Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

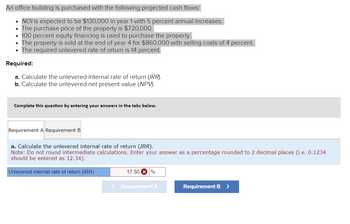

Transcribed Image Text:An office building is purchased with the following projected cash flows:

•

NOI is expected to be $130,000 in year 1 with 5 percent annual increases.

• The purchase price of the property is $720,000.

•

100 percent equity financing is used to purchase the property.

The property is sold at the end of year 4 for $860,000 with selling costs of 4 percent.

⚫ The required unlevered rate of return is 14 percent.

Required:

a. Calculate the unlevered internal rate of return (IRR).

b. Calculate the unlevered net present value (NPV).

Complete this question by entering your answers in the tabs below.

Requirement A Requirement B

a. Calculate the unlevered internal rate of return (IRR).

Note: Do not round intermediate calculations. Enter your answer as a percentage rounded to 2 decimal places (i.e. 0.1234

should be entered as 12.34).

Unlevered internal rate of return (IRR)

17.50 ×%

< Requirement A

Requirement B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- An owner can lease her building for 100,000 per year for three years.aThe explicit cost of maintaining the building is cost 35,000 and the implicit cost is 50,000.All revenue are received and cost are borne at the end of each year.If the interest rate is 4 percent,determine the present value of the stream of: (I) accounting profit(II) ecenomic profitsarrow_forwardSuppose an industrial building can be purchased for $2,500,000 and is expected to yield cash flows of $180,000 in each of the next five years. (Note: assume payments are made at end of year.) If the building can be sold at the end of the fifth year for $2,800,000, calculate the IRR for this investment over the five-year holding period. A) 0.09%. B) 4.57%. C) 9.20%. Page 4 of 6 D) 10.37%arrow_forwardCan anyone help me to answer this ?arrow_forward

- Vishuarrow_forwardCaddis Company acquired a building with a loan that requires payments of $19,000 every six months for 3 years. The annual interest rate on the loan is 8%. What is the present value of the building? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Multiple Choice O O O O $99,600 $114,000 $38,988 $65,402 $48,965arrow_forwardTom Thompson expects to invest $17,000 at 9% and, at the end of a certain period, receive $43,867. How many years will it be before Thompson receives the payment? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) Future Value Present Value Table Factor Years yearsarrow_forward

- The annual debt service on a property is $25,000 and the pre-tax cash flow is $50,000. If the mortgage capitalization rate is 8.5% and the overall rate is 10%, what is the indicated value of the property?arrow_forwardProject A costs $5,300 and will generate annual after-tax net cash inflows of $1,900 for five years. What is the NPV using 5% as the discount rate? Round your present value factor to three decimal places and final answer to the nearest dollar. (Click here to see present value and future value tables) 2,928 xarrow_forwardA.4arrow_forward

- Please answer completearrow_forwardTom Thompson expects to invest $18,000 at 9% and, at the end of a certain period, receive $92,551. How many years will it be before Thompson receives the payment? (PV of $1. FV of $1. PVA of $1. and EVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) Future Value $ 92,551 Present Value $ 18,000 = Table Factor Years yearsarrow_forwardA firm, whose cost of capital is 8 percent, may acquire equipment for $146,825 and rent it to someone for a period of five years. Note: Although payment of rent is typically considered to be an annuity due, treat it as an ordinary annuity when completing this problem in a spreadsheet or when using present value factors. If the firm charges $38,730 annually to rent the equipment, what are the net present value and the internal rate of return on the investment? Use Appendix D to answer the questions. Use a minus sign to enter negative values, if any. Round your answers for the net present value to the nearest dollar and for the internal rate of return to the nearest whole number. NPV: $ IRR: % Should the firm acquire the equipment? The firm acquire the equipment as the net present value is , and the internal rate of return the firm's cost of capital. If the equipment has no estimated residual value, what must be the minimum annual rental charge for the firm to earn the required 8…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education