Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

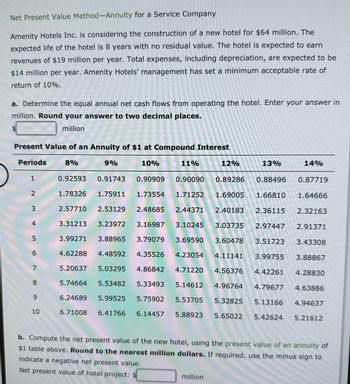

Transcribed Image Text:Net Present Value Method-Annuity for a Service Company

Amenity Hotels Inc. is considering the construction of a new hotel for $64 million. The

expected life of the hotel is 8 years with no residual value. The hotel is expected to earn

revenues of $19 million per year. Total expenses, including depreciation, are expected to be

$14 million per year. Amenity Hotels' management has set a minimum acceptable rate of

return of 10%.

a. Determine the equal annual net cash flows from operating the hotel. Enter your answer in

million. Round your answer to two decimal places.

million

Present Value of an Annuity of $1 at Compound Interest

Periods

8%

10%

0.92593 0.91743 0.90909

0.90090 0.89286 0.88496

1.78326 1.75911

1.73554

1.71252

1.69005 1.66810

2.57710 2.53129

2.48685 2.44371

2.40183 2.36115

3.31213 3.23972

3.16987

3.10245

3.03735 2.97447

3.99271 3.88965

3.79079 3.69590

3.60478

3.51723

3.43308

4.62288 4.48592

4.35526

4.23054

4.11141 3.99755 3.88867

5.20637 5.03295

4.86842 4.71220

4.56376

4.28830

5.74664 5.53482

5.33493 5.14612

4.96764

4.79677

4.63886

5.75902 5.53705

5.32825

5.13166 4.94637

6.24689 5.99525

6.71008 6.41766 6.14457 5.88923 5.65022 5.42624 5.21612

1

2

3

4

5

6

7

8

9

10

9%

11%

12%

million

13%

4.42261

14%

0.87719

1.64666

2.32163

2.91371

b. Compute the net present value of the new hotel, using the present value of an annuity of

$1 table above. Round to the nearest million dollars. If required, use the minus sign to

indicate a negative net present value.

Net present value of hotel project: $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please help me. Thankyou.arrow_forwardNet Present Value A project has estimated annual net cash flows of $7,500 for three years and is estimated to cost $45,000. Assume a minimum acceptable rate of return of 10%. Use the Present Value of an Annuity of $1 at Compound Interest table below. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 Determine (a) the net present value of the project and (b) the present value index. If required, use the minus sign to indicate a negative net present value. Net present value of the project (round to the nearest dollar) Present value index (rounded to two decimal places)arrow_forwardPlease show complete steps all parts or skip itarrow_forward

- 1. A mechanical device will cost $30,000 when purchased. Maintenance will cost $2,000 each year. The device will generate revenues of $5,000 each year for five years. At the end of the fifth year, the salvage value of the device is $6,500. Draw and simplify the cash flow diagram. Calculate: (a) the present value and (b) the equivalent annual cost of the cash flows using a discount rate of 12%.arrow_forwardA $350,000 capital investment proposal has an estimated life of four years and no residual value. The estimated net cash flows are as follows: Year Net Cash Flow 1 $150,000 2 130,000 3 104,000 4 90,000 The minimum desired rate of return for net present value analysis is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is 0.893, 0.797, 0.712, and 0.636, respectively. Determine the net present value.$fill in the blank 1arrow_forwardProject A requires an original investment of $64,300. The project will yield cash flows of $19,600 per year for seven years. Project B has a calculated net present value of $3,760 over a four-year life. Project A could be sold at the end of four years for a price of $14,000. Below is a table for the present value of $1 at Compound interest. Year 6% 10% 12% 1 0.943 0.909 0.893 2 0.890 0.826 0.797 3 0.840 0.751 0.712 4 0.792 0.683 0.636 5 0.747 0.621 0.567 Below is a table for the present value of an annuity of $1 at compound interest. Year 6% 10% 12% 1 0.943 0.909 0.893 2 1.833 1.736 1.690 3 2.673 2.487 2.402 4 3.465 3.170 3.037 5 4.212 3.791 3.605 Use the tables above. (a) Using the present value tables above, determine the net present value of Project A over a four-year life with salvage value assuming a minimum rate of return of 12%. Round your answer to two decimal places. Enter negative values as negative numbers.$fill in the blank 1 (b) Which…arrow_forward

- Capital Investment Analysis: Spanish Peaks Railroad Incarrow_forwardPRESENT AND FUTURE VALUES OF A CASH FLOW STREAM An investment will pay $150 at the end of each of the next 3 years, $250 at the end of Year 4, $350 at the end of Year 5, and $550 at the end of Year 6. a. If other investments of equal risk earn 10% annually, what is its present value? Round your answer to the nearest cent. $ b. If other investments of equal risk earn 10% annually, what is its future value? Round your answer to the nearest cent. $arrow_forwardNet Present Value—Unequal Lives Project 1 requires an original investment of $63,800. The project will yield cash flows of $13,000 per year for five years. Project 2 has a calculated net present value of $15,600 over a three-year life. Project 1 could be sold at the end of three years for a price of $56,000. Use the Present Value of $1 at Compound Interest and the Present Value of an Annuity of $1 at Compound Interest tables shown below. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690…arrow_forward

- Incognito Company is contemplating the purchase of a machine that provides it with cash savings of $93,000 per year for five years. Interest is 11%. Assume the cash savings.occur at the end of each year. Required: Calculate the present value of the cash savings. Note: Use tables, Excel, or a financial calculator. Round your final answer to the nearest whole dollar. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Present valuearrow_forwardNet Present Value A project has estimated annual net cash flows of $13,750 for three years and is estimated to cost $30,000. Assume a minimum acceptable rate of return of 15%. Use the Present Value of an Annuity of $1 at Compound Interest table below. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 Determine (a) the net present value of the project and (b) the present value index. If required, use the minus sign to indicate a negative net present value. Net present value of the project (round to the nearest dollar) Present value index (rounded to two decimal places)arrow_forwardNet Present Value A project has estimated annual net cash flows of $6,250 for eight years and is estimated to cost $37,500. Assume a minimum acceptable rate of return of 15%. Use the Present Value of an Annuity of $1 at Compound Interest table below. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9. 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 Determine (a) the net present value of the project and (b) the present value index. If required, use the minus sign to indicate a negative net present value. Net present value of the project (round to the nearest dollar) Present value index (rounded to two decimal places) Feedback V Check My Work a. Multiply the present value factor for an annuity of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education