Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

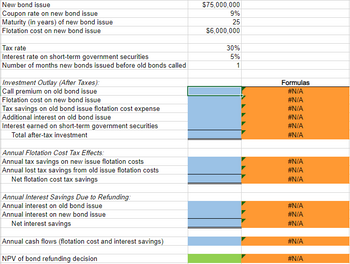

Transcribed Image Text:New bond issue

Coupon rate on new bond issue

Maturity (in years) of new bond issue

Flotation cost on new bond issue

Tax rate

Interest rate on short-term government securities

Number of months new bonds issued before old bonds called

Investment Outlay (After Taxes):

Call premium on old bond issue

Flotation cost on new bond issue

Tax savings on old bond issue flotation cost expense

Additional interest on old bond issue

Interest earned on short-term government securities

Total after-tax investment

Annual Flotation Cost Tax Effects:

Annual tax savings on new issue flotation costs

Annual lost tax savings from old issue flotation costs

Net flotation cost tax savings

Annual Interest Savings Due to Refunding:

Annual interest on old bond issue

Annual interest on new bond issue

Net interest savings

Annual cash flows (flotation cost and interest savings)

NPV of bond refunding decision

$75,000,000

9%

25

$6,000,000

30%

5%

Formulas

#N/A

#N/A

#N/A

#N/A

#N/A

#N/A

#N/A

#N/A

#N/A

#N/A

#N/A

#N/A

#N/A

#N/A

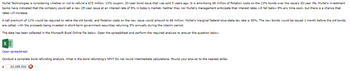

Transcribed Image Text:Mullet Technologies is considering whether or not to refund a $75 million, 13% coupon, 30-year bond issue that was sold 5 years ago. It is amortizing $8 million of flotation costs on the 13% bonds over the issue's 30-year life. Mullet's investment

banks have indicated that the company could sell a new 25-year issue at an interest rate of 9% in today's market. Neither they nor Mullet's management anticipate that interest rates will fall below 9% any time soon, but there is a chance that

rates will increase.

A call premium of 11% would be required to retire the old bonds, and flotation costs on the new issue would amount to $6 million. Mullet's marginal federal-plus-state tax rate is 30%. The new bonds would be issued 1 month before the old bonds

are called, with the proceeds being invested in short-term government securities returning 5% annually during the interim period.

The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below.

Open spreadsheet

Conduct a complete bond refunding analysis. What is the bond refunding's NPV? Do not round intermediate calculations. Round your answer to the nearest dollar.

$ 20,359,532 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Similar questions

- The Wagner Corporation has a $29 million bond obligation outstanding, which it is considering refunding. Though the bonds were initially issued at 16 percent, the interest rates on similar issues have declined to 13.3 percent. The bonds were originally issued for 25 years and have 21 years remaining. The new issue would be for 21 years. There is a 8 percent call premium on the old issue. The underwriting cost on the new $29 million issue is $640,000, and the underwriting cost on the old issue was $490,000. The company is in a 40 percent tax bracket, and it will allow an overlap period of one month (1/12 of the year). Treasury bills currently yield 5 percent. (Do not round intermediate calculations. Enter the answers in whole dollars, not in millions. Round the final answers to nearest whole dollar.) a Calculate the present value of total outflows. Total outflows $ 3450000 b. Calculate the present value of total inflows. Total inflows $ 469800 c. Calculate the net present value. Net…arrow_forwardPaints plans to issue a $1,000 par value, 20 year noncallable bond with a 7% annual coupon paid semiannually. The cost marginal tax rate is 40% but Congress is considering a change in the corporate tax to 30%. By how much would the component cost of debt used to calculate the WACC change if the new tax rate was adopted?arrow_forwardCastle Company’s pension fund projected that a significant number of its employees would take advantage of a retirement program the company plans to offer in 10 years. Anticipating the need to fund these pensions, the firm bought zero coupon Government of Canada bonds maturing in 10 years. When these instruments were originally issued, they were 6% semiannual 30-year bonds. The stripped bonds are currently priced to yield 3.75%. Their total maturity value is $18,000,000. What is their total cost (price) to Castle today?arrow_forward

- The Optical World Corporation, a manufacturerof peripheral vision storage systems, needs $10 million to market its new robotics-based vision systems.The firm is considering two financing options: common stock and bonds. If the firm decides to raise thecapital through issuing common stock, the flotationcosts will be 6%, and the share price will be $25. Ifthe firm decides to use debt financing, it can sell a10-year, 12% bond with a par value of $1,000. Thebond flotation costs will be 1.9%.(a) For equity financing, determine the flotationcosts and the number of shares to be sold to net$10 million.(b) For debt financing, determine the flotation costsand the number of $1,000 par value bonds tobe sold to net $10 million. What is the requiredannual interest payment?arrow_forwardMark Motel's debt has a face value of $40 million, a coupon rate of 14% (paid semiannually), and expires in 12 years (at t = 12 . The current annual yield-to-maturity (stated) for all bonds of the company is 15%. Mark wishes to conserve cash for the next few years. To do this, Mark decides to issue new equity and use the proceeds to purchase the existing debt at the market price. The current stock price of Mark is $60 and there are 2 million shares outstanding. 1. How many shares should Mark issue to purchase the existing debt? Assume the decision to purchase the bond does not change the stock price. Instead, the company decides to issue a zero-coupon bond that matures at year 5, and use the proceeds to purchase the existing debt at the market price. 2. What is the face value of the zero-coupon bond that Mark needs to issue?arrow_forwardNew York Waste (NYW) is considering refunding a $50,000,000, annual payment, 10% coupon, 30-year bond issue that was issued 5 years ago. It has been amortizing $3 million of flotation costs on these bonds over their 30-year life. The company could sell a new issue of 25-year bonds at an annual interest rate of 6% in today's market. A call premium of 10% would be required to retire the old bonds, and flotation costs on the new issue would amount to $3 million. NYW's marginal tax rate is 40%. The new bonds would be issued when the old bonds are called. Should NYW proceed with the bond refunding? What is the NPV?arrow_forward

- To help finance a major expansion, a company sold a noncallable bond several years ago that now has 14 years to maturity. This bond has a 14.00% annual coupon, paid semiannually, sells at a price of $1,400, and has a par value of $1,000. If the firm's tax rate is 21%, what is the component cost of debt for use in the WACC calculation? Do not round your intermediate calculations. 8.94% 7.06% 3.53%arrow_forwardThe Mossman Castle Hill has a $19 million bond obligation outstanding, which it is considering refunding. Though the bonds were initially issued at 10 percent, the interest rates on similar issues have declined to 8.6 percent. The bonds were originally issued for 20 years and have 10 years remaining. The new issue would be for 10 years. There is a 10 percent call premium on the old issue. The underwriting cost on the new $18,000,000 issue is $530,000, and the underwriting cost on the old issue was $380,000. The company is in a 35 percent tax bracket, and it will use an 8 percent discount rate (rounded after-tax cost of debt) to analyse the refunding decision. Should the old issue be refunded with new debt? (Follow the steps from the textbook example!) Skip Start Solvingarrow_forwardAccess Ltd is financing a new investment and was previously unsuccessful to secure a similar interest rate as they had with their previous debt from their local Bank. Given their AAA credit rating, they instead decided to issue 5000 units of a 10-year bond to fund the investment. Coupon rate is set at 8% per annum and will be paid quarterly. The face value of one of the bonds is $1,000. The estimated yield for similar bonds of comparable risk rating is 12% per annum. Determine the market price of the one of the bonds.arrow_forward

- (Cost of debt) Sincere Stationery Corporation needs to raise $500,000 to improve its manufacturing plant. It has decided to issue a $1,000 par value bond with an annual coupon rate of 14 percent and a maturity of 10 years. The investors require a rate of return of 9 percent. a. Compute the market value of the bonds b. What will the net price be if flotation costs are 10.5 percent of the market price? c. How many bonds will the firm have to issue to receive the needed funds? d. What is the firm's after-tax cost of debt if its average tax rate is 25 percent and its marginal tax rate is 21 percent? e. Rework the problem as follows: Assume a coupon rate of 8 percent. f. What effect does changing the coupon rate have on the firm's after-tax cost of capital? Why is there a change? GUD a. If the bond's annual coupon rate is 14%, what is the market value of the bond? (Round to the nearest cent.) b. What will the net price be if flotation costs are 10.5 percent of the market price? (Round to…arrow_forwardHorizon Corporation has decided to a capital restructuring. This process of restructuring involves increasing its existing $80 million in debt to $125 million. However, the interest rate on the debt is 9 percent and it is not expected to change. The firm currently has 10 million shares outstanding, and the price per share is $60. If the restructuring is expected to increasethe return on equity (ROE), what is the minimum level for EBIT that Horizon’s management must be expecting? Ignore taxes in your answer.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education