FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:S

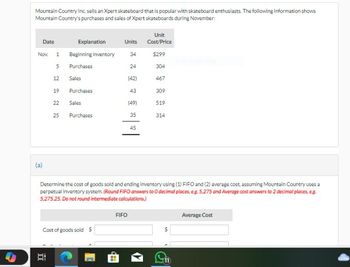

Mountain Country Inc. sells an Xpert skateboard that is popular with skateboard enthusiasts. The following information shows

Mountain Country's purchases and sales of Xpert skateboards during November:

Date

Nov. 1

5

12

19

I

22

25

Explanation

Beginning inventory

Purchases

Sales

Purchases

Sales

Purchases

Cost of goods sold $

Units

34

24

(42)

43

FIFO

(49)

35

45

Unit

Cost/Price

$299

Determine the cost of goods sold and ending inventory using (1) FIFO and (2) average cost, assuming Mountain Country uses a

perpetual inventory system. (Round FIFO answers to 0 decimal places, eg. 5,275 and Average cost answers to 2 decimal places, e.g.

5,275.25. Do not round intermediate calculations.)

304

467

309

519

314

68

L

Average Cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ! Required information [The following information applies to the questions displayed below.] Sandra's Purse Boutique has the following transactions related to its top-selling Gucci purse for the month of October. Sandra's Purse Boutique uses a periodic inventory system. Date October 1 October 4 October 10 October 13 October 20 October 28 October 30 Transactions Beginning inventory Sale Purchase Sale Purchase Sale Purchase Ending inventory Cost of goods sold Units Unit Cost 6 $ 890 4 5 3 4 7 6 900 910 920 Total Cost $5,340 4,500 3,640 5,520 $19,000 Using FIFO, calculate ending inventory and cost of goods sold at October 31.arrow_forwardREI sells snowboards. Assume the following information relates to REI's purchases of snowboards during September. During the same month, 106 snowboards were sold. REI uses a periodic inventory system. Date Sept. 1 Sept. 12 Sept. 19 Sept. 26 Explanation Units Unit Cost Inventory Purchases Purchases Purchases Totals 15 42 57 21 135 $100 103 104 105 Total Cost $1,500 4,326 5,928 2,205 $13,959arrow_forwardDorothy's Boards sells a snowboard, Xpert, that is popular with snowboard enthusiasts. Information relating to Dorothy's purchases of Xpert snowboards during September is shown below. During the same month, 126 Xpert snowboards were sold. Dorothy's uses a periodic inventory system. Date Sept. 1 Sept. 12 Sept. 19 Sept. 26 (a) Explanation Inventory Purchases (b) Purchases Purchases Totals Units Unit Cost 29 Cost of goods sold 45 20 Your Answer Correct Answer (Used) 50 e Textbook and Media 144 $95 102 104 105 The ending inventory at September 30 $ Total Cost $ $ 2,755 Compute the ending inventory at September 30 and cost of goods sold using the FIFO and LIFO methods. 4,590 2,080 5,250 $14,675 FIFO The sum of ending inventory and cost of goods sold $ 1,890 12,785 For both FIFO and LIFO, calculate the sum of ending inventory and cost of goods sold. $ FIFO $ LIFO 1.710 12.965 LIFOarrow_forward

- I→ 3 Tremblay Company began June with 45 units of inventory that cost a total of $900. During June, Tremblay purchased and sold goods as follows: (Click the icon to view the transactions.) Calculate the gross margin amount using the weighted-average method. assuming Tremblay uses a periodic inventory system. Jave Before we can calculate gross margin, we must first determine the cost of goods sold, using the periodic method of costing inventory. Start by determining the formula, and then enter the amounts. (Round your answers to the nearest whole dollar.) Cost of goods available for sale Less: Cost of goods sold More info June 8 Purchase: 65 units at $14.00 June 14 June 22 Sale: 55 units at $32 Purchase: 48 units at $16.00 June 27 Sale: 65 units at $37.00 - Xarrow_forwardYou are provided with the following information for Geo Inc., which purchases its inventory from a supplier on account. All sales are also on account. Geo uses the FIFO cost formula in a perpetual inventory system. Increased competition has recently decreased the price of the product. Date Explanation Oct. 1 Beginning inventory 5 Purchases 8 Sales Purchases 15 20 Sales 26 Purchases Units 60 100 (120) 35 (60) 15 Unit Cost Price $140 130 200 120 160 110 Instructions (a) Prepare all journal entries for the month of October for Geo, the buyer. (b) Determine the cost of goods sold and ending inventory amount for Geo. (c) On October 31, Geo learns that the product has a net realizable value of $108 per unit. What amount should ending inventory be valued at on the October 31 statement of financial position? (d) Now assume that Geo uses the average cost formula in a perpetual inventory system. Determine the cost of goods sold and ending inventory amount for Geo, ignoring the effect of (c). (e)…arrow_forwardUse the following inventory table to find the cost of goods sold using the first-in, first-out (FIFO) inventory method. Date of purchase Units purchased Cost per unit Retail price per unit Beginning inventory 42 $860 $965 February 5 25 $1,770 $2,115 February 9 19 $945 $1,208 March 3 27 $490 $600 Units sold 81 Question content area bottom Part 1 The cost of goods sold is $enter your response here. (Type an integer or a decimal.)arrow_forward

- Beginning inventory, purchases, and sales data for tennis rackets are as follows: April 3 Inventory 18 units @ $16 11 Purchase 17 units @ $14 14 Sale 23 units 21 Purchase 8 units @ $18 25 Sale 12 units Complete the inventory cost card assuming the business maintains a perpetual inventory system and determine the cost of goods sold and ending inventory using LIFO. Cost of Purchases Goods Sold Inventory Date Qty. Unit Cost Total Cost Qty. Unit Cost Total Cost Qty. Unit Cost Total Cost April 3 11 14 21 25 Total Cost of goods sold Ending inventory value 00arrow_forwardWeatarrow_forwardPlease do not give solution in image formatarrow_forward

- Please don't give image formatarrow_forwardSport Box sells a wide variety of sporting equipment. The following is information on the purchases and sales of their top selling hockey stick. The hockey stick sells for $130. Description Mar. 1 Beginning Inventory Mar. 3 Purchase Mar. 6 Purchase Mar. 17 Sale Mar. 23 Purchase Mar. 31 Sale 1. FIFO Units. 19 64 114 59 58 148 2. Moving weighted average Required: Calculate the cost of goods sold and ending inventory under the perpetual inventory system using the following methods. (Do not round your "Unit Cost" answers. Round all other intermediate and final answers to nearest whole dollar.) Unit Cost $44 $49 $54 Cost of Goods Sold $54 Ending Inventory < Prev www 2 of 8 --- Nexarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education