Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

The number of days in the cash flow cycle is

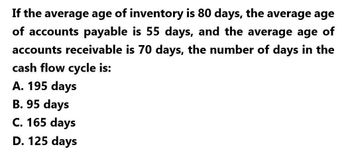

Transcribed Image Text:If the average age of inventory is 80 days, the average age

of accounts payable is 55 days, and the average age of

accounts receivable is 70 days, the number of days in the

cash flow cycle is:

A. 195 days

B. 95 days

C. 165 days

D. 125 days

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- If an average age of accounts payable is 15 days, the average age of accounts receivables is 60 days, and the average age of inventory is 10 days, the number of days in the operating cash conversion cycle is O A. 70 days O B. 85 days O C. 55 days O D. 60 daysarrow_forwardGeneral accountingarrow_forwardSub. General Accountarrow_forward

- 9. JX Limited has a receivables collection period of 47 days, a payables payment period of 36 days and an inventory holding period of 21 days. What is the length of the operating cycle? A 10 days. 32 days. 62 days. 68 days. B C Darrow_forwardWant Answerarrow_forwardBased on the following data for the current year, what is the number of days' sales in receivables? Assume 365-Day year. Sales on account during year $425,334 Cost of goods sold during year 211,989 Accounts receivable, beginning of year 43,627 Accounts receivable, end of year 51,814 Inventory, beginning of year 83,323 Inventory, end of year 108,050 Round your answer up to the nearest whole day. a. 182 b. 93 Ос. 82 d. 41arrow_forward

- If the average age of inventory is 120 days, the average age of accounts payable is 80 days, and the average age of accounts receivable is 100 days, the number of days in the cash flow cycle is: A. 140 days B. 120 days C. 100 days D. 140 daysarrow_forwardComparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total of 500,000 shares of common stock were outstanding. The interest rate on the bonds, which were sold at their face value, was 10%. The income tax rate was 40% and the dividend per share of common stock was $0.40 this year. The market value of the company's common stock at the end of the year was $30. All of the company's sales are on account. Weller Corporation Comparative Balance Sheet (dollars in thousands) This Year Last Year Assets Current assets: Cash Accounts receivable, net Inventory Prepaid expenses $ 1,090 9,200 12,500 740 $ 1,320 7,500 11,800 540 Total current assets 23,530 21,160 Property and equipment: Land 9,200 44,083 9,200 39,201 Buildings and equipment, net Total property and equipment 53,283 48,401 Total assets $76,813 $69,561 Liabilities and Stockholders' Equity Current…arrow_forwardplease answer parts 10, 11, and 12arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning