Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Financial Accounting Question

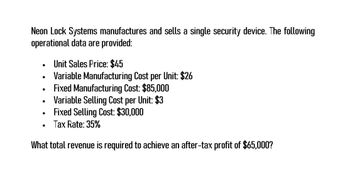

Transcribed Image Text:Neon Lock Systems manufactures and sells a single security device. The following

operational data are provided:

•

Unit Sales Price: $45

•

Variable Manufacturing Cost per Unit: $26

.

Fixed Manufacturing Cost: $85,000

•

Variable Selling Cost per Unit: $3

•

Fixed Selling Cost: $30,000

•

Tax Rate: 35%

What total revenue is required to achieve an after-tax profit of $65,000?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- answer ? : General accountingarrow_forwardZachia Ltd provides the following data regarding its four product lines: Product Sales mix Weighted average contribution margin per unit (WACMU) Fixed costs Desired profit after tax w Y 60 20 15 $13.7 $71,000 $33,950 The corporate tax rate is 30% Required Calculate the number of units of Product X that must be sold in order to achieve the desired after-tax profit?arrow_forwardResearch on a new laptop case indicates that the product can be sold for $40 per unit. Cost analysis provides the following information. Fixed cost per period = $5500 Variable cost per unit = $25 Production capacity per period = 956 units What is the revenue function?arrow_forward

- If the current market price for selling a product at Andrew Materials is $15.50 per unit, and the company wishes to make a 12% profit, what is the target cost? Accounting questionarrow_forwardCan you help me with this question general accounting?arrow_forwardWhat is the gross profit margin % ? Accountingarrow_forward

- Shock Company manufactures computer monitors. The following is a summary of its basic cost and revenue data: Per Unit Percent Sales price $ 460 100.00 Variable costs 237 51.52 Unit contribution margin $ 223 48.48 Assume that Shock Company is currently selling 590 computer monitors per month and monthly fixed costs are $79,800. What is Shock Company's degree of operating leverage (DOL) at this sales volume (i.e., at 590 units)? (Round your answer to three decimal places.) Multiple Choice 2.813. 2.100. 3.325. 2.695. 2.541.arrow_forwardHow much Total sales are required to achieve a net income of 160000?arrow_forwardThe following annual information is for Dexter Corporation: Product A Revenue per unit: $20.00 Variable cost per unit: $15.00 Total fixed costs: $100,000 How many units does the company have to sell to achieve an after tax income of $75,000 if the income tax rate is 25%?arrow_forward

- What is the firm’s margin of safety?arrow_forwardStaley Co. manufactures computer monitors. The following is a summary of its basic cost and revenue data: PerUnit Percent Sales price $ 460 100.00 Variable costs 237 51.52 Unit contribution margin $ 223 48.48 Assume that Staley Co. is currently selling 590 computer monitors per month and monthly fixed costs are $79,800.Staley Co.'s margin of safety ratio (MOS%) if 590 units are sold would be (round intermediate calculation up to nearest whole number of units):arrow_forwardDelta Co. sells a product for $150 per unit. The variable cost per unit is $90 and fixed costs are $15,250. Delta Co.s tax rate is 36% and the company wants to earn $44,000 after taxes. What would be Deltas desired pre-tax income? What would be break-even point in units to reach the income goal of $44,000 after taxes? What would be break-even point in sales dollars to reach the income goal of $44000 after taxes? Create a contribution margin income statement to show that the break-even point calculated in B, generates the desired after-tax income.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning