FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

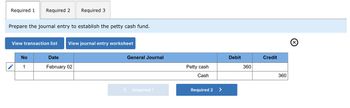

Transcribed Image Text:Required 1

Required 2 Required 3

Prepare the journal entry to establish the petty cash fund.

View transaction list View journal entry worksheet

No

1

Date

February 02

General Journal

Required 1

Petty cash

Cash

Required 2

>

Debit

360

Credit

360

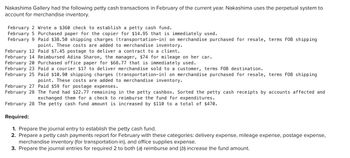

Transcribed Image Text:Nakashima Gallery had the following petty cash transactions in February of the current year. Nakashima uses the perpetual system to

account for merchandise inventory.

February 2 Wrote a $360 check to establish a petty cash fund.

February 5 Purchased paper for the copier for $14.95 that is immediately used.

February 9 Paid $38.50 shipping charges (transportation-in) on merchandise purchased for resale, terms FOB shipping

point. These costs are added to merchandise inventory.

February 12 Paid $7.45 postage to deliver a contract to a client.

February 14 Reimbursed Adina Sharon, the manager, $74 for mileage on her car.

February 20 Purchased office paper for $68.77 that is immediately used.

February 23 Paid a courier $17 to deliver merchandise sold to a customer, terms FOB destination.

February 25 Paid $10.90 shipping charges (transportation-in) on merchandise purchased for resale, terms FOB shipping

point. These costs are added to merchandise inventory.

February 27 Paid $59 for postage expenses.

February 28 The fund had $22.77 remaining in the petty cashbox. Sorted the petty cash receipts by accounts affected and

exchanged them for a check to reimburse the fund for expenditures.

February 28 The petty cash fund amount is increased by $110 to a total of $470.

Required:

1. Prepare the journal entry to establish the petty cash fund.

2. Prepare a petty cash payments report for February with these categories: delivery expense, mileage expense, postage expense,

merchandise inventory (for transportation-in), and office supplies expense.

3. Prepare the journal entries for required 2 to both (a) reimburse and (b) increase the fund amount.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education