Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

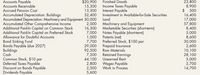

The following is an alphabetical list of Lloyd’s Hudson Dealership Inc.’s December 31, 2019,

1. Prepare a properly classified balance sheet for Lloyd’s Hudson Dealership as of December 31, 2019. List the additional parenthetical or note disclosures (if any) that should be made for each item. 2. Next Level Compute the

Transcribed Image Text:Finished Goods

Accounts Payable

Accounts Receivable

Accrued Pension Cost

$20,900

15,300

13,300

32,400

23,800

8,900

$ 500

16,400

17,000

57,800

8,400

5,000

8,600

30,000

2,600

10,100

28,100

5,000

2,700

14,700

Income Taxes Payable

Interest Payable

Investment in Available-for-Sale Securities

Accumulated Depreciation: Buildings

Accumulated Depreciation: Machinery and Equipment 30,000 Land

Accumulated Other Comprehensive Income

Additional Paid-In Capital on Common Stock

Additional Paid-In Capital on Preferred Stock

Allowance for Doubtful Accounts

Bond Sinking Fund

Bonds Payable (due 2027)

Buildings

Cash

Common Stock, $10 par

Deferred Taxes Payable

Discount on Bonds Payable

Dividends Payable

2,000 Machinery and Equipment

16,300 Marketable Securities (short-term)

7,000 Notes Payable (short-term)

1,000 Patents (net)

7,700 Preferred Stock, $100 par

29,000

92,500 Raw Materials

7,200

44,100

2,800

2,500

5,600

Prepaid Insurance

Retained Earnings

Unearned Rent

Wages Payable

Work in Process

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Haresharrow_forwardThe net pension liability (PBO minus plan assets) is increased by: A. Service cost. B. Expected return on plan assets. C. Amortization of prior service cost. D. Cash contributions to plan assets.arrow_forwardFair value of plan assets 4,750,000Unamortized past service cost 1,250,000Projected benefit obligation 5,500,000Unrecognized actuarial gain 850,000The transactions for the current year relating to the defined benefit plan are as follows:Current service cost 925,000Discount rate 6%Actual return on plan assets 485,000Contribution to the plan 1,350,000Benefits paid to retirees 995,000Increase in projected benefit obligation due to changes in actuarial assumptions 150,000Effective in the current year, the entity has applied the provisions of revised PAS 19 in relation to the definedbenefit plan.REQUIRED:15. Prepare journal entry to recognize the transitional effect of adopting revised PAS 19.16. Determine the employee benefit expense for the current year.17. Compute the remeasurement related to the defined benefit plan.18. Prepare journal entry to record the employee benefit expense.19. Compute for the Fair Value Plan Asset (FVPA) as of December 31.20. Compute for the projected benefit…arrow_forward

- Need help with this general accounting questionarrow_forwardIndicate by letter whether each of the events listed below increases (I), decreases (D), or has no effect (N) on an employer's periodic pension expense in the year the event occurs. Events 1. Interest cost. _____ 2. Amortization of prior service cost---AOCI. ______ 3.Excess of the expected return on plan assets over the actual return _____ 4. Expected return on plan assets. _____ 5. A plan amendment that increases benefits is made retroactive to prior years. ____ 6. Actuary's estimate of the PBO is increased.…arrow_forwardQuestion text The computation of pension expense includes all the following except Select one: 13 a. interest on plan assets b. all of these are included C. service cost component measured using current salary levels. d. interest on defined benefit obligation.arrow_forward

- Current Attempt in Progress The following data are for the pension plan for the employees of Beaufort Company. Accumulated benefit obligation Projected benefit obligation Market-related asset value Plan assets (at fair value) Unrecognized net loss Settlement rate (for year) Expected rate of return (for year) 1/1/17 O $135,300. O $81,700. O $51,800. O $37,600. $7,350,000 7,998,000 7,468,000 7,762,000 0 12/31/17 12/31/18 $7,644,000 $9,996,000 8,232,000 10,689.000 8.350,000 9,014,000 8.820,000 9,901,000 1,450,000 1,490,000 10% 995 9% 8% Beaufort's contribution was $1,247,000 in 2018 and benefits paid were $1.102,000. Beaufort estimates that the average remaining service life is 15 years. The actual return on plan assets in 2018 was $749,700. The unexpected gain on plan assets in 2018 wasarrow_forwardPlease provide answer this financial accounting questionarrow_forwardrmn.5arrow_forward

- PROBLEM 6: MULTIPLE CHOICE – COMPUTATIONAL 1. The actuarial valuation report of an entity shows the following information: Present value of defined benefit obligation, Jan. 1 340,000 Current service cost 30,000 Discount rate 10% Benefits paid to retirees Actuarial gain 100,000 60,000 How much is the year-end balance of the present value of defined benefit obligation? a. 210,000 b. 244,000 c. 304,000 d. 364,000arrow_forwardPlease Introduction and show work no plagiarism pleasearrow_forwardOwearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College