FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

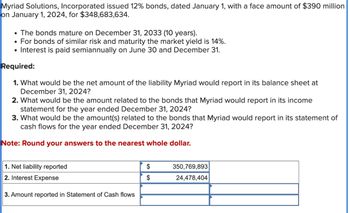

Transcribed Image Text:Myriad Solutions, Incorporated issued 12% bonds, dated January 1, with a face amount of $390 million

on January 1, 2024, for $348,683,634.

• The bonds mature on December 31, 2033 (10 years).

For bonds of similar risk and maturity the market yield is 14%.

• Interest is paid semiannually on June 30 and December 31.

Required:

1. What would be the net amount of the liability Myriad would report in its balance sheet at

December 31, 2024?

2. What would be the amount related to the bonds that Myriad would report in its income

statement for the year ended December 31, 2024?

3. What would be the amount(s) related to the bonds that Myriad would report in its statement of

cash flows for the year ended December 31, 2024?

Note: Round your answers to the nearest whole dollar.

1. Net liability reported

2. Interest Expense

3. Amount reported in Statement of Cash flows

$

$

350,769,893

24,478,404

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2020, Blindo Corp. issued ten - year, 12% bonds with a face value of $ 500,000, with interest payable semi-annually on June 30 and December 31. At the time, the market rate was 10%. Required: a) Find PMT and Use your calculator to calculate the issue price of the bonds. Round the answer to the nearest dollar. b) Independent of your solution to part a), assume that the issue price was $ 562, 000. Prepare the amortization table for 2020. Round values to the nearest dollar.arrow_forwardWhen Patey Pontoons issued 10% bonds on January 1, 2024, with a face amount of $880,000, the market yield for bonds of similar risk and maturity was 11%. The bonds mature December 31, 2027 (4 years). Interest is paid semiannually on June 30 and December 31. Required: 1. Determine the price of the bonds at January 1, 2024. 2. Prepare the journal entry to record their issuance by Patey on January 1, 2024. 3. Prepare an amortization schedule that determines interest at the effective rate each period. 4. Prepare the journal entry to record interest on June 30, 2024. 5. What is the amount related to the bonds that Patey will report in its balance sheet at December 31, 2024? 6. What is the amount related to the bonds that Patey will report in its income statement for the year ended December 31, 2024? (Ignore income taxes.) 7. Prepare the appropriate journal entries at maturity on December 31, 2027 Note: Use tables, Excel, or a financial calculator. (EV of $1. PV of $1. EVA of $1. PVA of $1.…arrow_forwardHi there, Can you help with attached questions, thanks kindly.arrow_forward

- When Patey Pontoons issued 10% bonds on January 1, 2024, with a face amount of $880,000, the market yield for bonds of similar risk and maturity was 11%. The bonds mature December 31, 2027 (4 years). Interest is paid semiannually on June 30 and December 31. Required: 1. Determine the price of the bonds at January 1, 2024. 2. Prepare the journal entry to record their issuance by Patey on January 1, 2024. 3. Prepare an amortization schedule that determines interest at the effective rate each period. 4. Prepare the journal entry to record interest on June 30, 2024. 5. What is the amount related to the bonds that Patey will report in its balance sheet at December 31, 2024? 6. What is the amount related to the bonds that Patey will report in its income statement for the year ended December 31, 2024? (Ignore income taxes.) 7. Prepare the appropriate journal entries at maturity on December 31, 2027 Note: Use tables, Excel, or a financial calculator. (EV of $1. PV of $1. EVA of $1. PVA of $1.…arrow_forwardanswer is A: how do you get to this answers?arrow_forwardOn June 30, 2020, Wayne's Company issued $4,000,000 face value of 13%, 20-year bonds at $4,300,920, a yield of 12%.Wayne uses the effective-interest method to amortize bond premium or discount. The bonds pay semiannual interest on June 30 and December 31. #1. Set up a schedule of interest expense and premium/discount amortization under the effective-interest method. (Hint: The eff ective-interest rate must be computed.) (Please use excel & show all formulas)arrow_forward

- On March 1, 2024, Baddour, Incorporated, issued 10% bonds, dated January 1, with a face amount of $160 million. The bonds were priced at $142.00 million (plus accrued interest) to yield 12%. The price if issued on January 1 would have been $139.25 million. Interest is paid semiannually on June 30 and December 31. Baddour’s fiscal year ends September 30. Required: 1. to 3. What would be the amount(s) related to the bonds Baddour would report in its balance sheet, income statement and statement of cash flows for the year ended September 30, 2024?arrow_forwardPlease help me. Thankyou.arrow_forwardA company issues P5,000,000, 7.8%, 20-year bonds to yield 8% on January 1, 2022. Interest is paid on June 30 and December 31. The proceeds from the bonds are P4,901,036. Using effective-interest amortization, what will the carrying value of the bonds be on the December 31, 2022 statement of financial position? a. 4903160 b. 4,903,160.00 c. 4903160 d. 4,903,160arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education