FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

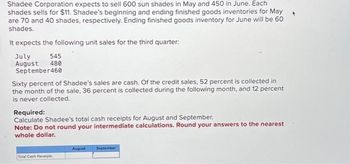

Transcribed Image Text:Shadee Corporation expects to sell 600 sun shades in May and 450 in June. Each

shades sells for $11. Shadee's beginning and ending finished goods inventories for May

are 70 and 40 shades, respectively. Ending finished goods inventory for June will be 60

shades.

It expects the following unit sales for the third quarter:

July

August

545

480

September460

Sixty percent of Shadee's sales are cash. Of the credit sales, 52 percent is collected in

the month of the sale, 36 percent is collected during the following month, and 12 percent

is never collected.

Required:

Calculate Shadee's total cash receipts for August and September.

Note: Do not round your intermediate calculations. Round your answers to the nearest

whole dollar.

Total Cash Receipts

August

September

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Indarrow_forwardSimpson Glove Company has made the following sales projections for the next six months. All sales are credit sales. March April May $54,000 June 63,000 July 45,000 August $60,000 71,000 75,000 Sales in January and February were $41,000 and $39,000, respectively. Experience has shown that of total sales receipts 10 percent are uncollectible, 45 percent are collected in the month of sale, 35 percent are collected in the following month, and 10 percent are collected two months after sale. Sales Prepare a monthly cash receipts schedule for the firm for March through August. Simpson Glove Company Cash Receipts Schedule February $ Collections of current sales Collections of prior month's sales Collections of sales 2 months earlier Total cash receipts January $ March - $ $ April $ $ May $ $ $ June $ $ July $arrow_forwardYung Reeds, a manufacturer of saxophone, oboe, and clarinet reeds, has projected sales to be $892,000 in October, $954,000 in November, $1,040,000 in December, and $928,000 in January. Yung's sales are 25% cash and 75% credit. The company's collection history indicates that credit sales are collected as follows: 20% in the month of the sale 65% in the month after the sale 8% two months after the sale 7% are never collected Requirements 1. Prepare a sales budget for all four months, showing the breakdown between cash and credit sales. 2. Prepare a cash collection budget for December and January. Round all answers up to the nearest dollar. Yung Reeds Budgeted Cash Collections from Customers For the Months of December and January December Cash sales Collection of credit sales: 20% of current month credit sales 65% of prior month credit sales 8% of credit sales two months ago Total collection of credit sales Total cash collections $ $ 260,000 $ 156,000 465,075 53,520 934,595 $ January…arrow_forward

- Hannon Retailing Company prices its products by adding 30% to its cost. Hannon anticipates sales of $715,000 in July, $728,000 in August, and $624,000 in September. Hannon’s policy is to have on hand enough inventory at the end of the month to cover 25% of the next month’s sales. What will be the cost of the inventory that Hannon should budget for purchase in August?a. $509,600b. $540,000c. $565,000d. $680,000arrow_forwardCampbell Pointers Corporation expects to begin operations on January 1, year 1; it will operate as a specialty sales company that sells laser pointers over the Internet. Campbell expects sales in January year 1 to total $360,000 and to increase 10 percent per month in February and March. All sales are on account. Campbell expects to collect 66 percent of accounts receivable in the month of sale, 22 percent in the month following the sale, and 12 percent in the second month following the sale. Required a. Prepare a sales budget for the first quarter of year 1. b. Determine the amount of sales revenue Campbell will report on the year 1 first quarterly pro forma income statement. c. Prepare a cash receipts schedule for the first quarter of year 1. d. Determine the amount of accounts receivable as of March 31, year 1.arrow_forwardVikrambhaiarrow_forward

- Jasper Company has 65% of its sales on credit and 35% for cash. All credit sales are collected in full in the first month following the sale. The company budgets sales of $531,000 for April, $541,000 for May, and $566,000 for June. Total sales for March are $301,600. Prepare a schedule of cash receipts from sales for April, May, and June. Sales Cash receipts from: Total cash receipts JASPER COMPANY Schedule of Cash Receipts from Sales April May 531,000 541,000 June 566,000arrow_forwardRocker Company expects to sell 7,000 units for $180 each for a total of $1,260,000 in January and 1,500 units for $190 each for a total of $285,000 in February. The company expects cost of goods sold to average 60% of sale revenue, and the company expects to sell 4,300 units in March for $260 each. Rocker's target ending inventory is $15,000 plus 50% of the next month's cost of goods sold Prepare Rocker's inventory, purchases, and cost of goods sold budget for January and February Rocker Company Inventory, Purchases, and Cost of Goods Sold Budget Two months Ended January 31 and February 28 January February Cost of goods soid Plus: Desired ending merchandise inventory Total merchandise inventory required Less: Beginning merchandise inventory Budgeted purchases Your protection has expire Don't leave your devices exposed to virus Uneretested devices are perfect targets forarrow_forward1.arrow_forward

- Graham Company projects the following sales for the first three months of the year: $10,600 in January: $14,600 in February; and $16,300 in March. The company expects 80% of the sales to be cash and the remainder on account. Sales on account are collected 50% in the month of the sale and 50% in the following month. The Accounts Receivable account has a zero balance on January 1. Round to the nearest dollar. Read the requirements. Requirement 1. Prepare a schedule of cash receipts for Graham for January, February, and March. What is the balance in Accounts Receivable on March 31? (If an input field is not used, leave the input field empty. Do not enter a zero.) Cash Receipts from Customers Total sales Cash Receipts from Customers: Accounts Receivable balance, January 1 January-Cash sales January-Credit sales, collection of January sales in January January-Credit sales, collection of January sales in February February-Cash sales February-Credit sales, collection of February sales in…arrow_forwardBen Company has the following sales forecast for the next quarter: April, 20,000 units; May, 24,000 units; June, 28,000 units. Sales totaled 16,000 units in March. The end of April finished goods inventory was 4,800 units. End-of-month finished goods inventory levels are planned to be equal to 20 percent of the next month's planned sales. The unit to be produced for May is: A. 29,600 units. B. 28,800 units. C. 24,000 units. D. 24,800 units.arrow_forwardCroy Inc. has the following projected sales for the next five months: Month Sales in Units April 3,450 May 3,940 June 4,640 July 4,180 August 3,980 Croy’s finished goods inventory policy is to have 50 percent of the next month’s sales on hand at the end of each month. Direct materials costs $3.00 per pound, and each unit requires 2 pounds. Direct materials inventory policy is to have 50 percent of the next month’s production needs on hand at the end of each month. Direct materials on hand at March 31 totaled 3,695 pounds. Required: 1. Determine budgeted production for April, May, and June. 2. Determine budgeted cost of materials purchased for April and May.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education