Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Financial accounting

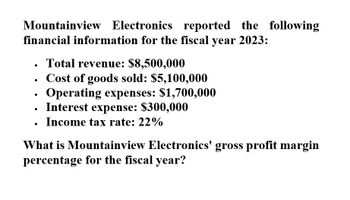

Transcribed Image Text:Mountainview Electronics reported the following

financial information for the fiscal year 2023:

•

Total revenue: $8,500,000

•

•

Cost of goods sold: $5,100,000

Operating expenses: $1,700,000

Interest expense: $300,000

Income tax rate: 22%

What is Mountainview Electronics' gross profit margin

percentage for the fiscal year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Financial Accountingarrow_forwardABC Company has the following information for the year ended December 31, 2022: Sales revenue: $1,500,000 Cost of goods sold: $800,000 Operating expenses: $300,000 Interest expense: $50,000 Income tax rate: 30% Calculate the net income for ABC Company for the year ended December 31, 2022.arrow_forwardWhat is the gross profitarrow_forward

- What is the gross profit that Brighton electronics would report?arrow_forwardCalculate gross profitarrow_forwardUse the balance sheets and information provided about revenue and expenses to answer the question. Stuart Company Balance Sheet As of December 31, 2022 (amounts in thousands) Cash Accounts Receivable Inventory Property Plant & Equipment, Gross 243,000 71,000 Accumulated Depreciation 71,000 67,000 Property Plant & Equipment, Net 172,000 235,000 28,000 302,000 Other Assets Total Assets 373,000 Total Liabilities & Equity 373,000 Stuart Company Balance Sheet As of March 31, 2023 (amounts in thousands) Cash 84,000 Accounts Payable 47,000 42,000 Accounts Receivable Debt Other Liabilities Total Liabilities Paid-In Capital Retained Earnings Total Equity 87,000 44,000 Accounts Payable Debt Other Liabilities Total Liabilities 19,000 28,000 Inventory 50,000 29,300 Property Plant & Equipment, Gross 243,000 76,300 Accumulated Depreciation 72,100 67,000 Property Plant & Equipment, Net 170,900 235,600 Other Assets 27,000 302,600 Total Assets 378,900 Total Liabilities & Equity 378,900 28,000 34,000…arrow_forward

- Crane Manufacturing Ltd's sales for the year ended December 31, 2022 are $1.24 million. The expenses for 2022 are as follows: Cost of goods sold Selling expenses Variable Fixed $416,000 $234.000 34,320 46,800 72,800 Administrative expenses 36,320 Prepare a detailed CVP income statement for the year ended December 31, 2022. Crane Manufacturing Ltd. CVP Income Statementarrow_forwardThe following information was taken from the financial statements of Sunland Company: 2021 2020 Gross profit on sales $678,600 $760,000 Income before income taxes 205,400 225,000 Net income 260,000 225,000 Net income as a percentage of net sales 10% 9% Please show steps to finding answer Compute the cost of goods sold in dollars and as a percentage of net sales for each year. (Round percentages to 1 decimal place, e.g. 15.2%) 2021 2020 Cost of goods sold in dollars $enter a dollar amount $enter a dollar amount Cost of goods sold as a percentage of net sales nter percentages rounded to 1 decimal place % nter percentages rounded to 1 decimal place %arrow_forwardBurrow Corporation had the following information for the year ended December 31, 2020: Sales Revenue $70,000 Cost of Goods Sold 30,000 Operating Expenses 15,000 Net Income 25,000 What is Burrow Corporation's gross profit ratio (rounded) for the year 2020?arrow_forward

- Can you explain this financial accounting question using accurate calculation methods?arrow_forwardThe following comparative information is available for Larkspur, Inc. for 2022. LIFO FIFO Sales revenue $91,000 $91,000 Cost of goods sold 40,000 31,600 Operating expenses (including depreciation) 27,000 27,000 Depreciation 10,000 10,000 Cash paid for inventory purchases 18,920 18,920 Determine net income under each approach. Assume a 30% tax rate. Net income $ LIFO FIFO Determine net cash provided by operating activities under each approach. Assume that all sales were on a cash basis and that income taxes and operating expenses, other than depreciation, were on a cash basis. Net cash provided by operating activities LIFO FIFO $ Calculate the quality of earnings ratio under each approach. (Round answers to 2 decimal places, e.g. 5.15.) LIFO Quality of earnings ratio FIFOarrow_forwardC Company has the following data for the year ending 12/31/2020 (dollars are in thousands): Net income = $600; EBIT = $1,184; Total assets = $3,000; Short-term investments = $200; Total capital employed = $2,193; and tax rate = 30%. The company’s WACC is 11.07%. What was its Economic Value Added (EVA) for the year 2020? Round your answer to the nearest dollar. Group of answer choices: $583 $586 $577 $572 $580arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning