Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Hi expert please give me answer general accounting

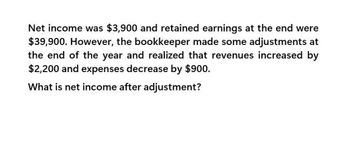

Transcribed Image Text:Net income was $3,900 and retained earnings at the end were

$39,900. However, the bookkeeper made some adjustments at

the end of the year and realized that revenues increased by

$2,200 and expenses decrease by $900.

What is net income after adjustment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Consider a comparative Income Statement for a particular company, where the company's results are being presented for two consecutive years. You are reviewing these results, and you notice the following about the comparative results: The comparative revenues (all revenues) increased. The comparative expenses (all expenses) increased. The comparative Net Income decreased. What do these observations tell you about the relative change in revenues vs. expenses over the two-year period?arrow_forwardI keep getting the answer 0.119% But it is informing me that this answer is wrong. Return on Total Assets A company reports the following income statement and balance sheet information for the current year: Net income $273,110 Interest expense 48,190 Average total assets 2,700,000 Determine the return on total assets. If required, round the answer to one decimal place.arrow_forwardIn the current year, Aveeno reported net income of $54,880, which was a 12% increase over prior year net income. Compute prior year net income. Prior year net incomearrow_forward

- Blossom Company's accounts receivable account balance was $112000 at the beginning of the year and $131992 at the end of the year. Blossom's percentage change calculation at the end of the current year is O 17.85% decrease. O 15.15% decrease. O 15.15% increase. O 17.85% increase.arrow_forwardCan you please solve this accounting question?arrow_forwardExercise 13-5 Determining income effects from common-size and trend percents LO P1, P2 Common-size and trend percents for Rustynail Company's sales, cost of goods sold, and expenses follow. Common-Size Percents 1 Yr Ago 100.0% Trend Percents 1 Yr Ago 103.0% 2 Yrs Ago 100.0% 100.0 100.0 Current Yr 100.0% 2 Yrs Ago 100.0% Current Yr 104.2% Sales Cost of goods sold Total expenses 116.5 105.7 56.6 111.2 63.3 61.1 14.1 100.8 14.3 13.8 Determine the net income for the following years. Did the net income increase, decrease, or remain unchanged in this three-year period? Complete this question by entering your answers in the tabs below. Change in Net Income Net Income Determine the net income for the following years. (Enter all amounts as positive values.) Current Yr 1 Yr Ago 2 Yrs Ago Sales 24 100,000 $ 100,000 $ 100,000 63,300 61,100 56,600 Cost of Goods Sold ... Prev 1 of 8 Next > ...........arrow_forward

- Barga Company's net sales for Year 1 and Year 2 are $665,000 and $743,000, respectively. Its year-end balances of accounts receivable follow: Year 1, $57,000; and Year 2, $97,000. a. Complete the below table to calculate the days' sales uncollected at the end of each year. b. Did days' sales uncollected improve or worsen in Year 2 versus Year 1? Complete this question by entering your answers in the tabs below. Required A Required B Complete the below table to calculate the days' sales uncollected at the end of each year. Note: Do not round intermediate calculations. Round your "Days" Sales Uncollected" answers to 1 decimal place. Year 1: Year 2: Choose Numerator: Days' Sales Uncollected Choose Denominator: X Days = Days' Sales Uncollected X == Days' sales uncollected X days X days Required A Requiredarrow_forwardWhat is summits net income for the year? General accountingarrow_forwardUsing the following information, prepare a vertical analysis of two years' income statements. Fees Earned is $153,500 for Year 2 and $149,700 for Year 1. Operating expenses are $122,800 for Year 2 and $127,245 for Year 1. Which of the following statements is true? O a. Operating expenses have increased as a percent of revenue. O b. Operating income has decreased as a percent of revenue. O c. Operating expenses has remained constant as a percent of revenue. O d. Operating income has increased as a percent of revenue.arrow_forward

- Barga Company's net sales for Year 1 and Year 2 are $663,000 and $749,000, respectively. Its year-end balances of accounts receivable follow: Year 1, $61,000; and Year 2, $98,000. a. Complete the below table to calculate the days' sales uncollected at the end of each year. b. Did days' sales uncollected improve or worsen in Year 2 versus Year 1? Complete this question by entering your answers in the tabs below. Required A Required B Complete the below table to calculate the days' sales uncollected at the end of each year. Note: Do not round intermediate calculations. Round your "Days' Sales Uncollected" answers to 1 decimal place. Year 1: Year 2: Choose Numerator: Accounts receivable $ $ Days' Sales Uncollected 1 Choose Denominator: X /Net sales X 61,000 x 98,000 x 663,000/ $ 749,000/ $arrow_forwardBerry Company reported the following on the company's income statement in two recent years: Current Year Prior Year Interest expense $499,000 $598,800 Income before income tax expense 7,435,100 $9,101,760 a. Determine the number of times interest charges were earned for current Year and prior Year. Round to one decimal place. Current Year Prior Year b. Is the number of times interest charges are earned improving or declining?arrow_forwardSuppose the balance in the Allowance for Doubtful Accounts at the end of year is a $400 Debit balance before adjustment. The company estimates future uncollectible accounts to be $3,200. At what amount would Bad Debt Expense be reported in the current year's income statement? A. $400 B. $2,800 C. $3,600 D. $3,200arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning