FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Hi there,

Can you help with attached questions, thanks kindly.

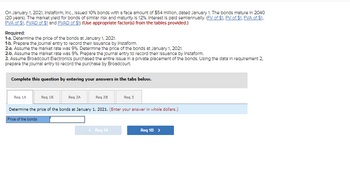

Transcribed Image Text:On January 1, 2021, Instaform, Inc., Issued 10% bonds with a face amount of $54 million, dated January 1. The bonds mature in 2040

(20 years). The market yield for bonds of similar risk and maturity is 12%. Interest is paid semiannually. (FV of $1, PV of $1, FVA of $1,

PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Required:

1-a. Determine the price of the bonds at January 1, 2021.

1-b. Prepare the journal entry to record their Issuance by Instaform.

2-a. Assume the market rate was 9%. Determine the price of the bonds at January 1, 2021.

2-b. Assume the market rate was 9%. Prepare the journal entry to record their Issuance by Instaform.

3. Assume Broadcourt Electronics purchased the entire issue in a private placement of the bonds. Using the data in requirement 2.

prepare the journal entry to record the purchase by Broadcourt.

Complete this question by entering your answers in the tabs below.

Reg 1B

Reg 1A

Req 3

Determine the price of the bonds at January 1, 2021. (Enter your answer in whole dollars.)

Price of the bonds

Reg 2A

Req 2B

< Req 1A

Req 1B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Bonds Price

VIEW Step 2: Req:1a Computation of the issue price of bonds by Instaform, Incorporated:

VIEW Step 3: Req:1b Journal entry to record their issuance by Instaform:

VIEW Step 4: Req:2b Computation of the issue price of bonds by Instaform, Incorporated:

VIEW Step 5: Req:2b Journal entry to record their issuance by Instaform:

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardMa1 . Who benefits most from Peace of Mind®? Complex return filers. EITC filers. Clients with refunds. All clients.arrow_forward

- please help with the question that is attached as a picture. thanksarrow_forwardWrite A little introduction on home depot.arrow_forwardTitle 1. Complete a search of online resources for grieving individuals. Which ones might you find helpful Description 1. Complete a search of online resources for grieving individuals. Which ones might you find helpful in your work with clients? Which ones might be helpful for your clients? 2. What do you think should be the minimum level of education, training, and experience for individuals who assist bereaved individuals?arrow_forward

- Can you tell me more about the role played by technology in contemporary accountancy?arrow_forwardQ1: Write an e-mail to technical support team of your college to retrieve your login credentials. In order to make your e- mail effective mention all the important details and reasons to prioritize your responsearrow_forwardHow do you know if a journal is reputable?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education