FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

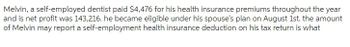

Transcribed Image Text:Melvin, a self-employed dentist paid $4,476 for his health insurance premiums throughout the year

and is net profit was 143,216. he became eligible under his spouse's plan on August 1st. the amount

of Melvin may report a self-employment health insurance deduction on his tax return is what

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Benny (56) and June (53) are married filing jointly. June's health insurance through work covers both of them, with a $3,500 annual deductible. June has a health savings account (HSA). They had no other insurance. What is the maximum contribution amount (including catch-up contributions) to their HSA account for 2023? $4,850 $7,750 $8,750 $9,750arrow_forwardHardaway earned $118,000 of compensation this year. He also paid (or had paid for him) $3,100 of health insurance (not through an exchange). What is Hardaway's AGI in each of the following situations? (Ignore the effects of Social Security and self-employment taxes.) a. Hardaway is an employee, and his employer paid Hardaway's $3,100 of health insurance for him as a nontaxable fringe benefit. Consequently, Hardaway received $114,900 of taxable compensation and $3,100 of nontaxable compensation. b. Hardaway is a self-employed taxpayer, and he paid $3,100 of health insurance himself. He is not eligible to participate in an employer-sponsored planarrow_forwardL. A. and Paula file as married taxpayers. In August of this year, they received a $5,200 refund of state income taxes that they paid last year. How much of the refund, if any, must L. A. and Paula include in gross income under the following independent scenarios? Assume the standard deduction last year was $25,100. Note: Leave no answer blank. Enter zero if applicable. Required: a. Last year L. A. and Paula had itemized deductions of $19,200, and they chose to claim the standard deduction. b. Last year L. A. and Paula claimed itemized deductions of $31,400. Their itemized deductions included state income taxes paid of $7,500 and no other state or local taxes. c. Last year L. A. and Paula claimed itemized deductions of $27,600. Their itemized deductions included state income taxes paid of $10,500, which were limited to $10,000 due to the cap on state and local tax deductions.arrow_forward

- Reggie is 55, had a AGI of 31200 in 2021. During the year, he paid the following medical expenses Drugs (prescribed by physicians) $520 Health I insurance premium after taxes $1420 Doctor's fees $1270 Eyeglasses $395 Over counter drugs $220 Reggies received $520 in 2021 for a portion of the Dr. fees from his insurance. What is Reggie's medical expenses deduction?arrow_forwardJacob is a member of WCC (an LLC taxed as a partnership). Jacob was allocated $150,000 of business income from WCC for the year. Jacob’s marginal income tax rate is 37 percent. The business allocation is subject to 2.9 percent of self-employment tax and 0.9 percent additional Medicare tax. (Round your intermediate calculations to the nearest whole dollar amount.) a. What is the amount of tax Jacob will owe on the income allocation if the income is not qualified business income? b. What is the amount of tax Jacob will owe on the income allocation if the income is qualified business income (QBI) and Jacob qualifies for the full QBI deduction?arrow_forwardJeremy (unmarried) earned $101,000 in salary and $6,050 in interest income during the year. Jeremy's employer withheld $10,000 of federal income taxes from Jeremy's paychecks during the year. Jeremy has one qualifying dependent child (age 14) who lives with him. Jeremy qualifies to file as head of household and has $24,060 in itemized deductions. (Use the tax rate schedules, Tax rates for Net Capital Gains and Qualified Dividends.) Required: a. Determine Jeremy's tax refund or taxes due. b. Assume that in addition to the original facts, Jeremy has a long-term capital gain of $4,020. What is Jeremy's tax refund or tax due including the tax on the capital gain? c. Assume the original facts except that Jeremy has only $7,100 in itemized deductions. What is Jeremy's tax refund or tax due?arrow_forward

- Amanda paid $6,120 for medical insurance and had $4,230 in medical expenses last year. Her medical insurance covered 70% of these expenses. The IRS allows medical and dental expenses deductions for the amount that exceeds 7.5% of a taxpayer's adjusted gross income. If Amanda's adjusted gross income is $71,450, how much can she claim as a medical deduction?arrow_forwardMeghan paid $9,212 for medical insurance and also had $5,700 in medical expenses last year. Her medical insurance covered 80% of these expenses. The IRS allows medical and dental expense deductions for the amount that exceeds 7.5% of a taxpayer's adjusted gross income. If Meghan's adjusted gross income is $65,432, how much can she claim as a medical deduction?arrow_forwardFor each taxpayer, compute the maximum contribution to the retirement plan. a. Lewis, a self-employed individual, has net earned income of $50,000 in 2019. If Lewis has no employees, calculate the maximum contribution to a SEP plan that he may deduct from his adjusted gross income. b. During 2019, Linda, age 32, has a salary of $40,000. She participates in a Section 401(k) plan and chooses to defer 25 percent of her compensation. What is the maximum amount Linda can contribute to the Section 401(k) plan on a tax-deferred basis? If Linda's salary was $125,000, instead of $40,000, what is the maximum amount that she could contribute to the Section 401(k) plan on a tax-deferred basis?arrow_forward

- Kevin owns a small business with two employees. For one payroll period the total withholding tax for all employees was 1,536. The total employees Social security tax was $168 and the total employers social security tax was $251. The total employees Medicare tax was $110 How much John deposit as the employer's share of social security tax and Medicare tax? What is the total tax that must be deposited?arrow_forwardStephen Belcher's filing status is single, and he has earned gross pay of $1,840. Each period he makes a 401(k) contribution of 6% of gross pay and contributes 3% of gross pay to a dependent care flexible spending plan. His current year taxable earnings for Medicare tax, to date, are $198,950.Total Medicare Tax = $arrow_forwardMalcolm Moore, single, had medical expenses of $5,000 last year and was able to deduct $3,000 of them. He was reimbursed $4,500 of these expenses this year by his insurance company. His total itemized deductions last year were $19,000. What amount must he include in this year's tax return as gross income?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education