Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

I am doing practice problems to help study for an exam for my class. I need help with the formulas.

Transcribed Image Text:Name

Phil de Cel

Manuel Labor

Phyllis Stein

Adam Sapple

Al Nino

Chris P. Bacon

Douglas S. Halfemptee

Ho Lee Guy

Periods per Year

12

1

4

12

4

12

1

4

Years

5

8

20

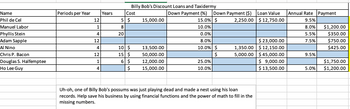

Billy Bob's Discount Loans and Taxidermy

Cost

$

10 $

15 $

6 $

$

15,000.00

13,500.00

50,000.00

12,000.00

15,000.00

Down Payment (%) Down Payment ($) Loan Value

15.0% $

2,250.00 $12,750.00

10.0%

0.0%

8.0%

10.0% $

$

25.0%

10.0%

$ 23,000.00

1,350.00 $12,150.00

5,000.00

$ 45,000.00

$ 9,000.00

$ 13,500.00

Uh-oh, one of Billy Bob's possums was just playing dead and made a nest using his loan

records. Help save his business by using financial functions and the power of math to fill in the

missing numbers.

Annual Rate Payment

9.5%

8.0%

5.5%

7.5%

9.5%

5.0%

$1,200.00

$350.00

$750.00

$425.00

$1,750.00

$1,200.00

Transcribed Image Text:1

2 Name

3 Sherman Wadever

4 Stu Pid

5 Seymour Art

6

Gene Us

7 Wanda Doff

8

Will D. Beast

9 Xavier Self

10

Opie Umsbad

11 Noah Count

12 Mr. E Mann

13

14

15

16

17

18

19

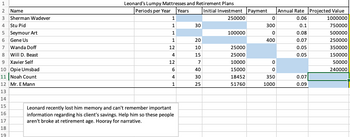

Leonard's Lumpy Mattresses and Retirement Plans

Periods per Year Years Initial Investment Payment

250000

1

1

1

1

12

4

12

6

4

1

Leonard recently lost him memory and can't remember important

information regarding his client's savings. Help him so these people

aren't broke at retirement age. Hooray for narrative.

30

20

10

15

7

40

30

25

100000

25000

25000

10000

15000

18452

51760

0

300

0

400

0

0

350

1000

Annual Rate Projected Value

0.06

1000000

0.1

750000

0.08

500000

0.07

250000

0.05

350000

0.05

150000

50000

240000

0.07

0.09

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- please answer all the questionss.,.within 30 minutes. make sure the explanation and reasons are explained in very detailed manner. else leave it for other tutor otherwise i will give negative ratings and will also report your answer for unprofessionalism. Make sure the answer is 100% correct and IS NOT COPIED FROM ANYWHERE ELSE YOUR ANSWER WILL DOWNVOTED AND REPORTED STRAIGHTAWAY. USE YOUR OWN LANGUAGE WHILST WRITING. ATTEMPT THE QUESTION ONLY IF YOU ARE 100% CORRECT AND SURE. ELSE LEAVE IT FOR ANOTHER TUTOR. BUT PLEASE DONT PUT WRONG ANSWER ELSE I WILL REPORT. MAKE SURE THE ANSWER IS WELL EXPLAINED AND DETAILED.arrow_forwardPlease explain why it is critically important for you to identify sources of information in both academic and business environments. Provide examples of possible consequences (both environments) when sources of information are not identified. (Minimum 200 words)arrow_forwardVisit the AICPA’s web site and read Sections ET 50 to 57 of the Code of Professional Conduct and By- laws. Prepare a memo to your professor setting forth the important professional guidelines incorporated in the Code. For each principle you identify, provide an example of how that principle might impact you in your career as a forensic accountant.arrow_forward

- I am confused on #36 of 3.3 in Finite Math for Business. My teacher wants me to find the interest using the TVM solver on my TI-84 and using the formula I=PRT. I am not sure what values to plug into my calculator though.arrow_forwardcan you help me on how to do my assignment?arrow_forwardPlease review the rubric prior to beginning the assignment to become familiar with the expectations for successful completion.You are required to submit this assignment to LopesWrite. Please refer to the directions in the Student Success Center.Paul Duncan, financial manager of EduSoft Inc., is facing a dilemma. The firm was founded 5 years ago to provide educational software for the rapidly expanding primary and secondary school markets. Although EduSoft has done well, the firm's founder believes an industry shakeout is imminent. To survive, EduSoft must grab market share now, and this will require a large infusion of new capital.Because he expects earnings to continue rising sharply and looks for the stock price to follow suit, Mr. Duncan does not think it would be wise to issue new common stock at this time. On the other hand, interest rates are currently high by historical standards, and the firm's B rating means that interest payments on a new debt issue would be prohibitive.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education