Concept explainers

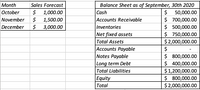

All sales are made on credit terms of net 30 days and are collected the following month and no

The annual interest rate on outstanding long-term debt and bank loans (notes payable) is 12%. There are no capital expenditures planned during the period, and no dividends will be paid. The company’s desired end-of-month cash balance is $80,000. The president hopes to meet any cash shortages during the period by increasing the firm’s notes payable to the bank. The interest rate on new loans will be 12 percent.

- Prepare monthly pro forma balance sheets at the end of October, November, and December, 2020.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

- Nyanza, Incorporated anticipates sales of 55,000 units, 53,000 units, and 56,000 units in July, August, and September, respectively. Company policy is to maintain an ending finished-goods inventory equal to 30% of the following month's sales. On the basis of this information, how many units would the company plan to produce in July?arrow_forwardVishnuarrow_forwardA company budgets the following merchandising purchases: April: $70.000; May $90,000, June: $60,000. All purchases are on account and the company pays 25% of purchases in the month of the purchase and the remaining amount in the following month. Cash disbursements for June for merchandise is $arrow_forward

- Garza Electronics expects to sell 500 units in January, 250 units in February, and 1,000 units in March. January's beginning inventory is 700 units. Expected sales for the whole year are 7,200 units. Garza has decided on a level monthly production schedule of 600 units (7,200 units/12 months = 600 units per month). What is the expected end- of-month inventory for January, February, and March?arrow_forwardAll sales are made on credit terms of net 30 days and are collected the following month and no bad debts are anticipated. The accounts receivable on the balance sheet at the end of September thus will be collected in October. The October sales will be collected in November, and so on. Inventory on hand represents a minimum operating level (or “safety” stock), which the company intends to maintain. Cost of goods sold average 80 percent of sales. Inventory is purchased in the month of sale and paid for in cash. Other cash expenses average 7 percent of sales. Depreciation is $10,000 per month. Assume taxes are paid monthly and the effective income tax rate is 40 percent for planning purposes. The annual interest rate on outstanding long-term debt and bank loans (notes payable) is 12%. There are no capital expenditures planned during the period, and no dividends will be paid. The company’s desired end-of-month cash balance is $80,000. The president hopes to meet any cash shortages during…arrow_forwardCave Hardware's forecasted sales for April, May, June, and July are $220,000, $260,000, $190,000, and $300,000, respectively. Sales are 70% cash and 30% credit with all accounts receivables collected in the month following the sale. Cost of goods sold is 75% of sales and ending inventory is maintained at $55,000 plus 20% of the following month's cost of goods sold. All inventory purchases are paid 28% in the month of purchase and 72% in the following month. What are the cash collections budgeted for June at Cave Hardware? $267,000 $133,000 $211,000 $156,000arrow_forward

- The beginning inventory is expected to be 3,100 cases. Expected sales are 13,300 cases, and the company wishes to begin the next period with an inventory of 2,100 cases. The number of cases the company must purchase during the month isarrow_forwardAssume that a company’s Inventory Turnover is 15. What does that mean? It takes about 15 days for inventory to move from the company to its customers. Receivables turn over 15 times per year. Inventories turn over 15 times per year. The average account receivable is collected about 15 days after the credit sale occurs.arrow_forwardNarai Co. has a desired ending inventory of 30% of the next months forecasted sales. In turn, their cost of goods sold is 60%, and their forecasted sales for the months of March, April, May, June, and July are as follows: $750,000, $880,000, $700,000, $800,000, and $900,000 respectively. Purchases for the months of February and March were $500,000 and $360,000 and their purchases are paid as follows: 10% during the month of the purchase 80% in the next month and the final 10% in the next month. Required: Prepare budget schedules for the months of April, May, and June for required purchases and also for disbursements for purchases.arrow_forward

- Shadee Corporation expects to sell 590 sun shades in May and 360 in June. Each shades sells for $15. Shadee's beginning and ending finished goods inventories for May are 80 and 50 shades, respectively. Ending finished goods inventory for June will be 60 shades. It expects the following unit sales for the third quarter. July August September 545 450 430 Sixty percent of Shadee's sales are cash. Of the credit sales, 52 percent is collected in the month of the sale. 40 percent is collected during the following month, and 8 percent is never collected. Required: Calculate Shadee's total cash receipts for August and September Note: Do not round your intermediate calculations. Round your answers to the nearest whole dollar. Total Cash Receipts August Septemberarrow_forwardShadee Corporation expects to sell 590 sun shades in May and 360 in June. Each shades sells for $15. Shadee's beginning and ending finished goods inventories for May are 60 and 45 shades, respectively. Ending finished goods inventory for June will be 55 shades. It expects the following unit sales for the third quarter: July August September 545 500 470 Sixty percent of Shadee's sales are cash. Of the credit sales, 52 percent is collected in the month of the sale, 38 percent is collected during the following month, and 10 percent is never collected. Required: Calculate Shadee's total cash receipts for August and September. Note: Do not round your intermediate calculations. Round your answers to the nearest whole dollar. August September Total Cash Receiptsarrow_forwardThe table contains the Sales estimates for the next year. The Purchases are 55% of Sales. Purchases are paid in the following month. The administrative expenses of $11,550 are paid each month Tax expenses of $16,458 are paid in March, June, September, and December each year. Rent expenses of $47,735 are paid in June and December. What is the cash outflow for March? Month Sales $ Month Sales $ Jan 87,400 July 21,931 Feb 89,751 Aug 78,038 Mar 78,038 Sep 87,400 Apr 21,931 Oct 78,038 May 87,400 Nov 89,751 June 89,751 Dec 21,931arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education