FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

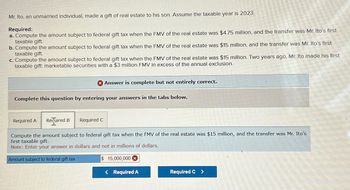

Transcribed Image Text:Mr. Ito, an unmarried individual, made a gift of real estate to his son. Assume the taxable year is 2023.

Required:

a. Compute the amount subject to federal gift tax when the FMV of the real estate was $4.75 million, and the transfer was Mr. Ito's first

taxable gift.

b. Compute the amount subject to federal gift tax when the FMV of the real estate was $15 million, and the transfer was Mr. Ito's first

taxable gift.

c. Compute the amount subject to federal gift tax when the FMV of the real estate was $15 million. Two years ago, Mr. Ito made his first

taxable gift marketable securities with a $3 million FMV in excess of the annual exclusion.

X Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Required A Required B

Compute the amount subject to federal gift tax when the FMV of the real estate was $15 million, and the transfer was Mr. Ito's

first taxable gift.

Note: Enter your answer in dollars and not in millions of dollars.

Amount subject to federal gift tax

$ 15,000,000 X

Required C

< Required A

Required C >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dexter owns a large tract of land and subdivides it for sale. Assume that Dexter meets all of the requirements of § 1237 and during the tax year sells the first eight lots to eight different buyers for $159,400 each. Dexter's basis in each lot sold is $111,580, and he incurs total selling expenses of $6,376 on each sale. What is the amount of Dexter's capital gain and ordinary income? If required, round your answers to the nearest dollar. Dexter has a realized and recognized gain of $ as a capital gain. of which $ is classified as ordinary income andarrow_forwardYour client has made previous lifetime gifts that have fully exhausted his applicable credit amount. He has asked you to advise him about the tax consequences of transferring his closely held business, valued at $350,000, to his daughter in exchange for a lump sum payment of $300,000. You should inform him that the most important tax implication of this intrafamily business transfer is that A) he will be making a taxable gift of $50,000, because the value of the transferred business exceeds the lump sum payment of $300,000. B) he will be making a taxable gift of $350,000, because the Chapter 14 rules require his retained interest to be valued at zero. C) he will have to include $50,000 minus one annual exclusion in adjusted taxable gifts in his estate tax calculation as an adjusted taxable gift. D) none of the above.arrow_forwardGrand Fender is a competitor of Pro Fender from Exercise E23-19. Grand Fender also uses a standard cost system and provides the following information:Static budget variable overhead$ 5,630Static budget fixed overhead$ 22,520Static budget direct labor hours563 hoursStatic budget number of units21,000 unitsStandard direct labor hours0.026 hours per fenderGrand Fender allocates manufacturing overhead to production based on standard direct labor hours. Grand Fender reported the following actual results for 2016: actual number of fenders produced, 20,000; actual variable overhead, $5,200; actual fixed overhead, $24,000; actual direct labor hours, 480.Requirements1. Compute the overhead variances for the year: variable overhead cost variance, variable overhead efficiency variance, fixed overhead cost variance, and fixed overhead volume variance.2. Explain why the variances are favorable or…arrow_forward

- Shun Li sold a capital property on July 31, 2019 for $400,000. She received $100,000 at the time of sale with the balance of $300,000 payable on July 31, 2021. The adjusted cost base of the property was $160,000. The minimum taxable capital gain that Shun Li can report in the 2019 taxation year is: $30,000. $60,000. $120,000. $180,000.arrow_forwardJacinto sold a plot of land to Eva on July 31,2021 for $25000, and Jacinto basis in the property was 15000. Eva made one payment of $5000 during 2021 and agree to pay additional $5000 each year, plus interest for the next 4 years. Using the installment method what is Jacinto taxable gain for 2021arrow_forwardIn 2016, Orville made a taxable gift of $32,000 to his brother Wilber. In 2020 Orville died and his entire estate passed passed to his son Ken. Which of the following may increased as a result of Orville's 2016 gift ? Estate tax paid by Orville's estate. Gift tax paid by Ken Gift tax paid by Wilber Income tax paid on Orville's final returnarrow_forward

- Aram's taxable income before considering capital gains and losses is $82,000. Determine Aram's taxable income and how much of the income will be taxed at ordinary rates in each of the following alternative scenarios (assume Aram files as a single taxpayer) Required: a. Aram sold a capital asset that he owned for more than one year for a $5,440 gain, a capital asset that he owned for more than one year for a $720 loss, a capital asset that he owned for six months for a $1,640 gain, and a capital asset he owned for two months for a $1,120 loss. b. Aram sold a capital asset that he owned for more than one year for a $2.220 gain, a capital asset that he owned for more than one year for a $2,940 loss, a capital asset that he owned for six months for a $420 gain, and a capital asset he owned for two months for a $2.340 loss c. Aram sold a capital asset that he owned for more than one year for a $2.720 loss, a capital asset that he owned for six months for a $4,640 gain, and a capital asset…arrow_forwardRichard placed his portfolio of income-producing stock valued at $200,000 into an irrevocable trust. The trust provides that the trustee is to pay to Richard 7% of the initial value of the trust annually for a period of 12 years. After the 12-year term, the trustee is directed to pay the remaining assets in the trust to Richard's daughter. Which of the following are CORRECT statements regarding the income, gift, or estate tax implications of this trust arrangement? Richard will owe a gift tax based on the present value of the remainder interest given to his daughter. Taxation of the income earned by this trust will be affected by the grantor trust rules. If Richard dies during the 12-year term of the trust, the trust assets will be included in his gross estate. The right that Richard has retained in this trust is considered to be "qualified" for purposes of the Chapter 14 rules. A) II and IV B) I and III C) I, II, III, and IV D) I and IVarrow_forwardK a married taxpayer, makes the following gifts during the current year (2022): $18,000 to her church, $72,000 to her daughter, and $44,000 to her husband. Requirement What is the amount of Hannah's taxable gifts for the current year (assuming she does not elect to split the gifts with ther spouse)? (To arrive at taxable gifts, a $16,000 annual exclusion is allowed per donee for 2022. Complete all input fields Enter a "0" for any zero amounts.) Gift to daughter Gift to husband Total gift given ... Taxable giftarrow_forward

- Carl made the following transfers during the current year. What are Carl’s taxable gifts for the current year? 1.Transferred $900,000 in cash and securities to a revocable trust, life estate to himself and remainder interest to his three adult children by a former wife. 2.In consideration of their upcoming marriage, gave Maria a $90,000 convertible. 3.Purchased a $100,000 certificate of deposit listing title as “Carl, payable on proof of death to Maria.” 4.Established a joint checking account with his now-wife, Maria, in December of the current year with $30,000 of funds he inherited from his parents. In January of the following year, Maria withdrew $18,000 of the funds. 5.Purchased for $80,000 a paid-up insurance policy on his life (maturity value of $500,000). Carl designated Maria as the beneficiary. 6.Paid $23,400 to a college for his niece Mindy’s tuition and $11,000 for her room and board. Mindy is not Carl’s dependent. 7.Gave his aunt Betty $52,000 for her heart bypass…arrow_forwardDuring the current year, Madison reports AGI of $195,000. As part of some estate planning, she donates $15,000 to her alma mater, Autumn University, and $70,000 to a private nonoperating foundation. (Assume the year is 2019.) Requirements a. What is the amount of Madison's charitable deduction for the current year? b. Assume the same facts in Part a except that she donates $25,000 to Autumn University. Requirement a. What is the amount of Madison's charitable deduction for the current year? Amount Charitable contribution for the year $ Charitable contribution carryover $ Requirement b. Assume the same facts in Part a except that she donates $25,000 to Autumn University. Amount Charitable contribution for the year Charitable contribution carryoverarrow_forwardAram's taxable income before considering capital gains and losses is $71,000. Determine Aram's taxable income and how much of the income will be taxed at ordinary rates in each of the following alternative scenarios (assume Aram files as a single taxpayer). Required: Aram sold a capital asset that he owned for more than one year for a $5,220 gain, a capital asset that he owned for more than one year for a $610 loss, a capital asset that he owned for six months for a $1,420 gain, and a capital asset he owned for two months for a $1,010 loss. Aram sold a capital asset that he owned for more than one year for a $2,110 gain, a capital asset that he owned for more than one year for a $2,720 loss, a capital asset that he owned for six months for a $310 gain, and a capital asset he owned for two months for a $2,120 loss. Aram sold a capital asset that he owned for more than one year for a $2,610 loss, a capital asset that he owned for six months for a $4,420 gain, and a capital asset he…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education