FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

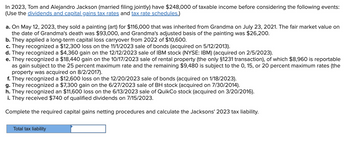

Transcribed Image Text:In 2023, Tom and Alejandro Jackson (married filing jointly) have $248,000 of taxable income before considering the following events:

(Use the dividends and capital gains tax rates and tax rate schedules.)

a. On May 12, 2023, they sold a painting (art) for $116,000 that was inherited from Grandma on July 23, 2021. The fair market value on

the date of Grandma's death was $93,000, and Grandma's adjusted basis of the painting was $26,200.

b. They applied a long-term capital loss carryover from 2022 of $10,600.

c. They recognized a $12,300 loss on the 11/1/2023 sale of bonds (acquired on 5/12/2013).

d. They recognized a $4,360 gain on the 12/12/2023 sale of IBM stock (NYSE: IBM) (acquired on 2/5/2023).

e. They recognized a $18,440 gain on the 10/17/2023 sale of rental property (the only §1231 transaction), of which $8,960 is reportable

as gain subject to the 25 percent maximum rate and the remaining $9,480 is subject to the 0, 15, or 20 percent maximum rates (the

property was acquired on 8/2/2017).

f. They recognized a $12,600 loss on the 12/20/2023 sale of bonds (acquired on 1/18/2023).

g. They recognized a $7,300 gain on the 6/27/2023 sale of BH stock (acquired on 7/30/2014).

h. They recognized an $11,600 loss on the 6/13/2023 sale of QuikCo stock (acquired on 3/20/2016).

i. They received $740 of qualified dividends on 7/15/2023.

Complete the required capital gains netting procedures and calculate the Jacksons' 2023 tax liability.

Total tax liability

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- P1.7 Equity Method Investment, Intercompany Sales Harcker Corporation acquires 40 percent of LO 2 Jackson Corporation's voting stock on January 3, 2017, for $40 million in cash. Jackson's net assets were fairly reported at $100 million at the date of acquisition. During 2017, Harcker sells $130 million in mer- chandise to Jackson at a markup of 30 percent on cost. Jackson still holds $26 million of this merchan- dise in its ending inventory. Also during 2017, Jackson sells $54 million in merchandise to Harcker at a markup of 20 percent on cost. Harcker still holds $12 million of this merchandite in its ending inventory. Jackson reports 2017 net income of $10 million. Required. a. Calculate Harcker's equity in Jackson's net income for 2017.. b. Assume Harcker reports total 2017 sales revenue and cost of sales of $310 million and $262 million, respectively, while Jackson reports total 2017 sales revenue and cost of sales of $254 million and $235 million, respectively. Compute each…arrow_forwardABC Company provided the following information on December 31, 2020Share capital 5,000,000Subscribed share capital 3,000,000Subscription receivable 2,000,000Share premium 1,500,000Treasury Shares, at cost 700,000Retained Earnings 1,000,000Cumulative unrealized gain on Financial Asset at FVOCI 600,000What is the contributed capital on December 31, 2020?arrow_forwardStep by step Answer & Fast Answer Plzzarrow_forward

- Dont give handwritten answer thankuarrow_forwardPlease dont provide solution image based answers thank youarrow_forwardProblem 11 Paul and Co. acquired a 90% interest in Shaq & Co. for $450,000 in cash on January 1, 2019. Paul & Co. uses the simple equity method: Assets: Current assets Depreciable assets, net $150,000 200,000 Current assets Depreciable Fixed assets Accumulated Depreciation Investment in Shaq & Co. Current liabilities Common Stock Retained Earnings 1/1/19 Sales Expenses Subsidiary Income Dividends Declared $350,000 The excess of the price paid over book value is attributable to Fixed ssets which have a value of $350,000, with the balance being Goodwill. The depreciable assets have a 10 year remaining life. Paul uses the simple equity method to record its nvestment in Shaq & Co. The following trial balances of the 2 companies are prepared on December 31, 2019: Paul Liabilities & Equity: Current liabilities Common Stock Retained Earnings 25,000 240,000 -96,000 486,000 -60,000 -250,000 -150,000 -1,400,000 1,250,000 -45,000 Shaq 130,000 200,000 -15,000 -100,000 -175,000 -700,000 650,000…arrow_forward

- Don't give answer in image formatarrow_forwardA company repurchased 10,000 of its outstanding ordinary shares with par value 2$ for 6$ in 5/01/2024, at 31/01/2024 the company re-issued 5000 for 7.5, and in 28/02/2024 issued 4000 for 2.5 which recorded in the company books for: OA. debit retained earning for $6500 OB. debit premium treasury for 6500 OC. debit treasury shares for 10,000 OD. credit treasury premium for 7500arrow_forwardzion 9 Assume that on Dec. 31, 2014, Paul's Investment in Saint Account has a balance of $ 438,000. Paul's 80 % interest in Saint has a fair value of $ 468,000. On January 1, 2015, Paul sells all of its Saint shares for $ 450,000. What is the gain/loss on sale? OAS 15000 Loss OBS 12000 Gain OCS 33000 Loss OD.S 33000 Gain Lying to another question will save this response.arrow_forward

- Question Armadillo Enterprises acquired the following equity investmentsat the beginning of year 1 as trading investments. Description Number of shares Market price per share Total price Finestra Company 15,000 X $25 $387,500 BVD Company 20,000 x$18 |S360,000 Market values at theend of Years 1 &2 are presented below: Market/Fair Value End of year 1 End of year 2 Finestra Company IS19 $23 BVD Company $22 $28 REQUIREMENTS: ( Prepare the journal entry to record the acquisition of theinvestments. Prepare the adjusting journal entry required at the end of year1. Armadillo Enterprises sells 15,000 shares of BVD Company for $16at the beginning of year 2. Prepare the journal entry to record thesale. Prepare the adjusting journal entry required at the end of year2. Assume that ArmadilloEnterprises now holds these investments asavailable-for-sale. Prepare the journal entry to record the acquisition of theinvestments. Prepare the adjusting journal entry required at the end of year1. Armadillo…arrow_forwardDo not give answer in imagearrow_forward1. Initial Value Method vs Equity Method (Spring 2015 Midterm) On January 1, 2012, Franel Co. acquired all of the common stock of Hurlem Corp. For 2012, Hurlem earned net income of $360, 000 and paid dividends of $190,000. Amortization of the patent allocation that was included in the acquisition was $6,000. How much difference would there have been in Franels income with regards to the effect of the investment, between using the equity method or using the initial value method of internal recordkeeping?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education