FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ces

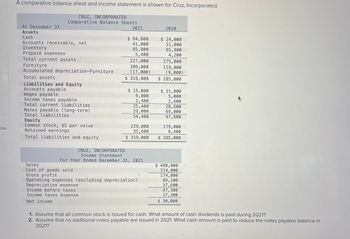

A comparative balance sheet and income statement is shown for Cruz, Incorporated.

CRUZ, INCORPORATED

Comparative Balance Sheets

2021

At December 31

Assets

Cash

Accounts receivable, net

Inventory

Prepaid expenses

Total current assets

Furniture

Accumulated depreciation-Furniture

Total assets

Liabilities and Equity

Accounts payable

Wages payable

Income taxes payable

Total current liabilities

Notes payable (long-term)

Total liabilities

Equity

Common stock, $5 par value

Retained earnings

Total liabilities and equity

$ 94,800

41,000

85,800

5,400

Sales

Cost of goods sold

Gross profit

227,000

109,000

(17,000)

$ 319,000

$ 15,000

9,000

1,400

25,400

29,000

54,400

229,000

35,600

$ 319,000

CRUZ, INCORPORATED

Income Statement

For Year Ended December 31, 2021

Operating expenses (excluding depreciation)

Depreciation expense

Income before taxes

Income taxes expense

Net income

2020

$ 24,000

51,000

95,800

4, 200

175,000

119,000

(9,000)

$285,000

$ 21,000

5,000

2,600

28,600

69,000

97,600

179,000

8,400

$ 285,000

$ 488,000

314,000

174,000

89, 100

37,600

47,300

17,300

$ 30,000

1. Assume that all common stock is issued for cash. What amount of cash dividends is paid during 2021?

2. Assume that no additional notes payable are issued in 2021. What cash amount is paid to reduce the notes payable balance in

2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 12 -ok 7 int Required Information [The following information applies to the questions displayed below.] Income statement and balance sheet data for The Athletic Attic are provided below. Net sales Cost of goods sold Gross profit Expenses: THE ATHLETIC ATTIC Income Statements For the Years Ended December 31 Operating expenses Depreciation expense Interest expense Income tax expense Total expenses Net income Assets Current assets: Cash Accounts receivable Inventory Supplies Long-term assets; Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable 2825 $ 10,680,000 6,980,000 3,700,000 1,620,000 200,000 42,000 424,000 2,286,000 $ 1,414,000 2024 $9,100,000 Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity 5,600,000 3,500,000 1,570,000 200,000 42,000 370,000 2,182,000 $1,318,000 THE ATHLETIC ATTIC…arrow_forwardA comparative balance sheet for Carla Vista Company appears below: CARLA VISTA COMPANY Comparative Balance Sheet Cash Accounts receivable Inventory Prepaid expenses Long-term investments Equipment Accumulated depreciation-equipment Total assets Accounts payable Bonds payable Common stock Retained earnings Total liabilities and stockholders' equity 1 2 Assets 3 4. 5. Dec. 31, 2022 $54,000 38,000 45,000 16.000 Liabilities and Stockholder's Equity 0 90,000 (40,000) $203,000 $37,000 46,000 60,000 60,000 Additional information: Net income for the year ending December 31, 2022 was $45,000. Cash dividends of $25,000 were declared and paid during the year. Long-term investments that had a cost of $37,000 were sold for $24,000. Sales for 2022 were $130.000. No equipment was sold during the year. $203,000 Dec. 31, 2021 $21,000 23,000 27,000 29,000 37,000 43,000 (25,000) $155,000 $17,000 65,000 33,000 40,000 $155,000 Prepare a statement of cash flows for the year ended December 31, 2022 using the…arrow_forwardText Predictions: On ABC Inc. Balance Sheet as at December 31, 2015 and 2016 ($ thousands) Current Assets Cash Accounts Receivable Inventory Total Current Assets Fixed Assets Property, Plant & Equipment Less Accumulated Depreciation Property, Plant & Equipment, net Total Assets Liabilities and S/H Equity Current Liabilities Accounts Payable Notes Payable and short-term debt Total Current Liabilities Long-Term Debt Shareholders' Equity Common Shares Paid-In Capital Retained Earnings Total Total Liabilities and S/H Equity ABC Inc. Income Statement for 2015 and 2016 ($ thousands) Revenue Cost of Goods Sold Operating Expenses Depreciation Earnings Before Interest & Taxes (EBIT) Interest Paid Income Before Taxes (EBT) Taxes Paid Net Income (NI) Dividend Accessibility: Investigate 2015 $ 200 450 550 $1,200 2.200 (1.000) 1,200 $2,400 $ 200 0 $ 200 $ 600 300 600 700 $1,600 $2,400 2015 $1,200 700 30 220 S 250 50 $ 200 180 $ 120 $ S 2016 $ 150 425 625 $1,200 2016 $1,450 850 40 200 $360 160 $ 300…arrow_forward

- Use the following financial statements: Balance Sheet (year-end) Assets Cash Dynamic Mattress Year-End Balance Sheet for 2020 (figures in $ millions) Marketable Securities Accounts Receivable Inventory Total current assets Fixed Assets Property, Plant and Equipment Less: Accumulated Depreciation Net Fixed Assets Total Assets Liabilities and Equity Bank Loans Accounts Payable Total Current Liabilities Long-Term Debt Shareholder's Equity Total Liability and Shareholder's Equity Dynamic Mattress Income Statement for 2020 (figures in $ millions) Sales Operating costs Depreciation Interest Pretax income Tax at 50% Net income $ 1,560.0 1,375.0 $185.0 12.5 $ 172.5 29.0 Notes: Dividends $36. Retained earnings = $35.8. $143.5 71.8 $71.8 Dynamic Mattress Statement of Cash Flows for 2020 (figures in $ millions) Sources of cash: Sold marketable securities Total sources Uses of cash: Increased bank loans Increased accounts payable Increased long-term debt Cash from operations: Net income…arrow_forwardThe current assets and liabilities sections of the comparative balance sheets of Regent Inc., a private entity reporting under ASPE, at December 31 are presented below, along with the income statement: REGENT INC. Comparative Balance Sheet Accounts 2024 2023 Cash $27,720 $29,400 Accounts receivable 17,920 11,480 Inventory 9,100 12,880 Prepaid expenses 2,100 1,624 Accounts payable 12,040 10,080 Accrued expenses payable 1,400 2,240 Dividends payable 6,720 4,760 Income tax payable 1,904 3,304 REGENT INC. Income Statement Year Ended October 31, 2024 Sales $175,000 Cost of goods sold 109,200 Gross profit 65,800 Operating expenses $24,640 Depreciation expense 6,440 Loss on sale of equipment 2,240 33,320 Profit before income tax 32,480 Income tax expense 8,120 Profit for the year $24,360 Instructions Prepare the operating section of the cash flow statement using the direct method.arrow_forwardBased on the above information, analyze the changes in the company's profitability and liquidity, in addition to the management of accounts receivable and inventory from 2022 to 2024. (Round answers to 1 decimal place, eg 13.5% or 13.5.) 2023 Sales Cost of goods sold Gross margin Other expenses Income taxes Net income Current ratio Quick ratio A/R turnover Average collection period Inventory turnover Days to sell inventory Debt to equity Return on assets 2022 Return on equity % 2022 % % 2022 :1 :1 times days times days 56 2023 % % % 2023 times days times days 2024 Based on the above information, analyze the company's use of leverage from 2022 to 2024. (Round answers to 1 decimal place, eg 15.1%) % 2024 % % % 2024arrow_forward

- The balance sheets for Dual Monitors Corporation and additional information are provided below. DUAL MONITORS CORPORATION Balance Sheets December 31, 2024 and 2023 Assets. Current assets: Cash Accounts receivable Inventory Investments Long-term assets: Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable. Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity Additional information for 2024: 1. Net income is $91,560. 2. Sales on account are $1,416,800. (All sales are credit sales.) 3. Cost of goods sold is $1,098,500. 2024 $149,560 72,000 92,000 3,700 450,000 760,000 2023 450,000 640,000 (398,000) (238,000) $1,129,260 $1,136,700 $95,400 6,000 8,000 $117,000 89,000 77,000 1,700 $82,000 11,700 4,700 220,000 670,000 148,300 110,000 670,000 239,860 $1,129,260 $1,136,700 Required: 1. Calculate the…arrow_forwardssarrow_forwardThe balance sheet data of Flounder Company at the end of 2020 and 2019 are shown below. Cash Accounts receivable (net) Inventory Prepaid expenses Equipment Accumulated depreciation-equipment Land Accounts payable Accrued expenses Notes payable-bank, long-term Bonds payable Common stock, $10 par Retained earnings (a) (b) (c) Net Cash Net Cash 2020 $29,800 55,100 65,400 15,200 89,200 (17,840) 70,700 $307,560 Net Cash $65,500 15,100 -0- 30,000 188,100 8.860 $307,560 ✓by operating activities Land was acquired for $30,300 in exchange for common stock, par $30,300, during the year, all equipment purchased was for cash. Equipment costing $12.900 was sold for $3,000, book value of the equipment was $6,100 Cash dividends of $10,000 were declare and paid during the year. Compute net cash provided (used) by: (Show amounts that decrease cash flow with either a-sign eg-12.000 or in parenthesis es (12.00 V by investing activities 2019 $34,800 44,800 ✓by financing activities 45,100 25,100 74,200…arrow_forward

- Some recent financial statements for Smolira Golf Corporation follow. Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Sales Cost of goods sold Depreciation Taxable income Taxes (22%) Earnings before interest and taxes Interest paid Net income Dividends Retained earnings 2020 $35,585 $38,940 28,846 43,112 18,401 3,970 SMOLIRA GOLF CORPORATION 2021 Income Statement a. Price-earnings ratio b. Dividends per share c. Market-to-book ratio d. PEG ratio SMOLIRA GOLF CORPORATION 2020 and 2021 Balance Sheets 2021 Liabilities and Owners' Equity Current liabilities $57,956 $110,898 $ 465,585 $ 27,000 37,022 Accounts payable Notes payable Other $ 521,433 Total $ 523,541 $ 632,331 Total liabilities and owners' equity Long-term debt times Owners' equity Common stock and paid-in surplus Accumulated retained earnings times times Total $ 512,454 363,528 45,963 $102,963 20,883 $ 82,080 18,058 $ 64,022 Smolira Golf Corporation has 52,000…arrow_forwardIKIBAN INCORPORATED Comparative Balance Sheets 2021 At June 30 Assets Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Equipment Accumulated depreciation Equipment Total assets Notes payable (long term) Total liabilities. Equity Common stock, $5 par value Retained earnings. Total liabilities and. equity Liabilities and Equity) Accounts payable Wages payable Income taxes payable. Total current liabilities 39,200 Sales Cost of goods sold. Gross profit $ 105,100 71,000 67,800 4,800 248,700 128,000 (29,000) $ 347,700 Cash flows from operating activities $ 29,000 6,400 3,800 IKIBAN INCORPORATED Income Statement For Year Ended June 30, 2021 Operating expenses (excluding depreciation) Depreciation expense: Other gains (losses) Gain on sale of equipment Income before taxes Income taxes expense Net income Cash flows from investing activities 228,000 46,500 $ 347,700 Cash flows from financing activities Net increase (decrease) in cash Cash balance at prior year-end…arrow_forwardRequired Information [The following information applies to the questions displayed below.] A comparative balance sheet and income statement is shown for Cruz, Incorporated. CRUZ, INCORPORATED Comparative Balance Sheets At December 31 Assets Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Furniture Accumulated depreciation-Furniture Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable Total current liabilities Notes payable (long-term) Total liabilities Equity Common stock, $5 par value Retained earnings Total liabilities and equity Sales Cost of goods sold Gross profit 2021 $ 85,600 36,800 77,100 4,700 204, 200 94,700 (14,700) $ 284,200 Operating expenses (excluding depreciation) Depreciation expense Income before taxes Income taxes expense Net income 1. Cash paid for inventory 2. Cash paid for operating expenses $ 13,400 8,000 1,400 CRUZ, INCORPORATED Income Statement For Year Ended December 31, 2021 22,800 28,900 51,700…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education