Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General Account Questions

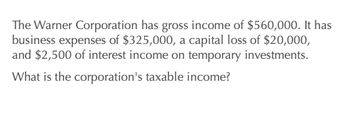

Transcribed Image Text:The Warner Corporation has gross income of $560,000. It has

business expenses of $325,000, a capital loss of $20,000,

and $2,500 of interest income on temporary investments.

What is the corporation's taxable income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Warner Corporation has gross income of $560,000. It has business expenses of $325,000, a capital loss of $20,000, and $2,500 of interest income on temporary investments. What is the corporation's taxable income?arrow_forwardProvide the Correct answerarrow_forward1). A corporation has income of $80,000 from operations, a $12,000 short-term capital gain, and a $16,000 long-term capital loss. What is the corporation’s taxable income for the year?arrow_forward

- INCOME?arrow_forwardThe ABC Corporation has net income reported on its books of $120, 500. For the current year, the corporation had federal income tax expense of $30,000, a net capital loss of $ 8,300, and tax-exempt interest income of $5,300. The company deducted depreciation of $20,000 on its tax return and $15,000 on its books. Calculate the ABC Corporation's taxable income.arrow_forward?arrow_forward

- Nonearrow_forwardLNS Corporation reports book income of $2,890,000. Included in the $2,890,000 is $32,750 of tax-exempt interest income. LNS reports $2,597,500 in ordinary and necessary business expenses. What is LNS Corporation's taxable income for the year? Taxable incomearrow_forwardGeneral Accountingarrow_forward

- Saffron Corporation has book income of $200,000, which includes tax expense of $40,000 and a net capital loss of $10,000. Saffron's taxable income is:arrow_forwardThe Wendt Corporation had $10.5 million of taxable income.a. What is the company’s federal income tax bill for the year?b. Assume the firm receives an additional $1 million of interest incomefrom some bonds it owns. What is the additional tax on this interestincome?c. Now assume that Wendt does not receive the interest income but doesreceive an additional $1 million as dividends on some stock it owns.What is the additional tax on this dividend income?arrow_forwardSunshine Company has book income of $250,000. It also has tax depreciation in excess of book depreciation of $30,000 and $10,000 of interest on tax-exempt bonds. Without regard to tax expense, what is Sunshine's taxable income? $230,000. $210,000. $290,000. $270,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT