Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Calculate

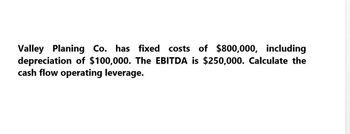

Transcribed Image Text:Valley Planing Co. has fixed costs of $800,000, including

depreciation of $100,000. The EBITDA is $250,000. Calculate the

cash flow operating leverage.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A proposed processing plant requires a fixed-capital investment of Php 9,008,632 and a working capital of Php 1,750,966. Annual depreciation is 6% of the fixed-capital investment. If the annual profit is Php 2,019,826, determine the payback period.arrow_forwardAt an output level of 19,500 units, you have calculated that the degree of operating leverage is 2.92. The operating cash flow is $66,300 in this case. Ignoring the effect of taxes, what are fixed costs? Questionarrow_forwardA proposed new investment has projected sales of $550,000. Variable costs are 40 percent of sales, and fixed costs are $130,500; depreciation is $50,750. Prepare a pro forma income statement assuming a tax rate of 23 percent. What is the projected net income? Answer Sales Variable costs Fixed costs Depreciation EBT Taxes Net incomearrow_forward

- At an output level of 19,500 units, you have calculated that the degree of operating leverage is 2.92. The operating cash flow is $66,300 in this case. Ignoring the effect of taxes, what are fixed costs? Provide answerarrow_forwardA proposed processing plant requires a fixed-capital investment of PhP8,832,292 and a working capital of PhP1,771,426. Annual depreciation is 7% of the fixed-capital investment. If the annual profit is PhP2,167,034, determine the payback period.arrow_forwardn the design of a chemical plant, the following expenditures and revenues are estimated after the plant has achieved its desired production rate. Total capital investment (TCI) : $10 000 000 Working capital investment (WCI) : $1 000 000 Annual sales : $8 000 000 /year Annual expenditures : $2 000 000 /year Assuming straight-line depreciation over a 10-year project analysis period, determine a) The return on the investment after taxes b) The payback periodarrow_forward

- Operating costs are an important criteria when selecting what machinery would be the best choice for a company. What is the EUAW of this investment that costs $53,700, has annual benefits of $8,162/year, annual costs of $1,540/year, and a disposal cost of $4,800 at the end of its useful life? It has a useful life of 14 years. Use a 15% MARR.arrow_forwardA proposed project has fixed costs of $88,000 per year. The operating cash flow at 11,300 units is $116,500. Ignore the effect of taxes. What is the degree of operating leverage?arrow_forwardA proposed new investment has projected sales of $515,000. Variable costs are 36 percent of sales, and fixed costs are $173,000; depreciation is $46,000. Prepare a pro forma income statement assuming a tax rate of 21 percent. What is the projected net income? (Do not round intermediate calculations.) Sales Variable costs Fixed costs Depreciation EBT Taxes Net incomearrow_forward

- A company’s average operating assets are P220,000 and its net operating income is P44,000. The company invested in new project, increasing average assets to P250,000 and increasing net operating income to P49,550. What is the project’s residual income if the required rat of return is 20%?arrow_forwardDescribe the cost formula for a strictly fixed cost such as depreciation of 15,000 per year.arrow_forwardChadron Motors is reviewing a project with sales of 6,200 units, ±2 percent, at a sales price of $29, ±1 percent, per unit. The expected variable cost per unit is $11, ±3 percent, and the expected fixed costs are $85,578, ±1 percent. The depreciation expense is $68,000 and the tax rate is 21 percent. What is the net income under the worst-case scenario? A. $4,696 B. –$28,704 C. $15,846 D. −$39,713 E. −$38,578arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub