FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Can you please check my work

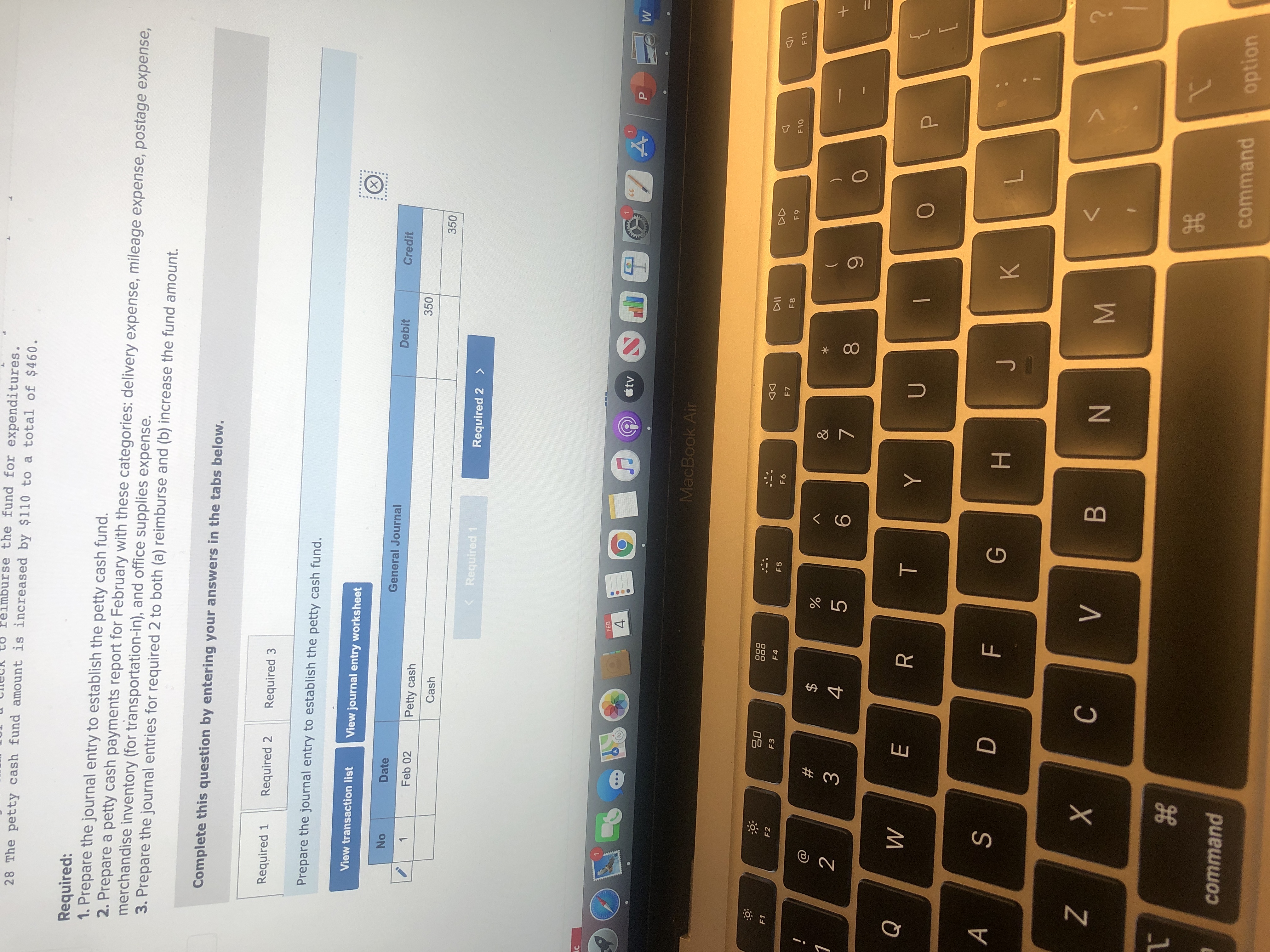

Transcribed Image Text:Nakashima Gallery had the following petty cash transactions in February of the current year. Nakashima uses the perpetual system to

account for merchandise inventory.

Feb. 2 Wrote a $350 check to establish a petty cash fund.

5 Purchased paper for the copier for $16.55 that is immediately used.

9 Paid $40.50 shipping charges (transportation-in) on merchandise purchased for resale, terms FOB shipping point.

These costs are added to merchandise inventory.

12 Paid $7.45 postage to deliver a contract to a client.

14 Reimbursed Adina Sharon, the manager, $73 for mileage on her car.

20 Purchased office paper for $69.77 that is immediately used.

23 Paid a courier $22 to deliver merchandise sold to a customer, terms FOB destination.

25 Paid $11.20 shipping charges (transportation-in) on merchandise purchased for resale, terms FOB shipping point.

These costs are added to merchandise inventory.

27 Paid $55 for postage expenses.

28 The fund had $25.78 remaining in the petty cashbox. Sorted the petty cash receipts by accounts affected and

exchanged them for a check to reimburse the fund for expenditures.

28 The petty cash fund amount is increased by $110 to a total of $460.

Required:

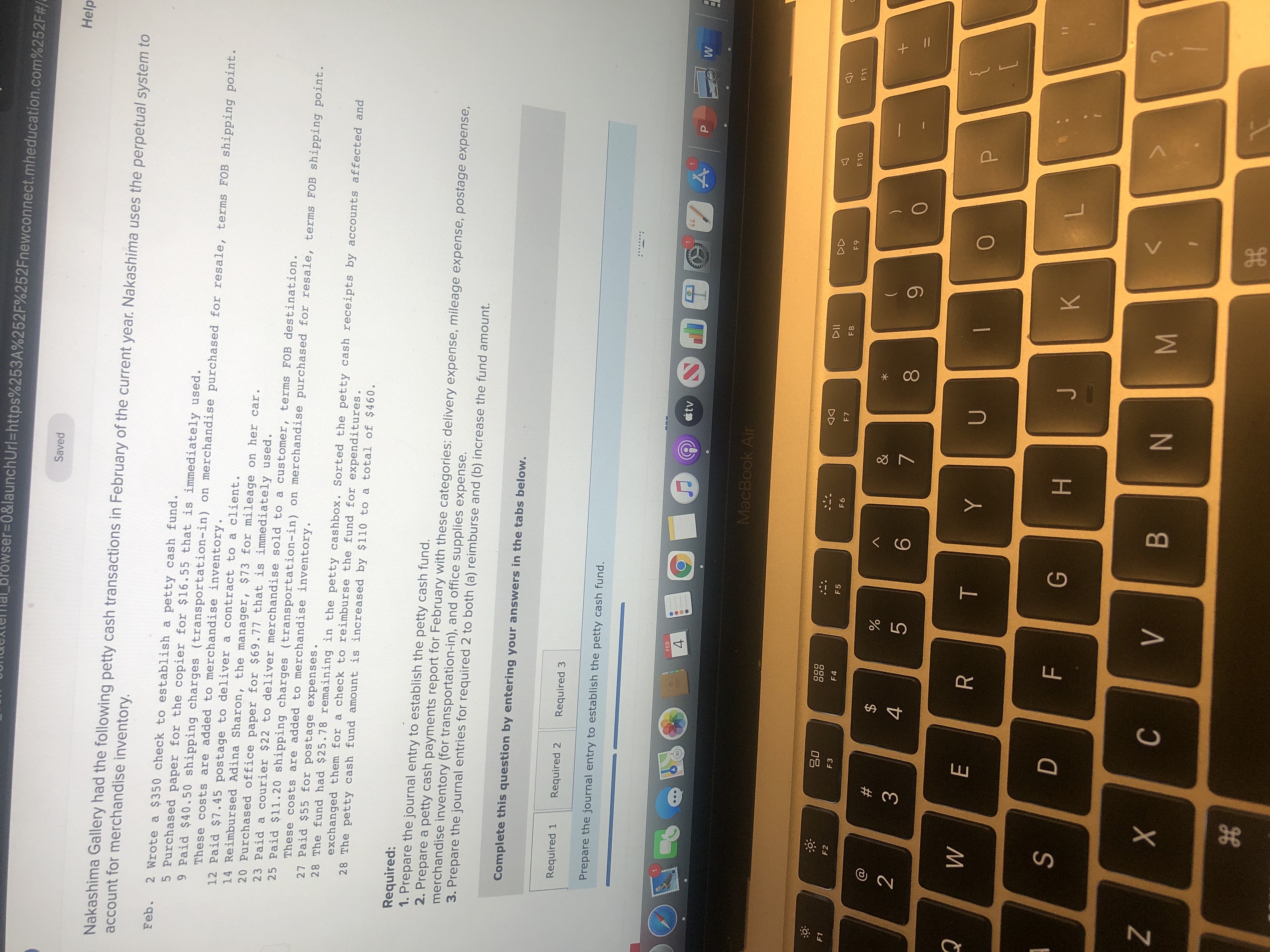

1. Prepare the journal entry to establish the petty cash fund.

2. Prepare a petty cash payments report for February with these categories: delivery expense, mileage expense, postage expense,

merchandise inventory (for transportation-in), and office supplies expense.

3. Prepare the journal entries for required 2 to both (a) reimburse and (b) increase the fund amount.

Complete this question by entering your answers in tho tn

Expert Solution

arrow_forward

Step 1

Petty cash refers to a special fund created by a business in order to meet the regular petty expenses. The business sets aside a small amount and hands it over either to a person or puts it in a locker box so that incidental expenses are met. This amount is usually set aside for a small period and is re-established as soon as the petty cash amount lapses.

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education