FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

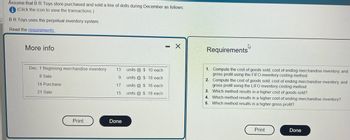

Transcribed Image Text:Assume that B R Toys store purchased and sold a line of dolls during December as follows:

(Click the icon to view the transactions.)

BR Toys uses the perpetual inventory system.

Read the requirements.

More info

Dec. 1 Beginning merchandise inventory 13

8 Sale

14 Purchase

9

17

15

21 Sale

Print

Done

units @ $10 each

units@ $ 18 each

units @ $ 16 each

units @ $ 18 each

- X

4

Requirements

1. Compute the cost of goods sold, cost of ending merchandise inventory, and

gross profit using the FIFO inventory costing method.

2. Compute the cost of goods sold, cost of ending merchandise inventory, and

gross profit using the LIFO inventory costing method.

3. Which method results in a higher cost of goods sold?

4. Which method results in a higher cost of ending merchandise inventory?

5. Which method results in a higher gross profit?

Print

Done

Expert Solution

arrow_forward

Step 1

“Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for you. To get remaining sub-part solved please repost the complete question and mention the sub-parts to be solved.”.

Perpetual inventory system is the one wherein the record of inventory is prepared on daily basis and not at the end of a specific period.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Units Sold at Retail Units Acquired at Cost 100 units @ $50 per unit 400 units@ $55 per unit Date Mar. Mar. Mar. Mar. 18 Purchase Mar. 25 Purchase Mar. 29 Sales Activities 1 Beginning inventory 5 Purchase 9 Sales 420 units @ $85 per unit 120 units @ $60 per unit 200 units @ $62 per unit 160 units @ $95 per unit Totals 820 units 580 units 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. For specific identification, the March 9 sale consisted of 80 units from beginning inventory and 340 units from the March 5 purchase; the March 29 sale consisted of 40 units from the March 18 purchase and 120 units from the March 25 purchase. es Complete this question by einering your answers in the tabs below. Perpetual FIFO Perpetual LIFO Weighted Average Specific Id Compute the cost assigned to…arrow_forwardDhapaarrow_forward! Required information [The following information applies to the questions displayed below.] Sandra's Purse Boutique has the following transactions related to its top-selling Gucci purse for the month of October. Sandra's Purse Boutique uses a periodic inventory system. Date October 1 October 4 October 10 October 13 October 20 October 28 October 30 Transactions Beginning inventory Sale Purchase Sale Purchase Sale Purchase Ending inventory Cost of goods sold Units Unit Cost 6 $ 890 4 5 3 4 7 6 900 910 920 Total Cost $5,340 4,500 3,640 5,520 $19,000 Using FIFO, calculate ending inventory and cost of goods sold at October 31.arrow_forward

- Please do not give solution in image format thankuarrow_forwardUramilabenarrow_forwardRequired information [The following information applies to the questions displayed below.] Sandra's Purse Boutique has the following transactions related to its top-selling Gucci purse for the month of October. Sandra's Purse Boutique uses a periodic inventory system. Date October 1 October 4 October 10 Transactions Beginning inventory Sale Purchase Sale Purchase Sale October 13 October 20 October 28 October 30 Purchase Ending inventory Cost of goods sold Units 6 4 5 3 4 7 8 Unit Cost $ 820 830 840 850 Total Cost $ 4,920 4,150 3,360 6,800 $19,230 Required: 1. Calculate ending inventory and cost of goods sold at October 31, using the specific identification method. The October 4 sale consists of purses from beginning inventory, the October 13 sale consists of one purse from beginning inventory and two purses from the October 10 purchase, and the October 28 sale consists of three purses from the October 10 purchase and four purses from the October 20 purchase.arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Sandra's Purse Boutique has the following transactions related to its top-selling Gucci purse for the month of October. Sandra's Purse Boutique uses a periodic inventory system. Date October 1 October 4 October 10 Transactions Beginning inventory Sale Purchase Sale Purchase October 13 October 20 October 28 Sale October 30 Purchase Ending inventory Cost of goods sold Units 6 4 5 3 4 7 8 Unit Cost $ 820 830 840 850 Total Cost $ 4,920 4,150 3,360 6,800 $19, 230 3. Using LIFO, calculate ending inventory and cost of goods sold at October 31.arrow_forwardAssume that J R Toys store purchased and sold a line of dolls during December as follows: (Click the icon to view the transactions.) JR Toys uses the perpetual inventory system. More info Dec. 1 Beginning merchandise inventory 8 Sale 14 Purchase 21 Sale 13 7 14 13 units @ $ 8 each units @ $18 each units @ $ 16 each units @ $ 18 each. - X Requirements 1. Compute the cost of goods sold, cost of ending merchandise inventory, and gross profit using the FIFO inventory costing method. 2. Compute the cost of goods sold, cost of ending merchandise inventory, and gross profit using the LIFO inventory costing method. 3. Which method results in a higher cost of goods sold? 4. Which method results in a higher cost of ending merchandise inventory? 5. Which method results in a higher gross profit?arrow_forwardpee Required information [The following information applies to the questions displayed below.] Sandra's Purse Boutique has the following transactions related to its top-selling Gucci purse for the month of October. Sandra's Purse Boutique uses a periodic inventory system. Cost per Date Transactions Units Unit Total Cost $ 4,620 Beginning inventory Sale October 1 6. October 4 4. October 10 Purchase 780 5. October 13 October 20 October 28 October 30 Sale 3. Purchase 3,160 4. Sale Purchase 008 $17,280 4. Using weighted-average cost, calculate ending inventory and cost of goods sold at October 31. (Do not round intermediat calculations. Round your final answers to 2 decimal places.) Ending inventory Cost of goods soldarrow_forward

- i need the answer quicklyarrow_forwardYou are provided with the following information for Geo Inc., which purchases its inventory from a supplier on account. All sales are also on account. Geo uses the FIFO cost formula in a perpetual inventory system. Increased competition has recently decreased the price of the product. Date Explanation Oct. 1 Beginning inventory 5 Purchases 8 Sales Purchases 15 20 Sales 26 Purchases Units 60 100 (120) 35 (60) 15 Unit Cost Price $140 130 200 120 160 110 Instructions (a) Prepare all journal entries for the month of October for Geo, the buyer. (b) Determine the cost of goods sold and ending inventory amount for Geo. (c) On October 31, Geo learns that the product has a net realizable value of $108 per unit. What amount should ending inventory be valued at on the October 31 statement of financial position? (d) Now assume that Geo uses the average cost formula in a perpetual inventory system. Determine the cost of goods sold and ending inventory amount for Geo, ignoring the effect of (c). (e)…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education