FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

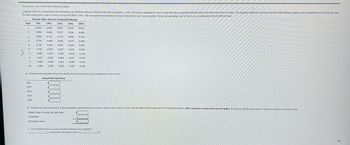

Transcribed Image Text:Net present value method for a service company

Coast-to-Coast Inc. is considering the purchase of an additional delivery vehicle for $39,000 on January 1, 20Y1. The truck is expected to have a 5-year life with an expected residual value of $7,000 at the end of 5 years. The expected additional revenues from the added delivery capacity are anticipated to be $77,000 per year

for each of the next 5 years. A driver will cost $55,000 in 20Y1, with an expected annual salary increase of $4,000 for each year thereafter. The annual operating costs for the truck are estimated to be $3,000 per year.

Present Value of $1 at Compound Interest

Year

6%

10%

12%

15%

20%

1

0.943

0.909

0.893

0.870

0.833

2

0.890

0.826

0.797

0.756

0.694

3

0.840

0.751

0.712

0.658

0.579

4

0.792

0.683

0.636

0.572

0.482

5

0.747

0.621

0.567

0.497

0.402

6

0.705

0.564

0.507

0.432

0.335

7

0.665

0.513

0.452

0.376

0.279

8

00

0.627

0.467

0.404

0.327

0.233

9

0.592

0.424

0.361

0.284

0.194

10

0.558

0.386

0.322

0.247

0.162

a. Determine the expected annual net cash flows from the delivery truck investment for 20Y1-20Y5.

Annual Net Cash Flow

20Y1

20Y2

20Y3

20Y4

20Y5

b. Compute the net present value of the investment, assuming that the minimum desired rate of return is 20%. Use the table of the present value of $1 presented above. When required, round to the nearest dollar. If required, use the minus sign to indicate a negative net present value.

Present value of annual net cash flows

Investment

Net present value

c. Is the additional truck a good investment based on your analysis?

because the net present value is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A three-year-old small crane is being considered for early replacement. Its current market value is $17,500. Estimated future market values and annual operating costs for the next five years are given in the table below. What is the economic life for this crane if the interest rate is 5.1% per year? Year 0 Market Value Annual Operating Cost $17,500 1 $15,110 $4,700 2 $12,930 $4,809 3 $10,110 $4,883 4 $7,400 $4,997 5 $- $5,095arrow_forwardFactor Company is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at a $495,000 cost with an expected four-year life and a $10,000 salvage value. Additional annual information for this new product line follows. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Machinery Selling, general, and administrative expenses Required: 1. Determine income and net cash flow for each year of this machine's life. $ 1,960,000 1,502,000 121,250 167,000 2. Compute this machine's payback period, assuming that cash flows occur evenly throughout each year. 3. Compute net present value for this machine using a discount rate of 8%. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Determine income and net cash flow for each year of this machine's…arrow_forwardCentral Mass Ambulance Service can purchase a new ambulance for $200,000 that will provide an annual net cash flow of $50,000 per year for five years. The salvage value of the ambulance will be $25,000. Assume the ambulance is sold at the end of year 5. Calculate the NPV of the ambulance if the required rate of return is 9%. (Round your answer to the nearest $1.) A) $(10,731) B) $10,731 C) $(5,517) D) $5,517arrow_forward

- A machine was purchased 4 years ago. Its current market value is $14,000. Estimated future market values and annual operating costs for the next 5 years are given in the following table. What is the Economic service life of the machine if a 12% per year return is required? YearMarket Value,$Annual Operating cost,$ 10084 2 2684 2700 3000 3500 4900 1 8084 6000 3 4 2000 5arrow_forwardA company purchase a piece of manufacturing equipment for an additional income. The expected income is $4,500 per semester. Its useful ife is 9 years. Expenses are estimated to be $500 semiannually if the purchase price is $44,000 and there is a salvage value of $4,500, what is the prospective rate of return (RR) of this investment? The MARR is 10% compounded semiannually Oa IRR-602% semiannual Oh IRR-3% semiannual ORR-12% semiannual Od IRR-6.23% semiannualarrow_forwardFactor Company is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at a $491,000 cost with an expected four-year life and a $20,000 salvage value. Additional annual information for this new product line follows. (PV of $1. EV of $1. PVA of $1, and EVA of $1) (Use appropriate factor(s) from the tables provided.) Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Machinery Selling, general, and administrative expenses Required: 1. Determine income and net cash flow for each year of this machine's life. 2. Compute this machine's payback period, assuming that cash flows occur evenly throughout each year. 3. Compute net present value for this machine using a discount rate of 7%. $ 1,990,000 1,509,000 117,750 162,000 Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute net present value…arrow_forward

- HT Bowling, Inc is considering the purchase of VOIP phone system. It will require an initial investment of $29,500 and $9,000 per year in annual operating costs over the equipment's estimated useful life of 4 years. The company will use a discount rate of 11%. What is the equivalent annual cost? $3,460 O $12,623 O $26,810 O $18,509arrow_forwardA four-year-old truck has a present net realizable value of $6,000 and is now expected to have a market value of $1,800 after its remaining three-year life. Its operating disbursements are expected to be $720 per year. An equivalent truck can be leased for $0.40 per mile plus $30 a day for each day the truck is kept. The expected annual utilization is 3,000 miles and 30 days. If the before-tax MARR is 15%, find which alternative is better by comparing before-tax equivalent annual costs. Solve, a. using only the preceding information; b. using further information that the annual cost of having to operate without a truck is $2,000.arrow_forwardClick to see additional instructions A company is considering an investment in a new product with a 10-year horizon (product will be sold for 10 years). The upfront investment is $5 million and it is assumed to depreciate on a straight-line basis for 10 years, with no residual value. Fixed costs are assumed to be $550,000 per year. The company estimates variable cost per unit (v) to be $120 and expects to sell each unit for $425. There are no taxes and the required rate of return is 17% per year. Assume that the investment would occur today, and all future cash-flows will occur at the end of each year beginning in one year. What is the annual financial breakeven quantity? [Keep at least 3 decimals for intermediate answers. Round your final answer UP to the next highest WHOLE unit. (ie 421.2 would be rounded to 422)]arrow_forward

- Rework the given problem, assuming the following additional information:• The machine is classified as a seven-year MACRS recovery period. Thetax rate is 40%. and the after-tax MARR is 10%.arrow_forwardAn investment of $20,000 for a new condenser is being considered. Estimated salvage value of the condenser is $5,000 at the end of an estimated life of 6 years. Annual income each year for the 6 years is $8,500. Annual operating expenses are $2,300. Assume money is worth 15% compounded annually. Determine the external rate of return and whether or not the condenser should be purchased.arrow_forwardSaved Cardinal Company is considering a project that would require a $2,765,000 investment in equipment with a useful life of five years. At the end of five years, the project would terminate and the equipment would be sold for its salvage value of $200,000. The company's discount rate is 12%. The project would provide net operating income each year as follows: Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses $2,861,000 1,101,000 1,760,000 $ 705,000 513,000 03:08:19 1,218,000 $ 542,000 Net operating income Required: What is the project's payback period? (Round your answer to 2 decimal places.) Project's payback period yearsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education