FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

I don't need ai answer general accounting question

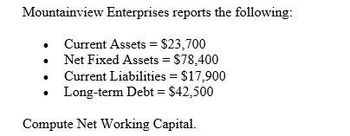

Transcribed Image Text:Mountainview Enterprises reports the following:

.

Current Assets = $23,700

Net Fixed Assets = $78,400

Current Liabilities = $17,900

⚫ Long-term Debt = $42,500

Compute Net Working Capital.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Give me total assets?arrow_forwardI want answerarrow_forwardLaroux Products has the following balance sheet. Its temporary current assets are 30 percent of the current assets, and the remaining are permanent current assets. Cash $ 100,000 Accounts Payable $ 600,000 Inventory $ 200,000 Notes Payable $ 200,000 Accounts Receivable $ 150,000 Long-Term Debt $ 150,000 Net Fixed Assets $ 550,000 Common Equity $ 50,000 What working capital financing policy (aggressive, moderate, or conservative) are they following?arrow_forward

- Balance Sheet You are evaluating the balance sheet for Cypress Corporation. From the balance sheet you find the following balances: Cash and marketable securities = $670,000, Accounts receivable = $870,000, Inventory = $570,000, Accrued wages and taxes = $111,000, Accounts payable = $207,000, and Notes payable = $1,070,000. What is Cypress's net working capital? Multiple Choice $1,388,000 O $2,110,000 $722,000 O $3,498,000arrow_forwardJones Corp. reported current assets of $191,000 and current liabilities of $136,000 on its most recent balance sheet. The working capital is:arrow_forwardConsider the following data for the firms Acme and Apex: Equity ($ million) Debt ($ million) ROC Cost of Capital Acme 290 145 17% 9% Apex 1,450 483 15% 10% a. Calculate the economic value added for Acme and Apex (round to 2 decimal places). Economic value added for Acme $? million Economic value added for Apex $? million b. Calculate the economic value added per dollar of invested capital for Acme and Apex (round to 2 decimal places)? Economic value added for Acme per dollar Economic value added for Apex per dollararrow_forward

- McRae Corporation's total current assets are $380,000, its noncurrent assets are $500,000, its total current liabilities are $340,000, its long-term liabilities are $250,000, and its stockholders' equity is $290,000. How much is the working capital? A. $290,000 B. $380,000 C. $40,000 D. $250,000arrow_forwardABC Corp is a manufacturing company with the following information: 1. Financial Statements: • Net Income: $10 million • Depreciation: $5 million • Capital Expenditures (CapEx): $8 million • Changes in Working Capital: $2 million (increase) 2. Balance Sheet: Total Debt: $40 million (long-term debt). Total Equity: $60 million • Total Assets: $100 million 3. Market Information: • Risk - Free Rate: 3% • Market Risk Premium: 5%. Comparable Companies' Unlevered Beta: 1.0 (average of industry peers) • Tax Rate: 30% . Current Stock Price: $25 per share • Number of Shares Outstanding: 4 million 4. Assumptions: • Terminal Growth Rate: 5%. Long-term WACC: 0.25% less than the initial WACC Questions: a. Calculate the Free Cash Flow to the Firm (FCFF) for ABC Corp for the next five years. b. Determine the Cost of Equity using the Capital Asset Pricing Model (CAPM) with unlevered beta.c. Calculate the Levered Beta for ABC Corp by using the industry average unlevered beta and the company's capital…arrow_forwardWhat is the capital turnover ratio on these accounting question?arrow_forward

- . The financial statements for BSW National Bank (BSWNB) are shown below: Earning assets: $13,884 Interest-bearing liabilities (Spread) = $9,012 Calculate BSWNB’s asset utilization ratio. 2. Calculate BSWNB’s net interest marginarrow_forwardThe discussion of EFN in the chapter implicitly assumed that the company was operating at full capacity. Often, this is not the case. Assume that Rosengarten was operating at 90 percent capacity. Full-capacity sales would be $1,000/.90 $1,111. The balance sheet shows $1,800 in fixed assets. The capital intensity ratio for the company is: Capital intensity ratio = Fixed assets/Full-capacity sales = $1,800/$1,111 - 1.62 This means that Rosengarten needs $1.62 in fixed assets for every dollar in sales when it reaches full capacity. At the projected sales level of $1,250, It needs $1,250 1.62 = $2,025 in fixed assets, which is $225 lower than our projection of $2,250 in fixed assets. So, EFN is $565-225= $340. Blue Sky Mfg., Inc., is currently operating at 90 percent of fixed asset capacity. Current sales are $805,500 and sales are projected to grow to $940,000. The current fixed assets are $775,000. How much in new fixed assets is required to support this growth in sales? (Do not round…arrow_forwardI need Solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education