FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

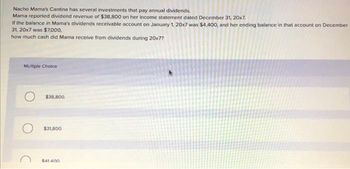

Transcribed Image Text:Nacho Mama's Cantina has several investments that pay annual dividends.

Mama reported dividend revenue of $38,800 on her income statement dated December 31, 20x7.

If the balance in Mama's dividends receivable account on January 1, 20x7 was $4,400, and her ending balance in that account on December

31, 20x7 was $7,000,

how much cash did Mama receive from dividends during 20x7?

Multiple Choice

$38,800.

$31,800.

$41.400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Kia deposited $1,100, at the BEGINNING of each year for 25 years in a credit union account. If the account paid 8% interest, compounded annually, use the appropriate formula to find the future value of her account. A. $73,441.24 B. $80,416.53 C. $86,849.86 D. $87,949.86arrow_forwardMiguel invested $1,900 at the beginning of every 6 months in an RRSP for 11 years. For the first 4 years it earned interest at a rate of 4.60% compounded semi-annually and for the next 7 years it earned interest at a rate of 5.10% compounded semi-annually.a. Calculate the accumulated value of her investment at the end of the first 4 years.A. $55,478.69B. $56,281.73C. $16,481.53D. $16,860.61b. Calculate the accumulated value of her investment at the end of 11 years.A. $55,478.69B. $56,281.73C. $49,155.52D. $16,860.61c. Calculate the amount of interest earned from the investment.A. $14,481.73B. $13,678.69C. $8,786.82D. $5,694.91arrow_forwardHeerarrow_forward

- Axel bought $13, 539 worth of stock on margin. The initial margin was 75% and the maintenance margin was 22 %. Actual margin decreased to 16%. Axel deposited enough cash to raise the margin to 35 %. Rounded to the nearest penny, how much cash did Axel deposit? Correct Answer: 1, 177.84arrow_forwardCalvin invests $3,200 at an APR of 5.3% compounded monthly. Hobbes invests $3,150 at an APR of 6% compounded quarterly.A. Who has the higher accumulated balance after 2 years? B. Who has the higher accumulated balance after 4 years?arrow_forwardOn 2003-06-17 Keiko invests $2,800.00 in an account paying i(¹) = 10.000%. The account uses the compound interest method for computing interest for partial periods. How much money does she receive when she withdraws it on 2008-10-03? a. $2,912.21 b. $2,909.63 c. $4,638.41 d. $2,916.08 e. $2,939.30arrow_forward

- Pronghorn Co. invested $1,070,000 in Stellar Co. for 25% of its outstanding stock. Stellar Co. pays out 30% of net income in dividene each year. Use the information in the following T-account for the investment in Stellar to answer the following questions. Investment in Stellar Co. 1,070,000 99,000 (a) How much was Pronghorn Co.'s share of Stellar Co's net income for the year? Net income 29,700 Total net income (b) What was Stellar Co's total net income for the year? 428000 Total Dividends. $ 396000 (c) What was Stellar Co's total dividends for the year? 128400arrow_forwardBaghibenarrow_forwardJennifer Pontesso, from Lincoln, Nebraska, wants to better understand her financial situation. Use the following balance sheet and cash flow statement information to determine her net worth and her net surplus for a recent month. Liquid assets: $9,000; home value: $230,000; monthly mortgage payment: $1,350 on $170,000 mortgage; investment assets: $70,000; personal property: $22,000; total assets: $331,000; short-term debt: $3,240 ($270 a month); total debt: $173,240; monthly gross income: $10,000; monthly disposable income: $6,500; monthly expenses: $5,500. Round your answers to the nearest dollar.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education