Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

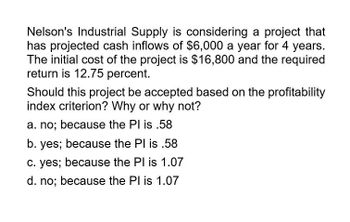

Transcribed Image Text:Nelson's Industrial Supply is considering a project that

has projected cash inflows of $6,000 a year for 4 years.

The initial cost of the project is $16,800 and the required

return is 12.75 percent.

Should this project be accepted based on the profitability

index criterion? Why or why not?

a. no; because the Pl is .58

b. yes; because the PI is .58

c. yes; because the PI is 1.07

d. no; because the PI is 1.07

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Project S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,000 per year for 5 years. Project L costs $25,000 and is expected to produce cash flows of $7,400 per year for 5 years. Calculate the two projects’ NPVs, IRRs, MIRRs, and PIs, assuming a cost of capital of 12%. Which project would be selected, assuming they are mutually exclusive, using each ranking method? Which should actually be selected?arrow_forwardJasmine Manufacturing is considering a project that will require an initial investment of $52,000 and is expected to generate future cash flows of $10,000 for years 1 through 3, $8,000 for years 4 and 5, and $2,000 for years 6 through 10. What is the payback period for this project?arrow_forwardRedbird Company is considering a project with an initial investment of $265,000 in new equipment that will yield annual net cash flows of $45,800 each year over its seven-year life. The companys minimum required rate of return is 8%. What is the internal rate of return? Should Redbird accept the project based on IRR?arrow_forward

- Need helparrow_forwardSolve this problemarrow_forwardThe Michner Corporation is trying to choose between the following two mutually exclusive design projects: Cash Flow (II) -$ 51,000 12,300 32,500 23,500 Year 0 1 2 3 Cash Flow (I) -$ 85,000 34,900 45,000 28,000 a-1. If the required return is 10 percent, what is the profitability index for each project? Note: Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161. a-2. If the company applies the profitability index decision rule, which project should it take? b-1. If the required return is 10 percent, what is the NPV for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b-2. If the company applies the net present value decision rule, which project should it take? a-1. Project I Project II a-2. b-1. Project I Project II b-2. Answer is not complete. Project II Project I 1.058arrow_forward

- The Michner Corporation is trying to choose between the following two mutually exclusive design projects: Year Cash Flow (I) Cash Flow (II) 0 -$ 76,000 -$ 34,000 1 29,000 11,000 23,500 17,500 2 3 36,000 42,000 a-1. If the required return is 12 percent, what is the profitability index for each project? Note: Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161. a-2. If the company applies the profitability index decision rule, which project should it take? b-1. If the required return is 12 percent, what is the NPV for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b-2. If the company applies the net present value decision rule, which project should it take? a-1. Project I a-2. Project II b-1. Project I b-2. Project IIarrow_forwardThe Whenworth Corporation is trying to choose between the following two mutually exclusive design projects: Year Cash Flow (I) Cash Flow (II) -$84,000 33,900 44,000 50,000 -$42,000 12,600 31,500 25,500 1 a-1. If the required return is 17 percent, what is the profitability index for each project? (Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161.) a-2. If the company applies the profitability index decision rule, which project should it take? b-1. If the required return is 17 percent, what is the NPV for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b-2. If the company applies the net present value decision rule, which project should it take? a-1. Project I Project II а-2. b-1. Project I Project IIarrow_forwardJefferson International is trying to choose between the following two mutually exclusive design projects: Cash Flow (B) -$38,000 Year Cash Flow (A -$75,000 32.400 17,800 30,200 14,200 3 36.600 19.800 The required return is 12 percent. If the company applies the profitability index (PI) decision rule, which project should the firm accept? If the company applies the NPV decision rule, which project should it take? Given your first two answers, which project should the firm actually accept? Project A; Project B; Project A O Project A; Project B; Project B O Project B; Project A; Project A O Project B; Project A; Project B O Project B; Project B, Project Barrow_forward

- Do the following problems. You must show your work.c) Find the IRR and MIRR of the following project and make your decision. Assume that the project's cost of capital (or WACC) is 4%. Project X that costs $30 million is expected to generate $13m per year for 3 years. Is this project acceptable?arrow_forwardThe Michner Corporation is trying to choose between the following two mutually exclusive design projects: Year Cash Flow (I) 0 -$ 82,000 1 37,600 2 37,600 37,600 Cash Flow (II) -$ 21,700 11, 200 11,200 11, 200 a-1. If the required return is 10 percent, what is the profitability index for each project? Note: Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161. a-2. If the required return is 10 percent and the company applies the profitability index decision rule, which project should the firm accept? b-1. If the required return is 10 percent, what is the NPV for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b-2. If the company applies the NPV decision rule, which project should it take? a-1. Project I Project II a-2. Project acceptance b-1. Project I Project II b-2. Project acceptancearrow_forward3.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College