Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

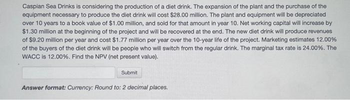

Transcribed Image Text:Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the

equipment necessary to produce the diet drink will cost $28.00 million. The plant and equipment will be depreciated

over 10 years to a book value of $1.00 million, and sold for that amount in year 10. Net working capital will increase by

$1.30 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues

of $9.20 million per year and cost $1.77 million per year over the 10-year life of the project. Marketing estimates 12.00%

of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 24.00%. The

WACC is 12.00%. Find the NPV (net present value).

Submit

Answer format: Currency: Round to: 2 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The Fizzy Beverage Co. is considering two alternative capital projects. Project 1: expansion of its existing traditional line of Fizzy beverages. Project 2: introduction of a new “healthy” line of beverages. The company has already spent $1,400,000 on research into the feasibility of these projects and has arrived at the following financial projections. · Both projects are estimated to have a life of 5 years. The required fixed asset investment or capital spending for project 1 is $30,000,000 and for project 2 is $35,000,000. Fixed assets will be depreciated straight line to zero. Fixed asset salvage value estimate for project 1 is $6,200,000 and for project 2 is $8,500,000 · In order to support anticipated sales, either project will require an increase in inventory of $8,600,000, an increase in accounts receivable of $2,800,000, and an increase in accounts payable of $6,300,000 · Cost of goods sold is projected at 35% of sales for either project. Selling,…arrow_forwardCaspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines. This new equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $13.00 million fully installed and will be fully depreciated over a 15 year life, then removed for no cost. The RGM-7000 will result in additional revenues of $3.37 million per year and increased operating costs of $612,883.00 per year. Caspian Sea Drinks' marginal tax rate is 28.00%. The internal rate of return for the RGM-7000 is Submit Answer format: Percentage Round to: 4 decimal places (Example: 9.2434%, % sign required. Will accept decimal format rounded to 6 decimal places (ex: 0.092434))arrow_forwardCrane Company is considering buying a new farm that it plans to operate for 10 years. The farm will require an initial investment of $11.85 million. This investment will consist of $2.70 million for land and $9.15 million for trucks and other equipment. The land, all trucks, and all other equipment are expected to be sold at the end of 10 years for a price of $5.05 million, which is $2.50 million above book value. The farm is expected to produce revenue of $2.00 million each year, and annual cash flow from operations equals $1.80 million. The marginal tax rate is 35 percent, and the appropriate discount rate is 10 percent. Calculate the NPV of this investment. (Do not round factor values. Round final answer to 2 decimal places, e.g. 15.25.) NPV The project should bearrow_forward

- Ivanhoe Company is considering buying a new farm that it plans to operate for 10 years. The farm will require an initial investment of $11.85 million. This investment will consist of $2.15 million for land and $9.70 million for trucks and other equipment. The land, all trucks, and all other equipment are expected to be sold at the end of 10 years for a price of $5.25 million, which is $2.00 million above book value. The farm is expected to produce revenue of $2.10 million each year, and annual cash flow from operations equals $1.90 million. The marginal tax rate is 25 percent, and the appropriate discount rate is 10 percent. Calculate the NPV of this investment? (Do not round factor values. Round final answer to 2 decimal places, e.g. 15.25.)arrow_forwardPurple Haze Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $526,528 is estimated to result in some amount of annual pretax cost savings. The press will have an aftertax salvage value at the end of the project of $86,879. The OCFS of the project during the 4 years are $170,654, $199,481, $175,232 and $169,873, respectively. The press also requires an initial investment in spare parts inventory of $23, 482, along with an additional $1,631 in inventory for each succeeding year of the project. The shop's discount rate is 6 percent. What is the NPV for this project?arrow_forwardCaspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines. This new equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $13.00 million fully installed and will be fully depreciated over a 20 year life, then removed for no cost. The RGM-7000 will result in additional revenues of $3.89 million per year and increased operating costs of $548,726.00 per year. Caspian Sea Drinks' marginal tax rate is 32.00%. If Caspian Sea Drinks uses a 8.00% discount rate, then the net present value of the RGM-7000 is _____. (ROUND TO 4 DECIMAL PLACES)arrow_forward

- Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $28.00 million. The plant and equipment will be depreciated over 10 years to a book value of $1.00 million, and sold for that amount in year 10. Net working capital will increase by $1.29 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $9.46 million per year and cost $1.84 million per year over the 10-year life of the project. Marketing estimates 13.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 22.00%. The WACC is 15.00%. Find the NPV (net present value). Submit Answer format: Currency: Round to: 2 decimal places.arrow_forwardBullock Gold Mining is evaluating a new gold mine in South Dakota. All of the analysis has been done and the CFO has forecast some of the relevant cash flow information. If BGM opens the mine, it will cost $635 million today (Time 0) and it will have a cash outflow nine years from today (Time 9) of $45 million in costs related to closing the mine and reclaiming the area around. Of the initial costs, BGM will depreciate $500 million over 8 years using straight line method. Expected earnings before taxes for the eight years of operation are shown below. BGM has a required rate of return for all of its gold mines of 12%. Earnings before taxes (in $1,000s): 0 1 2 3 4 5 6 7 8 9 37,857.14 60,714.29 96,428.57 157,857.1 203,571.4 132,142.9 117,857.1 85,000.00 Find the relevant cash flows for each of the relevant periods (Time 0 – Time 9). Calculate the NPV, IRR and Payback Period for the cash flows and indicate whether BGM should…arrow_forwardBlossom Company is considering buying a new farm that it plans to operate for 10 years. The farm will require an initial investment of $11.80 million. This investment will consist of $2.00 million for land and $9.80 million for trucks and other equipment. The land, all trucks, and all other equipment are expected to be sold at the end of 10 years for a price of $5.00 million, which is $2.00 million above book value. The farm is expected to produce revenue of $2.00 million each year, and annual cash flow from operations equals $1.90 million. The marginal tax rate is 25 percent, and the appropriate discount rate is 9 percent. Calculate the NPV of this investment. (Do not round factor values. Round final answer to 2 decimal places, e.g. 5,275.25.) NPV $ The project should bearrow_forward

- Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines. This new equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $13.00 million fully installed and will be fully depreciated over a 16.00 year life, then removed for no cost. The RGM-7000 will result in additional revenues of $3.09 million per year and increased operating costs of $680,871.00 per year. Caspian Sea Drinks' marginal tax rate is 33.00%. The incremental cash flows for produced by the RGM-7000 are Submit Answer format: Currency: Round to: 2 decimal places.arrow_forwardIndustrial Industries is considering opening a new 5 year project. The project will require investments in property, plant, and equipment totalling $75 million and an initial investment in net working capital of $20 million. The operating cash flows are expected to be $15 million the first year and are expected to increase by $5 million in each of the four remaining years. At the end of the project, they will recover the net working capital, and they expect to sell their equipment, producing an after tax cash flow of $15 million. Based on the riskiness of the project, they require a return of 17.5%. What is the NPV of this project? Question 2 options: $(5,504,371) $(5,344,049) $(4,916,526) $(5,611,252) $(5,130,287)arrow_forwardFossa Road Paving Corporation is considering an investment in a curb-forming machine. The machine will cost $240,000, will last 10 years, and will have a $40,000 salvage value at the end of 10 years. The machine is expected to generate net cash inflows of $60,000 per year in each of the 10 years. Fossa's discount rate is 18%. The net present value of the proposed investment is closest to (Ignore income taxes.): Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. Multiple Choice $69,640 $37,280 $(48,780) $5,840arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education