Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

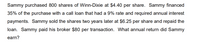

Transcribed Image Text:Sammy purchased 800 shares of Winn-Dixie at $4.40 per share. Sammy financed

35% of the purchase with a call loan that had a 9% rate and required annual interest

payments. Sammy sold the shares two years later at $6.25 per share and repaid the

loan. Sammy paid his broker $80 per transaction. What annual return did Sammy

earn?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Steven purchased 1000 shares of a certain stock for $25,700 (including commissions). He sold the shares 2 years later and received $33,400 after deducting commissions. Find the effective annual rate of return on his investment over the 2-year period. (Round your answer to two decimal places.) %/yeararrow_forwardRob borrowed $5,800 from Richard and signed a contract agreeing to pay it back 10 months later with 4.55% simple interest. After 3 months, Richard sold the contract to Chris at a price that would earn Chris 5.00% simple interest per annum. Calculate the price that Chris paid Richard.arrow_forwardSheldon put $500 into a certificate of deposit at his bank. In six months the value of the CD is $620. What is his ROI? Penny invested $10,000 into the stock market. She sold the stock two days later for $13,500. What is her ROI? Leonard bought a bond for $5,000 and sold it for $5,300 four years later. What is his ROI? Howard bought a house for $250,000 and sold it for $227,000 ten years later. What is his ROI? Raj bought a tractor for $25,000 and sold it for $32,000 one year later. What is his ROI? Amy put $50 in a savings account. A year later the balance on the account is $58. What is her ROI?arrow_forward

- Tobias has a brokerage account and buys on the margin, which resulted in an interest expense of $29,200 during the year. Income generated through the brokerage account was as follows: Municipal interest $58,400 Taxable dividends and interest 292,000 If required, round any division to two decimal places and use in subsequent computation. Round your final answer to the nearest dollar. How much investment interest can Tobias deduct?arrow_forwardThe Roths bought a house for $433,900. They paid the sellers a 20% down payment and obtained a simple interest amortized loan for the balance from their bank for the remainder, at 4 7/8% for thirty years. The bank in turn paid the sellers the loan amount, less a 6% sales commission paid to the sellers' and buyers' real estate agents. The bank charged them 2 points plus fees totaling $8,459.46; of these fees, $6,251.28 were included in the finance charge. (a) Find the loan amount. (b) Find the "legal loan amount" –the amount borrowed, according to the Truth in Lending Act. (Round your answer to the nearest cent.)(c) Find the Roth's monthly payment. (Round your answer to the nearest cent.)(d) Find the APR (round to the nearest hundredth of 1%).(e) Find the total interest paid. (Round your answer to the nearest cent.)(f) Find the total finance charge. (Round your answer to the nearest cent.)(g) Find the amount that the sellers are paid for their house.arrow_forwardAlan borrowed $5,000 from Janet due in seven years at 8% monthly. Four years after the debt is contracted, Janet sells the note to Burt for an amount based on 10% monthly. How much does Janet receive (the proceeds)?arrow_forward

- Kent sold his car to Carolynn for $2000 down and monthly payments of $295.88 for 3 years, including interest at 7.5%compounded monthly. What was the selling price of the car? Round to the nearest dollar.arrow_forwardThe Roths bought a house for $438,500. They paid the sellers a 20% down payment and obtained a simple interest amortized loan for the balance from their bank for the remainder, at 0.4875 for thirty years. The bank in turn paid the sellers the loan amount, less a 6% sales commission paid to the sellers' and buyers' real estate agents. The bank charged them 2 points plus fees totaling $8,549.15; of these fees, $6,317.55 were included in the finance charge. (a) Find the loan amount (b) Find the "legal loan amount" –the amount borrowed, according to the Truth in Lending Act. (Round your answer to the nearest cent.) (c) Find the Roth's monthly payment. (Round your answer to the nearest cent.) (d) Find the APR (round to the nearest hundredth of 1%). (e) Find the total interest paid. (Round your answer to the nearest cent.) (f) Find the total finance charge. (Round your answer to the nearest cent.) (g) Find the amount that the sellers are paid for their house.arrow_forwardJack and Laurie Worthington bought a house for $162,400. They put 10% down, borrowed 80% from their bank for thirty years at 12% interest, and convinced the owner to take a second mortgage for the remaining 10%. That 10% is due in full in five years, and the Worthingtons agree to make monthly interest-only payments to the seller at 12% simple interest in the interim. (a) Find the Worthingtons' down payment.$ (b) Find the amount that the Worthingtons borrowed from their bank.$ (c) Find the amount that the Worthingtons borrowed from the seller.$ (d) Find the Worthingtons' monthly payment to the bank. (Round your answer to the nearest cent.)$ (e) Find the Worthingtons' monthly interest payment to the seller.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education