash Flow

$800,000

$400,000

$600,000

Net present value

C. Determine the net present value of the equipment, assuming a desired rate of return of 15% and annual net cash flows of $400,000, $600,000, and $800,000. Use the present value tables (Exhibit 2

and 5) provided in the chapter in determining your answer. If required, use the minus sign to indicate a negative net present value.

$800,000

Annual Net Cash Flow

$400,000

$600,000

Net present value

d. Determine the minimum annual net cash flow necessary to generate a positive net present value, assuming a desired rate of return of 12%. Round to the nearest dollar.

Annual Net Cash Flow $

e. Boulder Creek industries wish to invest in an eauipment and the proiections for the same is as follows:

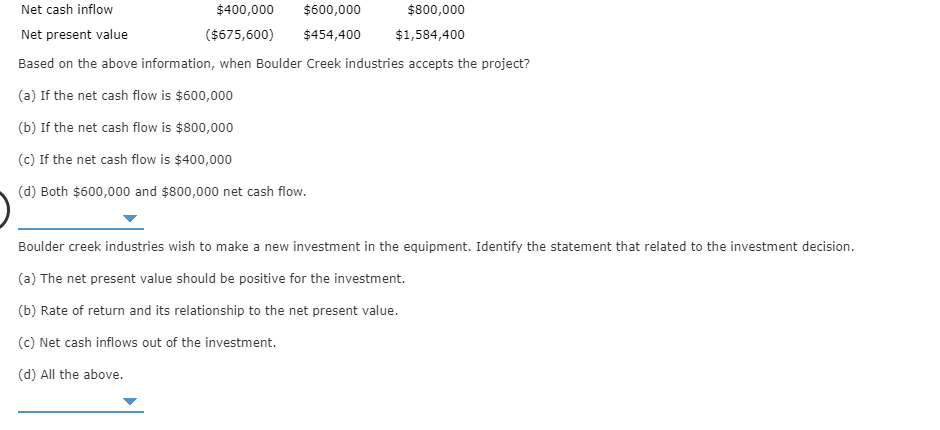

Transcribed Image Text:Net cash inflow

$400,000

$600,000

$800,000

Net present value

($675,600)

$454,400

$1,584,400

Based on the above information, when Boulder Creek industries accepts the project?

(a) If the net cash flow is $600,000

(b) If the net cash flow is $800,000

(c) If the net cash flow is $400,000

(d) Both $600,000 and $800,000 net cash flow.

Boulder creek industries wish to make a new investment in the equipment. Identify the statement that related to the investment decision.

(a) The net present value should be positive for the investment.

(b) Rate of return and its relationship to the net present value.

(c) Net cash inflows out of the investment.

(d) All the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 8 steps with 6 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

d. Determine the minimum annual net cash flow necessary to generate a positive

Annual Net Cash Flow fill in the blank 1 of 1$

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

d. Determine the minimum annual net cash flow necessary to generate a positive

Annual Net Cash Flow fill in the blank 1 of 1$

Solution

by Bartleby Expert

Knowledge Booster

Similar questions

- Compare the Annual Worth of the two systems and identify the better option at MARR = 10% per year: Solar: First cost $1,500,000; AOC $-700,000; Salvage value $100,000; Life of 8 years Geothermal: First cost $2,250,000; AOC $-600,000; Salvage value $50,000; Life of 8 years Select the Geothermal System with a calculated AW of $-1,017,368 Select the Geothermal System with a calculated AW of $-727,591 Select the Solar System with a calculated AW of $-1,238, Select the Solar System with a calculated AW of $-972,416arrow_forwardThe production department is proposing the purchase ONE automatic insertion machine. It has identified three machines (A, B and C). Each machine has an estimated useful life of 10 years. minimum desired rate of return of 10%. The accountant has identified the following data: Machine A Machine B Machine C Present value of future cash flows computed using 10% rate of return $305,000 $295,000 $300,500 Amount of initial investment 300,000 300,000 300,000 Based on net present value method, which machine do you recommend?arrow_forwardHarris Corporation has provided the following data concerning an investment project that it is considering: Initial investment Annual cash flow Salvage value at the end of the project Expected life of the project Discount rate $ 160,000 $ 54,000 $ 11,000 O $67,000 O $160,516 O $516 O $(5,776) 4 15 per year years % Use Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided. The net present value of the project is closest to:arrow_forward

- Required information A company that manufactures magnetic flow meters expects to undertake a project that will have the cash flows estimated. First cost, $ Equipment replacement cost in year 2, $ Annual operating cost, $/year Salvage value, $ Life, years -880,000 -300,000 -930,000 250,000 14 At an interest rate of 10% per year, what is the equivalent annual cost of the project? Find the AW value using tabulated factors The equivalent annual cost of the project is $- 980,731.95arrow_forwardThe following data are accumulated by Lone Star Security in evaluating two competing investment proposals. Category Surveillance Equipment Patrol Truck Amount of Investment $40,500 $55,000 Useful life 8 years 11 years Estimated residual value $3,000 $6,000 Estimated total income over the useful life $25,000 $38,700 Determine the expected average rate of return for each proposal. Year Net Income Net Cash Flow Year 1 $43,500 $81,000 Year 2 26,500 64,000 Year 3 13,500 50,500 Year 4 2,900 40,000 The following data are accumulated by Geddes Company in evaluating the purchase of $150,000 of equipment, having a four-year useful life: Assuming that the desired rate of return is 15%, determine the net present value for the proposal. Use the table of the present value of $1 appearing in Exhibit 2 of this chapter. Would management be likely to look with favor on the proposal? Explain.arrow_forwardTechnology Innovations is planning to purchase one of two chip insertion machines. Due to the pace of technological change in this area, it is realistic to assume that these are one-shot investments. The expected cash flows for each machine are shown below. MARR is 8%/year. Based on a present worth analysis, which machine is preferred?arrow_forward

- The expected average rate of return for a proposed investment of $6,720,000 in a fixed asset, using straight-line depreciation, a useful life of 20 years, no residual value, and an expected total income of $20,160,000 over the 20 years, is (round to two decimal places) a. 1.50% b. 30.00% c. 60.00% d. 15.00%arrow_forwardHow do you calculate net investment in working capital, net cash flows, present value of net cash flows, and NPV? WACC is 10.10%arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education