Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

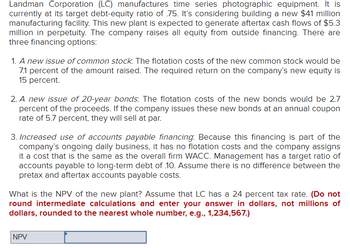

Transcribed Image Text:Landman Corporation (LC) manufactures time series photographic equipment. It is

currently at its target debt-equity ratio of .75. It's considering building a new $41 million

manufacturing facility. This new plant is expected to generate aftertax cash flows of $5.3

million in perpetuity. The company raises all equity from outside financing. There are

three financing options:

1. A new issue of common stock. The flotation costs of the new common stock would be

7.1 percent of the amount raised. The required return on the company's new equity is

15 percent.

2. A new issue of 20-year bonds. The flotation costs of the new bonds would be 2.7

percent of the proceeds. If the company issues these new bonds at an annual coupon

rate of 5.7 percent, they will sell at par.

3. Increased use of accounts payable financing. Because this financing is part of the

company's ongoing daily business, it has no flotation costs and the company assigns

it a cost that is the same as the overall firm WACC. Management has a target ratio of

accounts payable to long-term debt of 10. Assume there is no difference between the

pretax and aftertax accounts payable costs.

What is the NPV of the new plant? Assume that LC has a 24 percent tax rate. (Do not

round intermediate calculations and enter your answer in dollars, not millions of

dollars, rounded to the nearest whole number, e.g., 1,234,567.)

NPV

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Landman Corporation (LC) manufactures time series photographic equipment. It is currently at its target debt-equity ratio of .78. It’s considering building a new $66.8 million manufacturing facility. This new plant is expected to generate aftertax cash flows of $7.93 million in perpetuity. There are three financing options: A new issue of common stock: The required return on the company’s new equity is 15.2 percent. A new issue of 20-year bonds: If the company issues these new bonds at an annual coupon rate of 7.1 percent, they will sell at par. Increased use of accounts payable financing: Because this financing is part of the company’s ongoing daily business, the company assigns it a cost that is the same as the overall firm WACC. Management has a target ratio of accounts payable to long-term debt of .10. (Assume there is no difference between the pretax and aftertax accounts payable cost.) If the tax rate is 23 percent, what is the NPV of the new plant? Note: A negative answer should…arrow_forwardVijayarrow_forwardman.2arrow_forward

- Suppose you have just become the president of J&J and the first decision you face is whether Co go ahead with a plan to renovate the company's Al systems. The plan will cost the company $60 million, and it is expected to save $15 million per year after taxes over the next five years. The firm sources of funds and corresponding required rates of return are as follow: $5 million common stock at 16%, $800,000 preferred stock at 12%, $6 million debt at 7%. All amounts are listed at market values and the firm's tax rate is 30%. You are the financial manager and supposed to calculate the NPV. What's the NPV? Do you recommend taking the project? ง = O NPV $5.167 Millions; I'll recommend the owners to take the project. O NPV=-$1.720 Millions; I'll tell the owners not to take the project. NPV = $4.562 Millions; I'll tell the owners not to take the project. O NPV=-$8.098 Millions; I'll tell the owners not to take the project.arrow_forwardAdamson Corporation is considering four average-risk projects with the following costs and rates of return: Project Cost Expected Rate of Return 1 $2,000 16.00% 2 3 4 3,000 5,000 2,000 15.00 13.75 12.50 The company estimates that it can issue debt at a rate of rd = 9%, and its tax rate is 25%. It can issue preferred stock that pays a constant dividend of $4.00 per year at $56.00 per share. Also, its common stock currently sells for $49.00 per share; the next expected dividend, D₁, is $5.75; and the dividend is expected to grow at a constant rate of 5% per year. The target capital structure consists of 75% common stock, 15% debt, and 10% preferred stock. a. What is the cost of each of the capital components? Do not round intermediate calculations. Round your answers to two decimal places. % Cost of debt: Cost of preferred stock: Cost of retained earnings: % % b. What is Adamson's WACC? Do not round intermediate calculations. Round your answer to two decimal places. % c. Only projects…arrow_forwardBased on market values, Gubler's Gym has an equity multiplier of 168 times. Shareholders require a return of 1179 percent on the company's stock and a pretax return of 5.06 percent on the company's debt. The company is evaluating a new project that has the same risk as the company itself. The project will generate annual aftertax cash flows of $321,000 per year for 9 years. The tax rate is 21 percent. What is the most the company would be willing to spend today on the project? Multiple Choice $1,802,338 $1,953,295 $1,919,325 $1,864,487 $2,264,479arrow_forward

- Mary, Inc. is considering a project for next year, which will cost $5 million. Mary plans to use the following combination of debt and equity to finance the investment. Issue $1.5 million of 10-year bonds at a price of 101, with a coupon/contract rate of 4%, and flotation costs of 2% of par. Use $3.5 million of funds generated from retained earnings. The equity market is expected to earn 8%. U.S. Treasury bonds are currently yielding 3%. The beta coefficient for Mary, Inc. is estimated to be .70. Mary is subject to an effective corporate income tax rate of 30 percent. Compute Mary's expected rate of return using the Capital Asset Pricing Model (CAPM). Please show calculations.arrow_forwardYou are making a proposal to start a corporation that would require invested capital of P9,000,000 but will provide annual earnings of P1,500,000 every year. The capital will be from an 8%- interest, P2,500,000-face value perpetual bonds and the balance from equity requiring a rate of return of 15%. How much is the value of goodwill based on this forecast?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education