CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

Given answer accounting questions

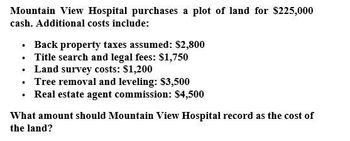

Transcribed Image Text:Mountain View Hospital purchases a plot of land for $225,000

cash. Additional costs include:

⚫ Back property taxes assumed: $2,800

⚫ Title search and legal fees: $1,750

⚫ Land survey costs: $1,200

⚫ Tree removal and leveling: $3,500

⚫ Real estate agent commission: $4,500

What amount should Mountain View Hospital record as the cost of

the land?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Manjiarrow_forwardAshvinbhaiarrow_forwardLarkspur Corporation donates equipment and a truck to the community Home Assistance Centre. The equipment had a cost of $98,000, accumulated depreciation to the contribution date of $41,000, and a fair value of $50,000. The truck had a cost of $49,000, accumulated depreciation to the contribution date of $41,000, and a fair value of $27,000. Prepare the journal entry Larkspur Corporation would make for the donation. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Debit Creditarrow_forward

- These expenditures were incurred by Blossom Company in purchasing land: cash price $55,000, assumed accrued property taxes $4,500, attorney's fees $2,100, real estate broker's commission $3,000, and clearing and grading $4,000. What is the cost of the land? The cost of the land 73900arrow_forwardBlossom Hospitalinstalls a new parking lot. The paving cost $29200 and the lights to illuminate the new parking a $11400 Which of the following statements is true with respect to these additions? 1.$11400 should be debited to Land Improvements. 2. $40600 should be debited to Land Improvements. 3.$29200 should be debited to the Land. 4.$40600 should be debited to the Land. < Save for Later don't use ai answer,i will 5 upvotesarrow_forwardDuring the year, a local merchant donated a building to the city of Stage Coach. The original cost of the building was $300,000. Accumulated depreciation at the date of the gift amounted to $250,000. The acquisition value of the donation at the date of the gift was $600,000. At what amount should Stage Coach record this donated property in the General Fund? Multiple Choice $600,000. $50,000. $0. $300,000.arrow_forward

- Land and a building on the land are purchased for $310,000. The appraised values of the land and building are $66,000 and $264,000, respectively. The cost allocated to the building should be: a. $25,200 b. $109,800 c. $135,000 d. $248,000arrow_forwardRenFair Clothing purchased land, paying $80,000 cash and signing a $220,000 note payable. In addition, RenFair Clothing paid delinquent property tax of $1,500, title insurance costing $800, and $4,000 to level the land and remove an unwanted building. Record the journal entry for purchase of the land. Begin by determining the cost of the land. Purchase price of land Add related costs: Total cost of landarrow_forwardRiverboat Adventures pays $310,000 plus $15,000 in closing costs to purchase real estate. The real estate consists of land appraised at $35,000, a building appraised at $105,000, and land improvements appraised at $210,000. Compute the cost that should be allocated to the building. Multiple Choice $97,500. $105,000. $89,178. $140,000. $93,000.arrow_forward

- Help please Rodriguez Company pays $352,755 for real estate with land, land improvements, and a building. Land is appraised at $200,000; land improvements are appraised at $75,000; and the building is appraised at $225,000. Allocate the total cost among the three assets. Prepare the journal entry to record the purchasearrow_forwardRenFair Clothing purchased land, paying $80,000 cash and signing a $220,000 note payable. In addition, RenFair Clothing paid delinquent property tax of $1,500, title insurance costing $800, and $4,000 to level the land and remove an unwanted building. Record the journal entry for purchase of the land. Begin by determining the cost of the land. Purchase price of land Add related costs: Total cost of land Record the journal entry for purchase of the land. (Record a single compound journal entry. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Creditarrow_forwardIdentify the following expenditures as capital expenditures or revenue expenditures. Immediately after acquiring a new delivery truck, paid$260 to have the name of the store and other advertising material painted on the vehicle. Painted delivery truck at a cost of $450 after two years of use. Purchased new battery at a c cost of $40 for two years old delivery truckarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you