FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

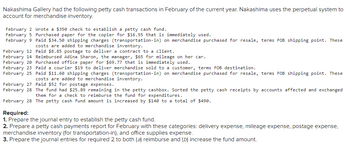

Transcribed Image Text:Nakashima Gallery had the following petty cash transactions in February of the current year. Nakashima uses the perpetual system to

account for merchandise inventory.

February 2 Wrote a $350 check to establish a petty cash fund.

February 5

February 9

Purchased paper for the copier for $16.55 that is immediately used.

Paid $34.50 shipping charges (transportation-in) on merchandise purchased for resale, terms FOB shipping point. These

costs are added to merchandise inventory.

Paid $8.85 postage to deliver a contract to a client.

February 12

February 14 Reimbursed Adina Sharon, the manager, $65 for mileage on her car.

February 20 Purchased office paper for $69.77 that is immediately used.

February 23 Paid a courier $19 to deliver merchandise sold to a customer, terms FOB destination.

February 25 Paid $11.60 shipping charges (transportation-in) on merchandise purchased for resale, terms FOB shipping point. These

costs are added to merchandise inventory.

February 27 Paid $52 for postage expenses.

February 28 The fund had $25.89 remaining in the petty cashbox. Sorted the petty cash receipts by accounts affected and exchanged

them for a check to reimburse the fund for expenditures.

February 28 The petty cash fund amount is increased by $140 to a total of $490.

Required:

1. Prepare the journal entry to establish the petty cash fund.

2. Prepare a petty cash payments report for February with these categories: delivery expense, mileage expense, postage expense,

merchandise inventory (for transportation-in), and office supplies expense.

3. Prepare the journal entries for required 2 to both (a) reimburse and (b) increase the fund amount.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Options are General Sales Purchases Cash receipts Cash Disbursementsarrow_forwardReview the following situations and record any necessary journal entries for Letter Depot. Mar. 9 Letter Depot purchases $11,490 worth of merchandise on credit from a manufacturer. Shipping charges are an extra $460 cash. Terms of the purchase are 2/10, n/40, FOB Destination, invoice dated March 9. Mar. 20 Letter Depot sells $7,540 worth of merchandise to a customer who pays on credit. The merchandise has a cost to Letter Depot of $2,830. Shipping charges are an extra $420 cash. Terms of the sale are 3/15, n/50, FOB Destination, invoice dated March 20. If an amount box does not require an entry, leave it blank. Assume the perpetual inventory system is used. Mar. 9 Mar. 20 Sale on credit Mar. 20 Cost of sale Mar. 20 Shipping chargesarrow_forwardPlease see imagearrow_forward

- Christine's Dance Studio created a $400 imprest petty cash fund. During the month, the fund custodian authorized and signed petty cash tickets as follows: View the petty cash tickets. Read the requirements. Requirement 1. Make the general journal entry to create the petty cash fund. Include an explanation. (Record debits first, then, credits. Select the explanation on the last line of the journal entry table.) Accounts and Explanation Date Debit Credit Requirements 1. Make the general journal entry to create the petty cash fund. Include an explanation. 2. 3. Make the general journal entry to record the petty cash fund replenishment. Cash in the fund totals $249. Include an explanation. Assume that Christine's Dance Studio decides to decrease the petty cash fund to $260. Make the general journal entry to record this decrease. Print Done Petty Cash Tickets Petty Cash Ticket No. Item Account Debited Amount Ticket No. 1 Ticket No. 2 Delivery of programs to customers Delivery Expense Mail…arrow_forwardPrepare a journal entry to record these cash sales.arrow_forwardTrinh Company has set up a petty cash fund with $250.00 on April 8. Prepare a journal entry to record this. On April 16, the petty cash box contained $58.25 cash and the following receipts. The petty cash was replenished the same day. Record the journal entry. Joe’s Coffee House - $22.55 (coffee and treats for meeting) Canada Post - $32.60 (for postage) Staples - $136.25 (office supplies)arrow_forward

- Greenleaf Company uses a sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal. Journalize the following transactions that should be recorded in the cash payments journal. June 3 Issued Check Number 380 to Skipp Corporation to buy office supplies for $375. June 5 Purchased merchandise for $4,600 on credit from Buck Company, terms n/15. June 20 Issued Check Number 381 for $4,600 to Buck Company to pay for the June 5 purchase. June 23 Paid salary of $6,200 to T. Bourne by issuing Check Number 382. June 26 Issued Check Number 383 for $5,750 to pay off a note payable to UT Bank.arrow_forwardChilders Company, which uses a perpetual inventory system, has an established petty cash fund in the amount of $400. The fund was last reimbursed on November 30. At the end of December, the fund contained the following petty cash receipts: December 4 Merchandise purchased December 7 Delivery expense December 12 Purchase of office supplies December 18 Miscellaneous expense $62 $46 $30 $51 If, in addition to these receipts, the petty cash fund contains $201 of cash, the Journal entry to reimburse the fund on December 31 will include:arrow_forwardIf cash on hand is $20, prepare the entry to replenish the petty cash on December 31. (Record debits first, then credits. Exclude explanations from journal entries.) Journal Entry Date Accounts PR Dr. Cr. More Info Dec. 31 Cash Short and Over Donations Expense 15 201X Miscellaneous Expense 19 December 1 A $108 petty cash fund is established. Office Supplies Expense 26 31 At end of the month, the following paid vouchers exist: donations expense, $15; postage expense, $13; office supplies expense, $26; miscellaneous expense, $19. Postage Expense 13 Cash Print Donearrow_forward

- Willard Company established a $440 petty cash fund on September 9, 2020. On September 30, the fund had $175,40 in cash along with receipts for these expenditures: transportation-in, $35.70, office supplies. $124.90, and repairs expense. $97.00. Willard uses the perpetual method to account for merchandise inventory. The petty cashier could not account for the $7.00 shortage in the fund. a. Prepare the September 9 entry to establish the fund. View transaction list Journal entry worksheet < Record the entry to establish the fund. Note: Enter debits before credits Date Debit Credit Sep 09, 2020 ✪ General Journalarrow_forwardHello, I need to do a general journal with the following directions: On May 1, a petty cash fund was established for $200 by the owner, Ilika Cash. The following vouchers were issued during the month. Prepare the journal entries to (a) establish the petty cash fund on May 1 and (b) replenish the petty cash fund on May 31. Date Voucher No. Purpose Amount 6 4-1 Office supplies 12.00 8 4-2 Taxi fare for customer (travel expense) 27.00 12 4-3 Postage due (Postage Expense) 4.00 17 4-4 Donation (Misc. Expense) 20.00 30 4-6 Ilika withdrew for personal use 50.00arrow_forwardSaenz Company uses a voucher system in which it records invoices at the gross amount. The following vouchers were issued during February and were unpaid on March 1: Voucher Number Company For Date of Voucher Amount 1729 Kipley Company Merchandise, FOB destination Feb. 26 $3,436 1732 J. R. Steven Merchandise, FOB destination Feb. 28 4,710 The following transactions were completed during March: Mar. 3 Issued voucher no. 1734 in favor of Larry Company for March rent, $1,220. 3 Issued Ck. No. 1829 in payment of voucher no. 1734, $1,220. 5 Bought merchandise on account from Lorenzo, Inc., $3,890; terms 2/10, n/30; FOB shipping point; freight prepaid and added to the invoice, $72 (total, $3,962). Issued voucher no. 1735. 5 Issued Ck. No. 1830 in payment of voucher no. 1729, $3,401.64 ($3,436 less 1 percent cash discount). 9 Issued voucher no. 1736 in favor of Mario Electric Company for electric bill, $216. 9 Issued Ck. No. 1831 in payment of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education