FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

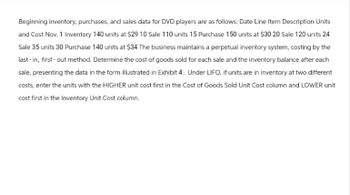

Transcribed Image Text:Beginning inventory, purchases, and sales data for DVD players are as follows: Date Line Item Description Units

and Cost Nov. 1 Inventory 140 units at $29 10 Sale 110 units 15 Purchase 150 units at $30 20 Sale 120 units 24

Sale 35 units 30 Purchase 140 units at $34 The business maintains a perpetual inventory system, costing by the

last-in, first-out method. Determine the cost of goods sold for each sale and the inventory balance after each

sale, presenting the data in the form illustrated in Exhibit 4. Under LIFO, if units are in inventory at two different

costs, enter the units with the HIGHER unit cost first in the Cost of Goods Sold Unit Cost column and LOWER unit

cost first in the Inventory Unit Cost column.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using the FIFO method, complete the steps below to calculate the ending inventory units, inventory account balance, and cost of goods sold account balance at the end of the period.Date Activity Units Purchase Price (per unit)Sale Price(per unit)1-Feb Beginning Inventory 100 $ 4515-Feb Purchase 700 $ 529-Apr Sale 1 600 $ 9029-May Purchase 500 $ 5610-Jul Sale 2 600 $ 9010-Sep Purchase 400 $ 5815-Oct Sale 3 400 $ 905-Nov Purchase 900 $ 6218-Dec Sale 4 200 $ 901. Compute the Cost of Goods Sold and ending inventory (units and value) after Sale 1.Cost of Goods Sold (units) Total COGS after Sale 1 Inventory Remaining (units) Total Inventory Balance after Sale 1Totals:2. Compute the Cost of Goods Sold and ending inventory (units and value) after Sale 2.Cost of Goods Sold (units) Total COGS after Sale 2 Inventory Remaining (units) Total Balance after Sale 2Totals:3. Compute the Cost of Goods Sold and ending inventory (units and value) after Sale 3. Cost of Goods Sold (units) Total COGS after…arrow_forwardEddy's Fishing Hole has the following transactions related to its top-selling Shimano fishing reel for the month of June. Eddy's Fishing Hole uses a periodic inventory system. Date June 1 June 7 June 12 June 15 June 24 June 27 June 29 Transactions Beginning inventory Sale Purchase Sale Purchase Sale Purchase Ending inventory Cost of goods sold Units 16 11 10 12 10 8 9 Unit Cost $260 250 240 230 2. Using FIFO, calculate ending inventory and cost of goods sold at June 30. Total Cost $4,160 2,500 2,400 2,070 $11,130arrow_forwardBeginning inventory, purchases, and sales data for tennis rackets are as follows: April 3 Inventory 22 units @ $16 11 Purchase 17 units @ $14 14 Sale 26 units 21 Purchase 10 units @ $20 25 Sale 19 units Complete the inventory record assuming the business maintains a perpetual inventory system, and determine the cost of goods sold and ending inventory using FIFO. Cost of Goods Sold Cost of Goods Sold Cost of Goods Sold Total Cost Qty Unit Cost Date April 3 11 14 21 25 Balances Purchases Qty Purchases Unit Cost Purchases Total Cost 00 A FA 00 00 00 Inventory Qty 0000 000 Inventory Unit Cost 000 0000 $ S Inventory Total Costarrow_forward

- Assume that Whitewall Tire Store completed the following perpetual inventory transactions for a line of tires: i (Click the icon to view the transactions.) Read the requirements. Requirement 1. Compute cost of goods sold and gross profit using the FIFO inventory costing method. Begin by computing the cost of goods sold and cost of ending merchandise inventory using the FIFO inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.) Date Quantity Dec. 1 11 23 261 29 Totals Purchases Unit Cost Cost of Goods Sold Total Unit Cost Quantity Cost Total Cost Inventory on Hand Unit Quantity Cost C Total Cost More info Dec. 1 Beginning merchandise inventory Dec. 11 Purchase Dec. 23…arrow_forwardI need help calculating the ending inventory and cost of goods sold using the LIFO method (Please Show Calculations) Note: I also attached an example of what the LIFO chart should look like, please follow that example to answer this question. Jensen Company had the following transactions regarding their inventory, They use a perpetual inventory system. Beginning Inventory: 100 units @ $6.00 per unit First Purchase: 100 units @ $7.00 per unit Sale: 150 units @ $15.00 per unit Second Purchase: 150 units @ $8.00 per unit Sale: 150 units @ $15.00 per unitarrow_forwardBeginning inventory, purchases, and sales data for tennis rackets are as followsarrow_forward

- The following data regarding purchases and sales of a commodity were taken from the related inventory account (perpetual inventory system is used): May 1 Balance 25 units at $41 6 Sale 20 units 8 Purchase 20 units at $42 16 Sale 10 units 20 Purchase 20 units at $43 23 Sale 25 units 30 Purchase 15 units at $45 (a) Determine the total cost of the inventory balance at May 31, using the first-in, first-out method. Also, identify the quantity, unit price, and total cost of each lot/layer in the ending inventory. (b) Determine the total cost of the inventory balance at May 31, using the last-in, first-out method. Also, identify the quantity, unit price, and total cost of each lot/layer in the ending inventory. (a) FIFO (b) LIFOarrow_forwardGlobal Company sold merchandise for $11,700 on account. The cost of the items sold was $7,900. If the company uses the perpetual inventory system, which of the following best reflects the journal entry that should be prepared to record this transaction? Debit Credit A. Sales revenue 11,700 Accounts receivable 11,700 Cost of goods sold 7,900 Merchandise inventory 7,900 B. Accounts receivable 11,700 Merchandise inventory 7,900 Sales revenue 3,800 C. Accounts receivable 3,800 Sales revenue 3,800 D. Accounts receivable 11,700 Sales revenue 11,700 Cost of goods sold 7,900 Merchandise inventory 7,900 Group of answer choices A. B. C. D.arrow_forwardSalmone Company reported the following purchases and sales of its only product. Salmone uses a perpetual inventory system. Determine the cost assigned to the ending inventory using FIFO. Date Activities Units Acquired at Cost Units Sold at Retail May 1 Beginning inventory 190 units @ $10 = $1,900 May 5 Purchase 260 units @ $12 = $3,120 May 10 Sales 180 units @ $20 May 15 Purchase 140 units @ $13 = $1,820 May 24 Sales 130 units @ $21 $3,500 $3,340 $3,370 $3,110 $3,380arrow_forward

- Bremmer uses a periodic inventory system and the following information is available: Sales Beginning Inventory Ending Inventory Purchases What is the cost of goods sold? Select one: Oa. $230,400 Ob. $96,800 Oc. $133,600 Od. $132,200 $ 230,400 21,200 19,800 132,200arrow_forwardanswer in text form please (without image), Note: .Every entry should have narration pleasearrow_forwardBeginning inventory, purchases, and sales data for portable game players are as follows: Apr. 1 Inventory 35 units @ $72 10 Sale 25 units 15 Purchase 46 units @ $75 20 Sale 26 units 24 Sale 8 units 30 Purchase 28 units @ $80 The business maintains a perpetual inventory system, costing by the last-in, first-out method. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 4. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Merchandise Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column. Schedule of Cost of Merchandise Sold LIFO Method Portable Game Players Date Quantity Purchased Purchases Unit Cost Purchases Total Cost Quantity Sold Cost of Merchandise Sold Unit Cost Cost of Merchandise Sold Total Cost Inventory Quantity Inventory Unit Cost…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education