Entrepreneurial Finance

6th Edition

ISBN: 9781337635653

Author: Leach

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Provide correct solution this general accounting question

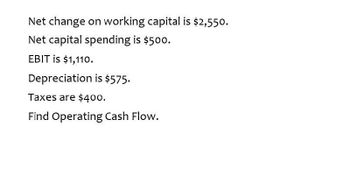

Transcribed Image Text:Net change on working capital is $2,550.

Net capital spending is $500.

EBIT is $1,110.

Depreciation is $575.

Taxes are $400.

Find Operating Cash Flow.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Determine the cash fixed costs which are used when calculating EBDAT: Administrative expenses = $100,000; Rent expenses expenses = $50,000; and Interest expenses = = $70,000; Depreciation $20,000.arrow_forwardGet correct answer general accountingarrow_forward7. The financial statements showed the following: Operating income $2,750,000, Depreciation $1,350,000, Expenditures on fixed assets and net operating working capital $860,000. Tax rate is 35%. Compute for the free cash flow.arrow_forward

- Please Given answer Accountingarrow_forwardGiven the following data for Year-1: (EBIT-taxes)=$5 million; Depreciation=$2 million; Capital expenditures=$4 million; Working capital expenditures=$1 million. Calculate the free cash flow (FCF) for Year-1: a. $11 million O b. $2 million C. $3 million O d. $7 million.arrow_forwardIf the OCF is $500; Net Capital Spending = $450; and Additions to NWC = $200; Find the Cash Flow from Assets.arrow_forward

- Calculate cash flow operating leverage on these financial accounting questionarrow_forwardGiven the following data for Year 1: Earnings before Interest and Tax = $11 million; Interests = $3 million, Taxes = $2 million; Depreciation = $4 million; Investment in fixed assets = 5 million; Investment net working capital = $1 million. Calculate the free cash flow (FCF) for Year 1: Group of answer choices $8 million $9 million $6 million $7 millionarrow_forwardGiven are the following data for year 1:Revenue = $45 million; Variable cost = $10 million; Fixed cost = $5 million; Depreciation = $1 million; Interest expense = $3 million; Capital expenditure = $12 million; Change in working capital = $2 million. Corporate tax rate is 30%. Calculate the free cash flow to firm (FCFF) for year 1: a. $4.2 million b. $6.3 million c. $7.3 million d. $5.2 millionarrow_forward

- Calculate the operating cash flow based on the following information: A company has EBIT of $10,000, the corporate tax rate is 21%, and depreciation is $7,000. O $7,900 O $17,000 O $14,900 O $2,370arrow_forwardUse the following to determine FCF (Free Cash Flow) for the current year. Assume an effective tax rate of 25%: Revenue COGS (Cost of Goods Sold) Gross Profit Wages Expense Rent and Other Occupancy Expense Depreciation Expense Operating Income Current Assets Accounts Receivable Inventory Total Current Assets Gross Fixed Assets (at historical cost) less: Accumulated Depreciation Net Fixed Assets Total Assets Current Year 100,000 67,000 11,500 15,000 1,000 8,500 5,500 50,000 30,000 20,000 Prior Year 4,200 950 8,200 6,000 46,000 29,000 17,000 Current Liabilities Accounts Payable Wages Payable Enter your answer as a monetary amount rounded to four decimal places, but without the currency symbol. For example, if your answer is $90.1234, enter 90.1234. Show a decrease as a negative figure. Type your answer... 4,500 900arrow_forwardIf cash flow from operating activities is 700,000, tax rate is 30%, and capital expenditure is 80,000, what is free cash flow?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you