PLEASE, PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULAS

PLEASE, PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULAS

PLEASE, PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULAS

(Not written.. please)

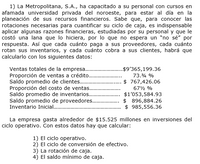

1) La Metropolitana, S.A., has trained its personnel with courses at a renowned private university in the northwest, in order to be up to date in the planning of its financial resources. It knows that, in order to know the necessary rotations to quantify its cash cycle, it is indispensable to apply some financial ratios, studied by its personnel and that it cost a lot of money to do so, so it does not expect an "I don't know" for an answer. So how often you pay your suppliers, how often you rotate your inventories, and how often you charge your customers, will have to be calculated with the following data:

Total company sales..........................$9'365,199.36

Proportion of credit sales....................... 73.¾ %

Average customer balance............................. $ 767,426.06

Cost of sales ratio...................... 67½ %

Average inventory balance...................... $1'053,584.93

Average suppliers' balance................... $ 896,884.26

Beginning inventory................................................ $ 985,556.36

The company spends about $15.525 million in operating cycle investments. With this data it is necessary to calculate:

1) The operating cycle.

2) The cash conversion cycle.

3) The cash turnover.

4) The minimum cash balance.

Note:

In the image, this is the original exercise, it is in Spanish, but it is easy to understand.

Very important Note:

It is necessary that you make a solution approach and then the result. Above all, to check the procedure and/or the formulas used, especially when you use excel.

please... understand the context of the exercise in Spanish, it is easy to understand

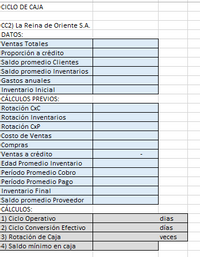

-THERE IS AN EXAMPLE OF EXCEL FORMATTING (IN THE PICTURE) , I WANT YOU TO USE A SIMILAR FORMAT.

----------------------------

Formulas (those given to me by the professor, this to guide you as a bartleby expert.)

-

Sales (on credit) / Average customer balance.

-Average collection period:

360 /accounts receivable turnover

------------------------------------------------------------------

-Inventory turnover

Cost of sales / average inventory

-Average inventory age

360/inventory turnover

------------------------------------------------------------------

-Accounts Payable Rotation

STEP ONE: Determine Ending Inventory

STEP TWO: Determine Purchases

STEP THREE:

-Calculate accounts payable turnover.

Purchases / Average supplier balance

-Average payment period

360/accounts payable turnover

------------------------------------------------------------------

Operating Cycle = Average age of inventory + Average collection period

Cash Conversion Cycle = Average payable period - Cash cycle

Cash Turnover = 360 / Cash Conversion Cycle

Minimum Cash Balance = Annual Expense / Cash Turnover

------------------------------------------------------------------

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

- hi tutor, please help to answer this coursework management accounting subject.arrow_forwardYou have been asked by your manager to review three potential investment opportunities. As part of your investigation, you are asked to provide calculated data for three different methods of comparison. What three methods do you decide to use for your calculations? Explain why you are choosing each of these methods. (Explain your answer in a minimum of 3 complete sentences.)arrow_forwardRequired information [The following information applies to the questions displayed below.] Cranshaw Business Services (CBS) operates an information technology (IT) consulting firm out of two offices: Detroit and Los Angeles. Corporate services, such as legal, finance, and personnel, are centralized at the main office and the costs of these services are allocated to the two offices for the purposes of profitability assessment. The Detroit office is the original unit of the company and is well established, having long-time clients from the automotive and other manufacturing industries. The Los Angeles office is new with a smaller, much more varied, clientele. The costs of personnel services at CBS are currently allocated on the basis of the number of employees in each office. The annual costs of the personnel department total $510,000. Data for the fiscal year just ended show the following: Number of employees Number of new hires. Number of employees departing Allocation based on…arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Cranshaw Business Services (CBS) operates an information technology (IT) consulting firm out of two offices: Detroit and Los Angeles. Corporate services, such as legal, finance, and personnel, are centralized at the main office and the costs of these services are allocated to the two offices for the purposes of profitability assessment. The Detroit office is the original unit of the company and is well established, having long-time clients from the automotive and other manufacturing industries. The Los Angeles office is new with a smaller, much more varied, clientele. The costs of personnel services at CBS are currently allocated on the basis of the number of employees in each office. The annual costs of the personnel department total $440,000. Data for the fiscal year just ended show the following: Number of employees Number of new hires Number of employees departing a. Using current…arrow_forwardReview the scripture below. Does God's word here have relevance to the concepts being studied in Managerial Accounting, or do spiritual and business concepts just not mix? Please share your ideas and give examples. Feel free to cite other sources. Luke 14:28-30 in the Bible reads: “But don’t begin until you count the cost. For who would begin construction of a building without first calculating the cost to see if there is enough money to finish it? Otherwise, you might complete only the foundation before running out of money, and then everyone would laugh at you. They would say, ‘There’s the person who started that building and couldn’t afford to finish it!’" Explain the meaning of (a) differential revenue, (b) differential cost, and (c) differential income. A company is offered incremental business at a special price that exceeds the variable cost. What other issues must the company consider in deciding whether to accept the business? Although the cost-plus approach to product…arrow_forwardDifferentiate among the different types of professional engagements. Assume you are auditing a city with a summer youth employment program. List some factors you might investigate in terms of (1) financial statement audits and (2) performance audits. Ans botharrow_forward

- a) Calculate the payback for both the Edinburgh and Newcastle upon Tynecontracts. b) Critically evaluate the payback technique c) Advise Flyers plc’s senior executive team on the comments made by ChangYing Simmonds and Travis van Riemsdyk. Your advice should include anexplanation of the characteristics of investment appraisal decisions and theadvantages and disadvantages of the IRR.arrow_forwardAshvinbhaiarrow_forwardMunabhaiarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education