Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

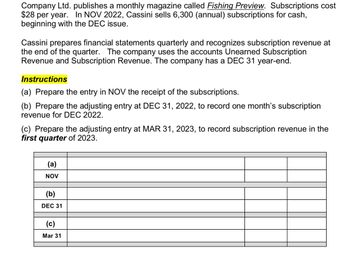

Transcribed Image Text:Company Ltd. publishes a monthly magazine called Fishing Preview. Subscriptions cost

$28 per year. In NOV 2022, Cassini sells 6,300 (annual) subscriptions for cash,

beginning with the DEC issue.

Cassini prepares financial statements quarterly and recognizes subscription revenue at

the end of the quarter. The company uses the accounts Unearned Subscription

Revenue and Subscription Revenue. The company has a DEC 31 year-end.

Instructions

(a) Prepare the entry in NOV the receipt of the subscriptions.

(b) Prepare the adjusting entry at DEC 31, 2022, to record one month's subscription

revenue for DEC 2022.

(c) Prepare the adjusting entry at MAR 31, 2023, to record subscription revenue in the

first quarter of 2023.

(a)

NOV

(b)

DEC 31

(c)

Mar 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Spath Company borrows 75,000 by issuing a 4-year, noninterest-bearing note to a customer on January 1, 2019. In addition, Spath agrees to sell inventory to the customer at reduced prices over a 5-year period. Spaths incremental borrowing rate is 12%. The customer agrees to purchase an equal amount of inventory each year over the 5-year period so that a straight-line method of revenue recognition is appropriate. Required: Prepare the journal entries on Spaths books for 2019 and 2020. (Round answers to 2 decimal places.)arrow_forwardChemical Enterprises issues a note in the amount of $156,000 to a customer on January 1, 2018. Terms of the note show a maturity date of 36 months, and an annual interest rate of 8%. What is the accumulated interest entry if 9 months have passed since note establishment?arrow_forwardOn December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan. Refer to RE6-10. On December 31, Jordan Inc. received 50,000 on assigned accounts. Prepare Jordans journal entries to record the cash receipt and the payment to McLaughlin.arrow_forward

- Anderson Air is a customer of Handler Cleaning Operations. For Anderson Airs latest purchase on January 1, 2018, Handler Cleaning Operations issues a note with a principal amount of $1,255,000, 6% annual interest rate, and a 24-month maturity date on December 31, 2019. Record the journal entries for Handler Cleaning Operations for the following transactions. A. Entry for note issuance B. Subsequent interest entry on December 31, 2018 C. Honored note entry at maturity on December 31, 2019arrow_forwardBlossom Company Ltd. publishes a monthly sports magazine, Fishing Preview. Subscriptions to the magazine cost $28 per year. During November 2022, Blossom sells 5,100 subscriptions for cash, beginning with the December issue. Blossom prepares financial statements quarterly and recognizes subscription revenue at the end of the quarter. The company uses the accounts Unearned Subscription Revenue and Subscription Revenue. The company has a December 31 year-end. Prepare the entry in November for the receipt of the subscriptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Nov. enter an account title for the entry in November for the receipt of the subscriptions enter a debit amount enter a credit amount enter an account title for the entry in November for the receipt of the subscriptions enter a debit amount enter a credit amount…arrow_forwardSunland Company publishes a monthly sports magazine, Fishing Preview. Subscriptions to the magazine cost $25 per year. During November 2020, Sunland sells 22,500 subscriptions beginning with the December issue. Sunland prepares financial statements quarterly and recognizes subscription revenue at the end of the quarter. The company uses the accounts Unearned Subscription Revenue and Subscription Revenue. Prepare the entry in November for the receipt of the subscriptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) DateAccount Titles and ExplanationDebitCreditNov. 30 Show List of AccountsLink to Text Prepare the adjusting entry at December 31, 2020, to record sales revenue recognized in December 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 5,275.)arrow_forward

- Wildhorse Co. Ltd. publishes a monthly sports magazine, Fishing Preview. Subscriptions to the magazine cost $28 per year. During November 2022, Wildhorse sells 8,400 subscriptions for cash, beginning with the December issue. Wildhorse prepares financial statements quarterly and recognizes subscription revenue at the end of the quarter. The company uses the accounts Unearned Subscription Revenue and Subscription Revenue. The company has a December 31 year-end. Prepare the entry in November for the receipt of the subscriptions. Date Account Titles and Explanation Debit Credit Nov. enter an account title for the entry in November for the receipt of the subscriptionsenter an account title for the entry in November for the receipt of the subscriptionsarrow_forwardVikrambhaiarrow_forwardFlores Company publishes a monthly sports magazine, Hunting Preview. Subscriptions to the magazine cost $25 per year. During October 2020, Flores sells 30,000 subscriptions beginning with the November issue. Flores prepares financial statements quarterly and recognizes subscription revenue earned at the end of the quarter. The company uses the accounts Unearned Subscription Revenue and Subscription Revenue. Prepare the entry in October for the receipt of the subscriptions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Oct. 31 eTextbook and Mediaarrow_forward

- Monty Company publishes a monthly sports magazine, Fishing Preview. Subscriptions to the magazine cost $29 per year. During November 2019, Monty sells 19,800 subscriptions beginning with the December issue. Monty prepares financial statements quarterly and recognizes subscription revenue at the end of the quarter. The company uses the accounts Unearned Subscription Revenue and Subscription Revenue. Prepare the entry in November for the receipt of the subscriptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually.)arrow_forwardSwifty Company publishes a monthly sports magazine, Fishing Preview. Subscriptions to the magazine cost $25 per year. During November 2022, Swifty sells 24,000 subscriptions beginning with the December issue. Swifty prepares financial statements quarterly and recognizes subscription revenue at the end of the quarter. The company uses the accounts Unearned Subscription Revenue and Subscription Revenue. (a) Your answer is correct. Prepare the entry in November for the receipt of the subscriptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Nov. Cash 600000 30 Unearned Subscription Revenue 600000arrow_forwardSwifty Company publishes a monthly sports magazine, Fishing Preview. Subscriptions to the magazine cost $25 per year. During November 2022, Swifty sells 24,000 subscriptions beginning with the December issue. Swifty prepares financial statements quarterly and recognizes subscription revenue at the end of the quarter. The company uses the accounts Unearned Subscription Revenue and Subscription Revenue. (a) Your answer is partially correct. Prepare the entry in November for the receipt of the subscriptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Nov. Cash 30arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College