Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

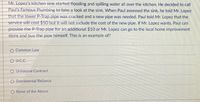

Transcribed Image Text:Mr. Lopez's kitchen sink started flooding and spilling water all over the kitchen. He decided to call

Paul's Famous Plumbing to take a look at the sink. When Paul assessed the sink, he told Mr. Lopez

that the lower P-Trap pipe was cracked and a new pipe was needed. Paul told Mr. Lopez that the

service will cost $50 but it will not include the cost of the new pipe. If Mr. Lopez wants, Paul can

provide the P-Trap pipe for an additional $10 or Mr. Lopez can go to the local home improvement

store and buy the pipe himself. This is an example of?

O Common Law

O U.C.C.

O Unilateral Contract

O Detrimental Reliance

O None of the Above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Similar questions

- Do leasebacks more frequently lead to disputes and litigation than other leases? YES NOarrow_forwardThe issuance of a W-9 will determine if a person is an independent contractor. True Falsearrow_forwardA pilot for a private jet stops for refueling in San Antonio. Topper Fuels offers him a case of premium Tequila to refuel with them (a total retail value of $423 to the pilot). For refueling, inspections, and minor repairs, Topper charges $2,900, over $400 more than the least expensive fuel company. What has happened to the company that owns the private jetarrow_forward

- Alicia Wong Alicia Wong, Corporate Supply Manager, Thain Foods Limited, wanted to prepare a proposal to manufacture mustard in-house. Mustard, an important ingredient in many of the company’s products, was currently purchased from an outside supplier. She hoped a comprehensive proposal could be prepared in one-month’s time for the CEO’s approval Thain Foods Limited (TFL) had been in business for morethan 30 years. Its products included a wide range of syrupsfudges, cone dips, sauces, mayonnaise, and salad dressings. Its customers were major food chains, hotels, and restaurants in North America and Europe. TFL believed in continuous improvement to its operations. Over the last two years, it invested more than $2 million in plant facilities, the bulk of it new, state-ofthe-art process equipment and process control. All production and process control functions were computerized for maximum efficiency. TFL employed about 120 people. It had a corporate structure of CEO; president; executive…arrow_forward13. Sam Fraser, 24 years of age and single, possesses a two-year-old vehicle which he drives to work (a distance of 7(1/2) miles, full circle). He keeps the vehicle in 03 region, and has had one auto crash during the previous three years. What amount would Sam save money on a mix of $100-deductible impact and thorough inclusion on the off chance that he drove a vehicle delegated image 1 instead of as image 5? We don't know whether Sam has had driver preparing.arrow_forwardYeah LTD purchased equipment on January 1, 2015 at a cost of $171,380. The equipment has an estimated useful life of 9 years and a residual value of $9,650. Crane realized that there was a declining demand for the product being produced by the equipment. Given this indicator of possible impairment, management determined that the recoverable amount of the asset on December 31, 2018 was $95,260. The company uses the straight-line method of depreciation. Record the impairment loss, if any, on December 31, 2018.arrow_forward

- An insurance company notifics an insured that $50 of the insured's physicians chaige is above the usual, customary, and reasonable limits covered situation, the excess amount would be ⓇA applied to the deductible ⓇB OC. OD. paid at the 80/20 coinsurance rate disallowed as a covered charge charged back to the physicianarrow_forwardKelly Clarkson moved from unincorporated Nashville which is in Davidson County to Atlanta without selling her house. Blake found out she moved and asked if he could purchase the property if the City decides to incorporate the house into the City of Nashville. Kelly agreed and the contract stated that if the City of Nashville incorporates the house into the City then Kelly would sell the house to Blake. This is an example of _________. Question options: An options contract A dumb move A condition subsequent A condition precedentarrow_forward1) Supplier and Retail Firm A retail-level firm has a contract to sell a single unit of a good to a consumer for 10$. Not delivering the good leads to no payment from the consumer along with a penalty of 5$ to be paid to the consumer by the firm as per the contract between the firm and the consumer. The retail-level firm must also pay an operating cost of 3$ in order to stay in business and in order to be able to deliver the good. This cost must be paid even if the firm decides not to sell the good. Failing to deliver the good and having to pay the penalty and the other costs would lead to the retail firm going out of business. A supplier firm is the only firm in the world that can build the good. The supplier can build the good for 2$ and does so after an order is made. The supplier cannot sell directly to the consumer and there is only one retail firm in this market. Both the supplier and the retailer only care about their own private profit. There is no contract at this point…arrow_forward

- Explain the differences between fee for service and prospective -payment models.arrow_forward90 questions remaining Your client insures his/her condominium unit under a Condominium Unit Owners Comprehensive policy. The policy includes $10,000 Property Loss Assessment coverage. The building suffers severe damage in a fire. The Condominium Corporation assesses each unit owner $500 to cover the deductible under its Master Policy on the building. How much would your client's policy pay? OA) 80% of $500 because all Condominium Corporation Master Policies are subject to 80% co-insurance. 8) $500 less the policy deductible. OC) $500.00 CD) Nothing.arrow_forwardWhat remedies are available to the buyer if the goods are defective or do not meet the contract requirements?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.