Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Hi expert please give me answer general accounting question

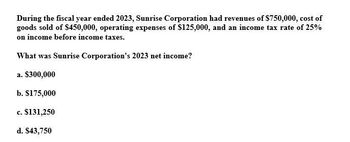

Transcribed Image Text:During the fiscal year ended 2023, Sunrise Corporation had revenues of $750,000, cost of

goods sold of $450,000, operating expenses of $125,000, and an income tax rate of 25%

on income before income taxes.

What was Sunrise Corporation's 2023 net income?

a. $300,000

b. $175,000

c. $131,250

d. $43,750

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Refer to the information for Juroe Company on the previous page. Also, assume that Juroes total assets at the beginning of last year equaled 17,350,000 and that the tax rate applicable to Juroe is 40%. Required: Note: Round answers to two decimal places. 1. Calculate the average total assets. 2. Calculate the return on assets.arrow_forwardI want to correct answer general accounting questionarrow_forwardGeneral accounting questionarrow_forward

- Swifty Incorporated had average total assets in 2025 of $6343000. It reported sales for of $8209000 that year. Average liabilities for the year were $5187000. Net income for the year was $964136. What is Swifty' return on assets for 2025? O 15.20% 18.59% O 11.74% 6.60%arrow_forwardNeed answer the financial accounting questionarrow_forwardCoronado Incorporated had average total assets in 2025 of $6345000. It reported sales for of $8217000 that year. Average liabilities for the year were $5199000. Net income for the year was $958095. What is Coronado' return on assets for 2025? O 15.10 % O 18.43% O 6.52% O 11.66%arrow_forward

- Calculate net incomearrow_forwardBCD Company had sales Revenue of $500,000 for the year 2019. Its cost of goods sold was $240,000, and its operating expenses were $50,000, and administrative expenses $ 25,000. Interest revenue for the year is $5,000 of which $2000 is unearned and interest expense was $12,000. BCD’s income tax rate is 25%. Required: Prepare a classified multiple-step income statement for the year for BCD Company.arrow_forwardThe following information is available for Bramble Corporation for the year ended December 31, 2020: cost of goods sold $225,000, sales revenue $477,000, other revenues and gains $51,000, and operating expenses $73,000.Assuming a corporate tax rate of 25%, prepare an income statement for the company. $ $arrow_forward

- MMT Corporation reports the following income statement items ($ in millions) for the year ended December 31, 2024: sales revenue, $2,195; cost of goods sold, $1,430; selling expense, $210; general and administrative expense, $200; interest expense, $35; and gain on sale of investments, $100. Income tax expense has not yet been recorded. The income tax rate is 25%.arrow_forwardC Company has the following data for the year ending 12/31/2020 (dollars are in thousands): Net income = $600; EBIT = $1,184; Total assets = $3,000; Short-term investments = $200; Total capital employed = $2,193; and tax rate = 30%. The company’s WACC is 11.07%. What was its Economic Value Added (EVA) for the year 2020? Round your answer to the nearest dollar. Group of answer choices: $583 $586 $577 $572 $580arrow_forwardSimons gross profit is?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning