FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

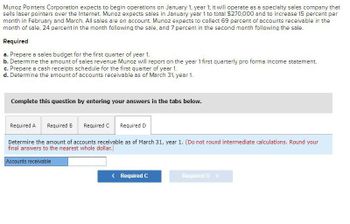

Transcribed Image Text:Munoz Pointers Corporation expects to begin operations on January 1, year 1; it will operate as a specialty sales company that

sells laser pointers over the Internet. Munoz expects sales in January year 1 to total $270,000 and to increase 15 percent per

month in February and March. All sales are on account. Munoz expects to collect 69 percent of accounts receivable in the

month of sale, 24 percent in the month following the sale, and 7 percent in the second month following the sale.

Required

a. Prepare a sales budget for the first quarter of year 1.

b. Determine the amount of sales revenue Munoz will report on the year 1 first quarterly pro forma income statement.

c. Prepare a cash receipts schedule for the first quarter of year 1.

d. Determine the amount of accounts receivable as of March 31, year 1.

Complete this question by entering your answers in the tabs below.

Required A

Required B Required C Required D

Determine the amount of accounts receivable as of March 31, year 1. (Do not round intermediate calculations. Round your

final answers to the nearest whole dollar.)

Accounts receivable

< Required C

Required D >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Thornton Pointers Corporation expects to begin operations on January 1, year 1; it will operate as a specialty sales company that sells laser pointers over the Internet. Thornton expects sales in January year 1 to total $300,000 and to Increase 15 percent per month in February and March. All sales are on account. Thornton expects to collect 66 percent of accounts receivable in the month of sale, 24 percent in the month following the sale, and 10 percent in the second month following the sale. Required a. Prepare a sales budget for the first quarter of year 1. b. Determine the amount of sales revenue Thornton will report on the year 1 first quarterly pro forma Income statement. c. Prepare a cash receipts schedule for the first quarter of year 1. d. Determine the amount of accounts receivable as of March 31, year 1. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Prepare a sales budget for the first quarter of year 1. Sales…arrow_forwardHorizon Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March $147,800 April 137,500 May 125,100 Depreciation, insurance, and property taxes represent $31,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in June. 61% of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month. Prepare a schedule of cash payments for selling and administrative expenses for March, April, and May. Horizon Financial Inc.Schedule of Cash Payments for Selling and Administrative ExpensesFor the Three Months Ending May 31 March April May March expenses: Paid in March $fill in the blank 1 Paid in April $fill in the blank 2 April expenses: Paid in April fill in the blank 3 Paid…arrow_forwardMiller Company expects its November sales to be 25% higher than its October sales of $170,000. All sales are on credit and are collected as follows: 35% in the month of the sale and 60% in the following month. Purchases were $70,000 in October and are expected to be $100,000 in November, Purchases are paid 20% in the month of purchase and 80% in the following month. The cash balance on November 1 is $13,800. The cash balance on November 30 will be OA. $86,575 OB. $114,175 OC. $190,175 OD. $100,375arrow_forward

- ABC plans to sell 10,000 units of a particular product during July, and expects sales to increase at the rate of 10% per month during the remainder of the year. The June 30 and September 30 ending inventories are anticipated to be 1,100 units and 950 units, respectively. On the basis of this information, how many units should ABC purchase for the quarter ended September 30?arrow_forward< Innovative Office Inc. has "cash and carry" customers and credit customers. Innovative Office estimates that 25% of monthly sales are to cash customers, while the remaining sales are to credit customers. Of the credit customers, 25% pay their accounts in the month of sale, while the remaining 75% pay their accounts in the month following the month of sale. Projected sales for the first three months of 20Y4 are as follows: January February March The Accounts Receivable balance on December 31, 20Y3, was $72,000. Prepare a schedule of cash collections from sales for January, February, and March. INNOVATIVE OFFICE INC. Schedule of Collections from Sales For the Three Months Ending March 31, 20Y4 January February Receipts from cash sales: Cash sales December sales on account: Collected in January January sales on account: Collected in January Collected in February February sales on account: Collected in February Collected in March March sales on account: Collected in March $107,000…arrow_forwardExcel Berhad manufactures one product line – the Nexus. Sales of Nexus over thenext few months are planned as follows:1. Demand: July 180,000 units, August 200,000 units, September 240,000 units,October 180,000 units. The selling price for each Nexus is RM5. 2. Debtor receipts: Credit customers (receivables) are expected to pay as follows: 70%during the month of sale and 28% during the following month.The remaining credit customers are expected to go bad (that is, to be uncollectable).Credit customers who pay in the month of sale are entitled to deduct a 2 per centdiscount from the invoice price. 3. Finished goods inventories: Inventories of finished goods are expected to be 50,000units at 1 July. The business’s policy is that, in future, the inventories at the end ofeach month should equal 20 percent of the following month’s planned salesrequirements. 4. Raw materials inventories: Inventories of raw materials is expected to be 50,000 kgon 1 July. The business’s policy is that, in…arrow_forward

- A company has expected sales for January through April of $9,800, 59, 500, $13, 800, and $9,500, respectively. Assume each month has 30 days and the accounts receivable period is 36 days. How much does the company expect to collect in the month of May?arrow_forwardThe Amherst Corporation has a 45-day accounts receivable period. The estimated quarterly sales for this year are $28,000, $41,000, $35,500, and $32,500, respectively, for the next four quarters. What is the accounts receivable balance at the beginning of the quarter 2? Each quarter has 90 days. Multiple Choice $36,750 $34,500 $20,500 $14,000 $28,000arrow_forwardCampbell Pointers Corporation expects to begin operations on January 1, year 1; it will operate as a specialty sales company that sells laser pointers over the Internet. Campbell expects sales in January year 1 to total $360,000 and to increase 10 percent per month in February and March. All sales are on account. Campbell expects to collect 66 percent of accounts receivable in the month of sale, 22 percent in the month following the sale, and 12 percent in the second month following the sale. Required a. Prepare a sales budget for the first quarter of year 1. b. Determine the amount of sales revenue Campbell will report on the year 1 first quarterly pro forma income statement. c. Prepare a cash receipts schedule for the first quarter of year 1. d. Determine the amount of accounts receivable as of March 31, year 1.arrow_forward

- Vikrambhaiarrow_forwardHalifax Shoes has 39% of its sales in cash and the remainder on credit. Of the credit sales, 65% is collected in the month of sale, 25% is collected the month after the sale, and 5% is collected the second month after the sale. How much cash will be collected in August if sales are estimated as $61,125 in June, $88,627 in July, and $70,376 in August? Round to the nearest penny, two decimal places.arrow_forwardDesiccate purchases direct materials each month. Its payment history shows that 70% is paid in the month of purchase with the remaining balance paid the month after purchase. Prepare a cash payment schedule for March if in January through March, it purchased $35,304, $36,973, and $39,905, respectively. Round to the nearest penny, two decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education