FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

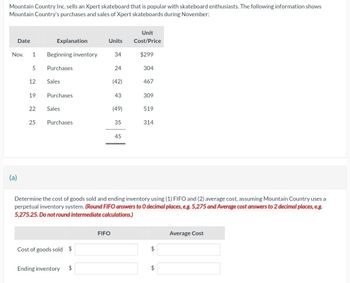

Transcribed Image Text:Mountain Country Inc. sells an Xpert skateboard that is popular with skateboard enthusiasts. The following information shows

Mountain Country's purchases and sales of Xpert skateboards during November:

Date

Nov.

(a)

1 Beginning inventory

5

12

19

22

Explanation

25

Purchases

Sales

Purchases

Sales

Purchases.

Cost of goods sold $

Ending inventory

Units

$

34

FIFO

24

(42)

43

(49)

35

45

Unit

Cost/Price

$299

304

467

Determine the cost of goods sold and ending inventory using (1) FIFO and (2) average cost, assuming Mountain Country uses a

perpetual inventory system. (Round FIFO answers to O decimal places, e.g. 5,275 and Average cost answers to 2 decimal places, e.g.

5,275.25. Do not round intermediate calculations.)

309

519

314

$

$

Average Cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- par.3arrow_forwardRequired information [The following information applies to the questions displayed below.] Cody's Fishing Hole has the following transactions related to its top-selling Shimano fishing reel for the month of June. Cody's Fishing Hole uses a periodic inventory system. Date June 11 June 7 June 12 June 15 June 241 June 27 June 29 Transactions Beginning inventory Sale Purchase Ending inventory Cost of goods sold Sale Purchase Sale Purchase Units Unit Cost $310 16 11 300 290 10 12 10 8 10 280 Total Cost $4,960 3,000 2,900 2,800 $13,660 Required: 1. Calculate ending inventory and cost of goods sold at June 30, using the specific identification method. The June 7 sale consists of fishing reels from beginning inventory, the June 15 sale consists of three fishing reels from beginning inventory and nine fishing reels from the June 12 purchase, and the June 27 sale consists of one fishing reel from beginning inventory and seven fishing reels from the June 24 purchase.arrow_forwardBuffalo Corp. sells a snowboard, EZslide, that is popular with snowboard enthusiasts. Below is information relating to Buffalo Corp.’s purchases of EZslide snowboards during September. During the same month, 103 EZslide snowboards were sold. Buffalo Corp. uses a periodic inventory system. Date Explanation Units Unit Cost Total Cost Sept. 1 Inventory 14 $110 $ 1,540 Sept. 12 Purchases 50 113 5,650 Sept. 19 Purchases 54 114 6,156 Sept. 26 Purchases 22 115 2,530 Totals 140 $15,876 (a) Compute the ending inventory at September 30 using the FIFO, LIFO and average-cost methods. (Round average cost per unit to 3 decimal places, e.g. 125.153 and final answers to 0 decimal places, e.g. 125.) FIFO LIFO AVERAGE-COST The ending inventory at September 30 $Enter a dollar amount $Enter a dollar amount $Enter a dollar amount (b) Compute the…arrow_forward

- Required information [The following information applies to the questions displayed below.] Sandra's Purse Boutique has the following transactions related to its top-selling Gucci purse for the month of October. Sandra's Purse Boutique uses a periodic inventory system. Date October 1 October 4 October 10 Transactions Beginning inventory Sale Purchase Sale Purchase Sale October 13 October 20 October 28 October 30 Purchase Ending inventory Cost of goods sold Units 6 4 5 3 4 7 8 Unit Cost $ 820 830 840 850 Total Cost $ 4,920 4,150 3,360 6,800 $19,230 Required: 1. Calculate ending inventory and cost of goods sold at October 31, using the specific identification method. The October 4 sale consists of purses from beginning inventory, the October 13 sale consists of one purse from beginning inventory and two purses from the October 10 purchase, and the October 28 sale consists of three purses from the October 10 purchase and four purses from the October 20 purchase.arrow_forwardBeginning inventory, purchases, and sales data for tennis rackets are as follows: April 3 Inventory 20 units @ $14 11 Purchase 14 units @ $15 14 Sale 26 units 21 Purchase 14 units @ $19 25 Sale 14 units Complete the inventory cost card assuming the business maintains a perpetual inventory system and determine the cost of goods sold and ending inventory using FIFO. Cost of Inventory Purchases Goods Sold Date Qty. Unit Cost Total Cost Qty. Unit Cost Total Cost Qty. Unit Cost Total Cost April 3 20 %24 14 11 14 15 20 $4 14 14 %24 $ 15 14 20 14 $ 21 14 19 24 %24 25 Total Cost of goods sold Ending inventory valuearrow_forwardBeginning inventory, purchases, and sales data for tennis rackets are as follows: April 3 Inventory 21 units @ $16 11 Purchase 17 units @ $15 14 Sale 21 Purchase 25 Sale Complete the inventory record assuming the business maintains a perpetual inventory system, and determine the cost of goods sold and ending inventory using FIFO. Cost of Goods Sold Unit Cost Cost of Goods Sold Total Cost Date April 3 11 14 21 25 28 units 10 units @ $18 13 units Balances Purchases Qty 17 10 Purchases Unit Cost 15 18 Purchases Total Cost 255 180 Cost of Goods Sold Qty 28 13 E 15.75 $ 441 Inventory Qty 21 21 10000 Inventory Unit Cost $ $ 16 16 000 Inventory Total Cost 6600 000 L 336 336arrow_forward

- Hans Inc. is a merchandising company that resells equestrian saddles. The company’s inventory data is as follows: Cost of Goods Available for Sale Jan. 1 Beginning Balance 3 units @ $200 = $600 Jan. 5 Purchase 2 units @ $400 = $800 Jan. 20 Purchase 3 units @ $500 = $1,500 Retail Sales of Goods Jan. 15 Sales 2 units @ $800 = $1,600 Jan. 31 Sales 1 units @ $1,000 = $1,000 For the January 15th sale, the company sold 1 unit that originally cost $200 and 1 unit that cost $400. For the January 31st sale, the 1 unit sold originally had a cost of $500. Using the Weighted Average method, the cost of goods sold for January would be: Answer formatting -when typing in your answer please include a dollar sign, a comma if necessary, use whole numbers, omit any periods, and make sure your response has no spaces. For example, $1,200arrow_forwardAssume that J R Toys store purchased and sold a line of dolls during December as follows: (Click the icon to view the transactions.) JR Toys uses the perpetual inventory system. More info Dec. 1 Beginning merchandise inventory 8 Sale 14 Purchase 21 Sale 13 7 14 13 units @ $ 8 each units @ $18 each units @ $ 16 each units @ $ 18 each. - X Requirements 1. Compute the cost of goods sold, cost of ending merchandise inventory, and gross profit using the FIFO inventory costing method. 2. Compute the cost of goods sold, cost of ending merchandise inventory, and gross profit using the LIFO inventory costing method. 3. Which method results in a higher cost of goods sold? 4. Which method results in a higher cost of ending merchandise inventory? 5. Which method results in a higher gross profit?arrow_forwardSolve all questionsarrow_forward

- S Mountain Country Inc. sells an Xpert skateboard that is popular with skateboard enthusiasts. The following information shows Mountain Country's purchases and sales of Xpert skateboards during November: Date Nov. 1 5 12 19 I 22 25 Explanation Beginning inventory Purchases Sales Purchases Sales Purchases Cost of goods sold $ Units 34 24 (42) 43 FIFO (49) 35 45 Unit Cost/Price $299 Determine the cost of goods sold and ending inventory using (1) FIFO and (2) average cost, assuming Mountain Country uses a perpetual inventory system. (Round FIFO answers to 0 decimal places, eg. 5,275 and Average cost answers to 2 decimal places, e.g. 5,275.25. Do not round intermediate calculations.) 304 467 309 519 314 68 L Average Costarrow_forwardBeginning inventory, purchases, and sales data for tennis rackets are as follows: April 3 Inventory 21 units @ $14 11 Purchase 13 units @ $17 14 Sale 27 units 21 Purchase 8 units @ $21 25 Sale 11 units Complete the inventory cost card assuming the business maintains a perpetual inventory system and determine the cost of goods sold and ending inventory using FIFO. Cost of Inventory Purchases Goods Sold Date Qty. Unit Cost Total Cost Qty. Unit Cost Total Cost Qty. Unit Cost Total Cost April 3 21 $ 14 $ 294 11 13 17 221 21 14 $ 294 13 $ 17 221 14 21 $ 14 2$ 294 17 102 21 8 21 168 $4 25 2$ 21 $4 168 3 21 63 Total Cost of goods sold $4 627 Ending inventory value %24 %24 %24 %24arrow_forwardDo not use EXCEL to type answers please write out answers and give explanations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education