Question

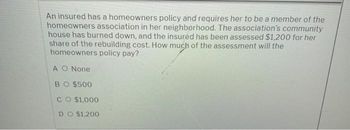

Transcribed Image Text:An insured has a homeowners policy and requires her to be a member of the

homeowners association in her neighborhood. The association's community

house has burned down, and the insured has been assessed $1,200 for her

share of the rebuilding cost. How much of the assessment will the

homeowners policy pay?

A O None

BO $500

CO $1,000

DO $1,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- What are the advantages and limitations of residual income (RI) as a performance measure?arrow_forwardAn insurance company has a life insurance policy, which have 10,000 clients, each client pays 200 yuan per year. If the client died in this year, the company paid out the beneficiary of 10,000 yuan. The mortality rate for the client is 0.017 , and what is the probability of the insurance company will deficit in this year?arrow_forwardRuby obtained a loan of $90,000 towards the purchase of her new home. If the loan was 75% of the purchase price, how much did she pay for the home? O $125,000 (Dollars) O $115,000 (Dollars) O $145,000 (Dollars) O $120.000 (Dollars)arrow_forward

- Salman v. United States was decided by the United States Supreme Court on December 6, 2016. The case revolves around the actions of Bassam Yacoub Salman, an individual who obtained insider information from his brother-in-law, Maher Kara. The Supreme Court, in the case of Salman, embraced the Ninth Circuit's interpretation, which states that an individual who provides insider information to a trading relative or friend obtains a personal benefit as an insider-tipper. The Court dismissed the additional conditions set forth by the Second Circuit in United States v. Newman. arrow_forward Step 2: Salman v. United States, Clarifying Insider Trading Law in the United States. Salman v. United States, decided by the Supreme Court in 2016, is an important case that clarified the law regarding insider trading in the United States. To understand the significance of Salman, it is essential to review the legal theories of insider dealing that preceded it, namely the Classical Theory, the…arrow_forwardA company purchased an item that is in the 7-year property class and has a cost basis of $12000. If the company purchased the item in a year that allowed 50% bonus depreciation, how much would the company be allowed to depreciate the asset in year 1 if the balance of the asset basis (after the bonus depreciation is deducted) was depreciated using the MACRS? Report your answer to the nearest dollar. Be sure to include in your answer the sum of both the bonus depreciation and the MACRS depreciation.arrow_forwardA suburban office building in Fort Worth, Texas with 36,000 square feet was purchased for $4,500,000 at an 8% cap rate. Debt service for the first year was $305,000 of which $236,000 was interest and $69,000 was principal. Annual depreciation for tax purposes was $148,000. What was the property’s first year taxable income? a. $124,000 b. $212,000 c. - $24,000 d. $55,000arrow_forward

- In the Ogden Tables for Personal Injury, what does the discount rate represent? a. The severity of the injury b.The rate of inflation from now until the injured person's retirement c.How many years the injured person is expected to live? d. The expected rate of return on investmentarrow_forward(d) The company only has 4 workstations available. If it only operates its 4stations, how many weeks does it need to meet the production requirements?(e) The company has other contracts it needs to satisfy. Working on themugs more than 4 weeks means it will have to cancel another contract,incurring a penalty of $4,500. Each new workstation costs the company$2,500. What should the company do: cancel the contract or buy therequired workstations?arrow_forwardHow the risk appetite of a business can affect theNature of product being manufactured.arrow_forward

- If the New York Philharmonic records Beethoven's 5t Symphony on DG records. And, DG records pays for the recording, musicians and expenses of the recording, WHO owns the "pertormance" of the work: A. The NY Philharmonic B.DG Records C.The Conductor of the Orchestra D.Beethovenarrow_forwardPlease don't hand writing suliutioarrow_forwardAbroducer has taken an application for an individual Disablay In CORRECT about this situation? ΟΛ 8 OD Y, CBS & GAS Since the producer collected a premium when taking the application, the road is As soon as the insurance company receives the application aren, wil policy. The Insurance company will be a policy to the applicant only the tongy te issued the appearty The insurance company will complete standard underwriting procedures before making a decision abt whether to was the op codeed Whe to may ad te led the ac à pricy to the with the ide dang the de time with parrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios