FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

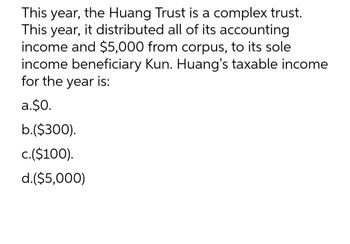

Transcribed Image Text:This year, the Huang Trust is a complex trust.

This year, it distributed all of its accounting

income and $5,000 from corpus, to its sole

income beneficiary Kun. Huang's taxable income

for the year is:

a.$0.

b.($300).

c.($100).

d.($5,000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- vi.3arrow_forwardCalculate Calvin's charitable contribution deduction and carryover (if any) under the following circumstances: Calvin's AGI is $119,000.arrow_forwardAn estate has the following income: Rental income . . . . . . . . . . . . . $5,000Interest income . .. . . . . . . . . . . . 3,000Dividend income . . . . . . . . . . . . . 1,000 The interest income was immediately conveyed to the appropriate beneficiary. The dividends were given to charity as per the decedent’s will. What is the taxable income of the estate? Choose the correct.a. $4,400b. $5,000c. $8,000d. $8,400arrow_forward

- The estate of Nancy Hanks reports the following information: What is the taxable estate value? $7,070,000. $7,100,000. $7,180,000. $7,420,000.arrow_forwardStephen transferred $19,125 to an irrevocable trust for Graham. The trustee has the discretion to distribute income or corpus for Graham's benefit but is required to distribute all assets to Graham (or his estate) not later than Graham's 21st birthday. What is the amount, if any, of the taxable gift? Answer is complete but not entirely correct. Amount of taxable gift $ 4,1250arrow_forwardThe Allwardt Trust is a simple trust that correctly uses the calendar year for tax purposes. Its income beneficiaries (Lucy and Ethel) are entitled to the trust's annual accounting income in shares of one-half each. For the current tax year, Allwardt reports the following: Ordinary income $255,000 Long-term capital gains, allocable to corpus 76,500 Legal and accounting fees, allocable to corpus 12,750 a. How much income is each beneficiary entitled to receive? b. What is the trust's DNI? c. What is the trust's taxable income? d. How much gross income is reported by each of the beneficiaries?arrow_forward

- Determine the correct value for each of the following questions: 1. Assuming that a single person has made taxable lifetime gifts of $1.2 million, what is the largest taxable estate that could exist and still not incur any estate tax?arrow_forwardThe Allwardt Trust is a simple trust that correctly uses the calendar year for tax purposes. Its income beneficiaries (Lucy and Ethel) are entitled to the trust's annual accounting income in shares of one-half each. For the current tax year, Allwardt reports the following. Ordinary income $100,000 Long-term capital gains, allocable to income 30,000 Legal and accounting fees, allocable to corpus 5,000 The trust instrument allocates the capital gain to income. a. How much income is each beneficiary entitled to receive? b. What is the trust's DNI? c. What is the trust's taxable income/loss?The trust's ______ (taxable income/loss) is ____ d. How much gross income is reported by each of the beneficiaries?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education