FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:The labour efficiency variance for July is:

(a)

(b)

(c)

(d) £5,400 F

£375 F

£375 A

£5,400 A

The Labour rate Variance for July is:

(a) £6,000 A

(b)

£5,775 F

(c)

£5,775 A

(d) £6,000 F

Notts Ltd's cost of sales on its statement of profit or loss for the ended 31

December 2020 is £105,066. Its inventory at 31 Dec 2019 is £6,430 and at 31

Dec 2020 is £5,757. Its trade payables at 31 December 2019 is £9,204 and at

31 December 2020 is £8,580.

6.

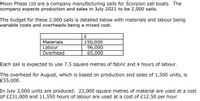

Transcribed Image Text:Moon Phase Ltd are a company manufacturing sails for Scorpion sail boats. The

company expects production and sales in July 2021 to be 2,000 sails.

The budget for these 2,000 sails is detailed below with materials and labour being

variable costs and overheads being a mixed cost.

Materials

150,000

96,000

65,000

Labour

Overhead

Each sail is expected to use 7.5 square metres of fabric and 4 hours of labour.

The overhead for August, which is based on production and sales of 1,500 units, is

£55,000.

In July 3,000 units are produced. 22,000 square metres of material are used at a cost

of £231,000 and 11,550 hours of labour are used at a cost of £12.50 per hour

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Time and Again Company makes clocks. The fixed overhead costs for 2020 total $900,000. The company uses direct labor-hours for fixed overhead allocation and anticipates 200,000 hours during the year for 330,000 units. An equal number of units are budgeted for each month. During June, 32,000 clocks were produced and $72,000 was spent on fixed overhead.a. Determine the fixed overhead rate for 2020 based on units of inputs.b. Determine the fixed overhead static-budget variance for June.c. Determine the production-volume overhead variance for June.arrow_forwardRose Company uses a flexible budget for manufacturing overhead based on direct labor hours. The following information are from the yearly static overhead budget for the Production Department for 2023. It is based on 300,000 direct labor hours. Variable Costs Fixed Costs Indirect labor ($1.2 per DL hour) $30,000 Supervision $ 5,000 Supplies and lubricants ($0.5 per DL hour) 12,500 Depreciation 2,000 Maintenance ($0,7 per DL hour) 17,500 Property taxes 1,500 Utilities ($0,4 per DL hour) 10,000 Insurance 1,000 During July, 24,500 direct labor hours were worked. The company incurred the following variable costs in July: indirect labor $30,200, supplies and lubricants $11,600, maintenance $17,500, and utilities $9,200. Actual fixed overhead costs were the same as monthly budgeted fixed costs. a.) Prepare a flexible monthly budget for the Production Department for the relevant range between 24,000 and 26,000 DL hours with increments of 1000 DL hours. b.) Prepare a flexible budget…arrow_forwardCarlton, Inc. manufactures model airplane kits and projects production at 550, 420, 150, and 800 kits for the next four quarters. (Click the icon to view the manufacturing information.) Prepare Carlton's direct materials budget, direct labor budget, and manufacturing overhead budget for the year. Round the direct labor hours needed for production, budgeted overhead costs, and predetermined overhead allocation rate to two decimal places. Round other amounts to the nearest whole number. Begin by preparing Carlton's direct materials budget. Direct materials (ounces) per kit Direct materials needed for production. Plus: Total direct materials needed Less: Budgeted purchases of direct materials Direct materials cost per ounce Budgeted cost direct materials purchases Carlton, Inc. Direct Materials Budget For the Year Ended December 31 First Second Quarter Quarter Third Quarter Fourth Quarter Total More info Direct materials are five ounces of plastic per kit and the plastic costs $3 per…arrow_forward

- Light It Up, Inc. manufactures lamps. The production budget shows that Light It Up plans to produce 3,600 lamps in June and 2,800 lamps in July. Each lamp requires 0.50 direct labor hours in its production. Light It Up has a direct labor rate of $19 per direct labor hour. What is the total combined direct labor cost that Light It Up should budget for June and July? $60,800 $13,300 $30,400 $17,100arrow_forwardPlease help me. Thankyou.arrow_forwardThe total factory overhead for Magnum Corporation is budgeted for the year at $500,000. This is divided into three activity pools: fabrication, $246,000; assembly, $144,000, and setup, $110,000. Magnum manufactures two types of kayaks: Basic and Deluxe. The activity-based usage quantities for each project by activity are as follows: Fabrication Assembly Setup Basic 2,000 dlh 8,000 dlh 5 setups Deluxe 10,000 dlh 24,000 dlh 15 setups Total activity-base usage 12,000 dlh 32,000 dlh 20 setups Each product is budgeted for 2,500 units of production for the year.What is the activity-based factory overhead per unit for the Deluxe kayak? a.$41.80 b.$158.20 c.$100.00 d.$154.54arrow_forward

- Becker Bikes manufactures tricycles. The company expects to sell 380 units in May and 510 units in June. Beginning and ending finished goods for May are expected to be 110 and 75 units, respectively. June's ending finished goods are expected to be 85 units. The company's variable overhead is $4.00 per unit produced and its fixed overhead is $4,500 per month. Compute Becker's manufacturing overhead budget for May and June. Note: Do not round intermediate calculations. Round your final answers to 2 decimal places. Budgeted manufacturing overhead May Junearrow_forwardSunrise Poles manufactures hiking poles and is planning on producing 3,646 units in March and 4,395 in April. Each pole requires a half pound of material, which costs $1.17 per pound. The company’s policy is to have enough material on hand to equal 7% of the next month’s production needs and to maintain a finished goods inventory equal to 17% of the next month’s production needs. What is the budgeted cost of purchases for March? Round to the nearest penny, two decimal places.arrow_forwardFor Gundy Company, units to be produced are 5,570 in quarter 1 and 6,600 in quarter 2. It takes 1.5 hours to make a finished unit, and the expected hourly wage rate is $16 per hour. Prepare a direct labor budget by quarters for the 6 months ending June 30, 2020.arrow_forward

- Whispering Winds Company has developed the following standard costs for its product for 2022: WHISPERING WINDSCOMPANY Standard Cost Card Product A Cost Component Standard Quantity Standard Price Standard Cost Direct materials 4 pounds $3 $12 Direct labor 3 hours 8. 24 Manufacturing overhead 3 hours 4 12 $48 The company expected to produce 31,700 units of Product A in 2022 using 95,900 direct labor hours. Actual results for 2022 are as follows: 33,000 units of Product A were produced. Actual direct labor costs were $794,580 for 96,900 direct labor hours worked. Actual direct materials purchased and used during the year cost $369,875 for 134,500 pounds. Actual variable overhead incurred was $165,000 and actual fixed overhead incurred was $220,000. Compute the following variances showing all computations to support your answers. Indicate whether the variances are unfavorable. Compute the following variances showing all computations to support your answers. Indicate whether the variances…arrow_forwardA company manufactures a single product, that has a standard cost per as below Direct materials Direct Labour Fixed overheads Per unit (15 metres @K6/metre) 90 (5 hours @K8/hour) 40 Variable Overheads (5hours @ K4/hour) 20 (5 hours @ K2/hour) 10 The standard selling price is K195 K The monthly budget production and sales was 1,300 units. Actual figures for the month of January 2019 are as follows: Sales Production Direct materials Direct wages Variable overheads Fixed overheads Required: 1,400 units @ K200 each. 1,500 Units 23,500 metres @ K6.50 per metre 7,000 hours @ K7.80 per hour K25,600 K14,200 Calculate the following variances: (a) Material price (b) Material usage (c) Labour rate (d) Labour efficiency (e) Variable overhead expenditure (f) Variable overhead efficiency (g) Fixed overhead volume (h) Fixed overhead expenditure (i) Sales Price (j) Sales Volumearrow_forwardSwifty Corp. supplies its customers with high-quality canvas tents. These canvas tents sell for $170 each, with the following DM and DL usage and price expectations. Direct materials Direct labor Variable-MOH Fixed-MOH (a) Throughout the year, Swifty used 3,780 DL hours in the process of making 3,500 tents. The company had originally planned to produce and sell 3,200 tents with budgeted fixed-MOH cost of $17,600. Its actual fixed-MOH costs amounted to $17,086 for the year. (b) 10 square yards per unit 1.1 DL hours per unit 1.1 DL hours per unit 1.1 DL hours per unit Your answer is correct. Determine Swifty's fixed-MOH price and volume variances. Also identify whether the company's fixed-MOH costs were under-or overapplied, and by how much. Fixed-MOH price variance Fixed-MOH Fixed-MOH volume variance $ (2) $ (3) @ $6/square yard @ $16/DL hour @ $2.80/DL hour No. Account Titles and Explanation (1) @ $5/DL hour 514 1650 2164 Favorable Record the journal entries to accompany the following…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education