FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

please prepare a classified

Transcribed Image Text:2

3

4

S

6

7

8

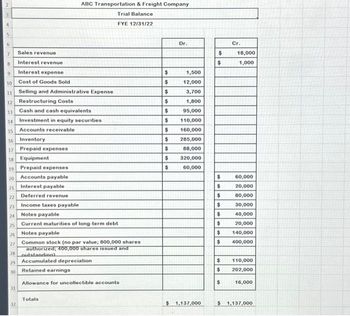

Sales revenue

Interest revenue

9

Interest expense

10

Cost of Goods Sold

11 Selling and Administrative Expense

12 Restructuring Costs

13. Cash and cash equivalents

14 Investment in equity securities

15

Accounts receivable

16 Inventory

17 Prepaid expenses

18 Equipment

19 Prepaid expenses

20 Accounts payable

21

Interest payable

Deferred revenue

22

23

24

25

26

27

28 outstanding)

29 Accumulated depreciation

30

Retained earnings

Allowance for uncollectible accounts

31

ABC Transportation & Freight Company

Trial Balance

FYE 12/31/22

32

Income taxes payable

Notes payable

Current maturities of long-term debt

Notes payable

Common stock (no par value; 800,000 shares

authorized; 400,000 shares issued and

Totals

$

$

$

$

$

$

$

$

$

$

$

Dr.

1,500

12,000

3,700

1,800

95,000

110,000

160,000

285,000

88,000

320,000

60,000

$ 1,137,000

$

$

$

$

$

$

$

$

$

$

$

$

Cr.

18,000

1,000

60,000

20,000

80,000

30,000

40,000

20,000

140,000

400,000

110,000

202,000

16,000

$ 1,137,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The inventories of Berry Company for the years 2019 and 2020 are as follows: Cost NRVJanuary 1, 2019 $10,000 $10,000December 31, 2019 13,000 11,500December 31, 2020 15,000 14,000 Berry uses the periodic inventory method and the FIFO inventory cost flow assumption. Required: 1. Assume the inventory that existed at the end of 2019 was sold in 2020. Prepare the necessary journal entries at the end of each year to record the correct inventory valuation if Berry uses the: a. direct method b. allowance method 2. Refer to your answer for E8-6. How does the use of a periodic or perpetual inventory system affect the valuation of inventory?arrow_forward"On January 1, 2019, the general ledger of Global Corporation included supplies of $1,000. During 2019, supplies purchased amounted to $5,000. A physical count of inventory on hand at December 31, 2019 determined that the amount of supplies on hand was $1,200. How much is the supplies expense for year 2019?"arrow_forwardCrane Company's balance sheet at December 31, 2021, is presented below. Cash Inventory Prepaid Insurance Equipment 1. 2. 3. 4. 5. 6. 7. CRANE COMPANY Balance Sheet December 31, 202 $24,000 Accounts Payable Interest Payable Notes Payable Owner's Capital 24,600 Adjustment data: 4,800 During January 2022, the following transactions occurred. (Crane Company uses the perpetual inventory system.) 30,400 $83,800 $11,000 200 40,000 32,600 $83,800 Crane paid $200 interest on the note payable on January 1, 2022. The note is due December 31, 2023. Crane purchased $208,880 of inventory on account. Crane sold for $352,000 cash, inventory which cost $212,000. Crane also collected $22,880 in sales taxes. Crane paid $184,000 in accounts payable. Crane paid $13,600 in sales taxes to the state. Paid other operating expenses of $24,000. On January 31, 2022, the payroll for the month consists of salaries and wages of $48,000. All salaries and wages are subject to 7.65% FICA taxes. A total of $7,120…arrow_forward

- https://www.republictt.com/pdfs/annual-reports/RFHL-Annual-Report-2022.pdf Financial Reporting Analysis: Use Republic Bank Limited Annual Report 2022 to answer the Questions. a) Evaluate the company’s latest annual financial statements (balance sheet, income statement, and cash flow statement) and comment on the company's financial performance and position. In your response, use the requirements of IAS 1 as a guide. b) Identify and discuss key accounting principles and standards applied in the company’s financial reporting process indicating their reasons for choosing these and how they were applied. Comment briefly on the appropriateness of the choices made given the company’s industry, location and type (e.g. MNC, regional conglomerate, etc.) c) Critically analyze any significant accounting policies and estimates disclosed in the notes to the financial statements. In your answer, indicate whether the company complied with the accounting standards and conventions.arrow_forwardA čompany uses a perpetual system to record inventory transactions. The company purchases inventory on account on February 9, 2021, for $57,000 and then sells this inventory on account on March 7, 2021, for $74,000. Record the transactions for the purchase and sale of the inventory. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list EX: ...... Record the purchase of inventory on account. 2 Record the sale of inventory on account. Record the cost of inventory sold. Credit Note : journal entry has been entered %3D View general journal Clear entry Record entryarrow_forwardFollowing information is available for Nick Company for the year ended 2020: Additional information: Amount for accounts receivable (net) at the end of 2019 was $57,000. The inventory as of 01st of January 2020 is calculated as $22,000. Required: Calculation of the following for the year ended 2020: a) Working capital b) Quick ratio c) Inventory turnover ratio. d) Accounts receivable turnover ratio and number of days in the collection assuming 366 days a year.arrow_forward

- Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31 2021 2020 2019 Sales $ 510,880 $ 391,376 $ 271,600 Cost of goods sold 307,550 248,524 173,824 Gross profit 203,330 142,852 97,776 Selling expenses 72,545 54,010 35,851 Administrative expenses 45,979 34,441 22,543 Total expenses 118,524 88,451 58,394 Income before taxes 84,806 54,401 39,382 Income tax expense 15,774 11,152 7,995 Net income $ 69,032 $ 43,249 $ 31,387 KORBIN COMPANY Comparative Balance Sheets December 31 2021 2020 2019 Assets Current assets $ 53,905 $ 36,079 $ 48,229 Long-term investments 0 500 3,040 Plant assets, net 101,665 92,652 55,799 Total assets $ 155,570 $ 129,231 $ 107,068 Liabilities and Equity Current liabilities $ 22,713 $ 19,255 $ 18,737 Common stock 68,000 68,000 50,000 Other paid-in capital 8,500 8,500 5,556 Retained earnings 56,357 33,476…arrow_forwardA company uses a perpetual system to record inventory transactions. The company purchases inventory on account on February 9, 2021, for $50,000 and then sells this inventory on account on March 7, 2021, for $70,000. Record the transactions for the purchase and sale of the inventory. (If no entry is required for a particular transaction/event select "No Journal Entry Required" in the first account field.)arrow_forwardPlease help mearrow_forward

- 19. A listing of the estimated balances in the company's ledger accounts as of December 31, 2023 is given below (as well as in your Excel template): Cash Accounts receivable Inventory-raw materials Inventory-finished goods Capital assets (net) Assets $ 83,365 1,122,900 10,000 9,125 724,000 $1,949,390 Total assets Liabilities and Shareholders' Equity Accounts payable $ 231,563 Capital stock 1,000,000 Retained Earnings Total liabilities and shareholders' equity 717,828 $1,949,390 Required: 1. Prepare a monthly master budget for ToyWorks for the year ended December 31, 2024, including the following schedules (Use the Excel template provided!): Sales Budget & Schedule of Cash Receipts Production Budget & Manufacturing Overhead Budget Direct Materials Budget & Schedule of Cash Disbursements Direct Labour Budget Selling and Administrative Expense Budget Ending Finished Goods Inventory Budget Cash Budget 2. Prepare budgeted financial statements at December 31, 2024, using absorption costing.arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardI also need the journal entry for december 31 2025arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education