FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

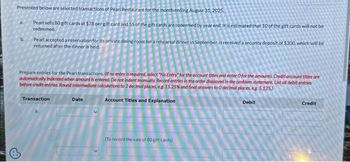

Transcribed Image Text:Presented below are selected transactions of Pearl Restaurant for the month ending August 31, 2025.

Pearl sells 80 gift cards at $78 per gift card and 55 of the gift cards are redeemed by year end. It is estimated that 10 of the gift cards will not be

redeemed

b.

Pearl accepted a reservation for its private dining room for a rehearsal dinner in September. It received a security deposit of $300, which will be

returned after the dinner is held.

Prepare entries for the Pearl transactions. Of no entry is required, select "No Entry for the account titles and enter O for the amounts. Credit account titles are

automatically indented when amount is entered. Do not indent manually. Record entries in the order displayed in the problem statement. List oll debit entries

before credit entries. Round Intermediate calculations to 2 decimal places, eg. 15.25% and final answers to O decimal places, eg. 5.125)

Transaction

Account Titles and Explanation

Debit

Date

(To record the sale of 80 gift cards)

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On February 1, 2021, a company loans one of its employees $21,000 and accepts a nine-month, 8% note receivable. Calculate the amount of interest revenue the company will recognize in 2021.arrow_forwardPrepare the journal entriesarrow_forwardThe Rink offers an annual $200 memberships that entitle members to unlimited use of ice-skating facilities and locker rooms. Each new membership also entitles the member to receive ten "35% off a $5 meal" coupons that are redeemable at the Rink’s snack bar. The Rink estimates that approximately 80% of the coupons will be redeemed, and that, if the coupons weren’t redeemed, $5 meals still would be discounted by 5% because of ongoing promotions. Prepare the journal entry to recognize the sale of a new membership.Clearly identify revenue or deferred associated with each field obligation.arrow_forward

- Bavarian Bar and Grill opened for business in November 2021. During its first two months of operation, the restaurant sold gift cards in various amounts totaling $7,600, mostly as Christmas presents. They are redeemable for meals within two years of the purchase date, although experience within the industry indicates that 90% of gift cards are redeemed within one year. Gift cards totaling $2,500 were presented for redemption during 2021 for meals having a total price of $2,900. The sales tax rate on restaurant sales is 4%, assessed at the time meals (not gift cards) are purchased. Sales taxes will be remitted in January.Required:1. Prepare the appropriate journal entries (in summary form) for the gift cards and meals sold during 2021 (keeping in mind that, in actuality, each sale of a gift card or a meal would be recorded individually).2. Determine the liability for gift cards to be reported on the December 31, 2021, balance sheet.3. What is the appropriate classification (current or…arrow_forwardes Texas Roadhouse opened a new restaurant in October. During its first three months of operation, the restaurant sold gift cards in various amounts totaling $2,500. The cards are redeemable for meals within one year of the purchase date. Gift cards totaling $728 were presented for redemption during the first three months of operation prior to year-end on December 31. The sales tax rate on restaurant sales is 4%, assessed at the time meals (not gift cards) are purchased. Texas Roadhouse will remit sales taxes in January. Required: 1. & 2. Record (in summary form) the $2,500 in gift cards sold (keeping in mind that, in actuality, the company would record each sale of a gift card individually) and the $728 in gift cards redeemed. (Hint: The $728 includes a 4% sales tax of $28.) 3. Determine the balance in the Deferred Revenue account (remaining liability for gift cards) Texas Roadhouse will report on the December 31 balance sheet. Complete this question by entering your answers in the…arrow_forwardA bank is offering to sell 6-month certificates of deposit for $12,000. At the end of 6 months, the bank will pay $13,000 to the certificate owner. Compute the nominal annual interest rate and the effective annual interest rate.arrow_forward

- Supply Club, Incorporated, sells a variety of paper products, office supplies, and other products used by businesses and individual consumers. During July 2024, it started a loyalty program through which qualifying customers can accumulate points and redeem those points for discounts on future purchases. Redemption of a loyalty point reduces the price of one dollar of future purchases by 20% (equal to 20 cents). Customers earn one loyalty point for each dollar of goods purchased, but do not earn additional loyalty points for purchases that are made by redeeming loyalty points. Based on past experience, Supply Club estimates a 60% probability that any point issued will be redeemed for the discount. During July 2024, the company redeemed 10,200 points and sold additional product of $127,500, so it recorded of revenue of $137,700. The aggregate stand-alone selling price of the purchased products is $137,700. Seventy percent of sales were cash sales, and the remainder were credit sales.…arrow_forwardMoon Co. sells food blenders. During 2019, Moon made 37,000 blenders at an average cost of $80. It sold out 25,000 food blenders at an average price of $130. Moon provides a 2-year warranty for each blender sold and estimates 9% of blenders will be returned for warranty with an estimated cost of $36 each. By the end of 2019, Moon has spent $44,000 servicing the warranty repairs. All the above transactions have been settled in cash. During 2019, Moon has 50 employees who work 5-day per week and get paid each other Friday. Salaries of $324,000 and payroll expense of $37,000 have been paid until December 22. Since the business grows quickly, Moon needs cash to expand. By the end of 2018, the Board of Directors authorized the management to issue 10-year bonds with a par value of $3,000,000, annual contract interest rate of 8% and semi-annual interest payments. Moon chose to use the straight-line method to amortize discount or premium on its bonds. On January 1, 2019, management…arrow_forwardSweet, Inc. issued a $120,000, 4-year, 8% note at face value to Flint Hills Bank on January 1, 2025, and received $120,000 cash. The note requires annual interest payments each December 31. Prepare Sweet's journal entries to record (a) the issuance of the note and (b) the December 31 interest payment. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) No. Date (a) (b) Account Titles and Explanation Debit Creditarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education