Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please provide this question solution general accounting

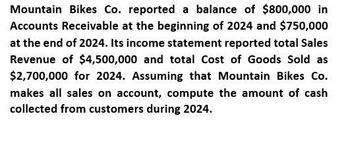

Transcribed Image Text:Mountain Bikes Co. reported a balance of $800,000 in

Accounts Receivable at the beginning of 2024 and $750,000

at the end of 2024. Its income statement reported total Sales

Revenue of $4,500,000 and total Cost of Goods Sold as

$2,700,000 for 2024. Assuming that Mountain Bikes Co.

makes all sales on account, compute the amount of cash

collected from customers during 2024.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Smoltz Company reported the following information for the current year: cost of goods sold, $252,500; increase in inventory, $21,700; and increase in accounts payable, $12,200. What is the amount of cash paid to suppliers that Smoltz would report on its statement of cash flows under the direct method? a. $218,600 c. $262,000 b. $243,000 d. $286,400arrow_forwardkany company reported net income of $78,000 and sales of $219,000at December 31, 2020, Kathy also reported beginning and ending accounts receivable at $20,000 and $25,000, respectively. Kathy will report cash collected from customers in its 2020 statement of cash flows (direct method) in the amount of:arrow_forwardCompany A's net credit sales in 2020 and 2021 are 21115 and 35118 respectively. Cost of sales in 2020 is 15432, and in 2021 is 17088. Company A'a account receivable in 2020 and 2021 are 500 and 1000 respectively and its inventory in 2020 and 2021 are 2839 and 3489 respectively. Company A's cash collections from customers in 2021 are:arrow_forward

- n its CASH BASIS income statement for the year ended June 30, 2020, Selena Corp. reported revenue of $142,000 (i.e., total cash receipts from sales). Additional information was as follows: Accounts receivable June 30, 2019 $40,000 Accounts receivable June 30, 2020 $45,600 Under the ACCRUAL basis, Selena Corp. should report sales revenue of A. $147,600 B. $102,000 C. $182,000 D. $136,400arrow_forwardSwifty Ltd. had the following 2023 income statement data: Revenues Expenses 1/1/23 Revenues $113,000 In 2023, Swifty had the following activity in selected accounts: 12/31/23 49,200 $63,800 Accounts Receivable 19,100 113,000 34,780 1,320 Write-offs 96,000 Collections Allowance for Expected Credit Losses Write-offs 1.320 Swifty Ltd. Statement of Cash Flows (Indirect Method) 1,300 1.540 1.520 1/1/23 Loss on impairment 12/31/23 Prepare Swifty's cash flows from operating activities section of the statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a negative sign e.g. -10,000 or in parenthesis eg. (10,000).arrow_forwardSuppose Columbia Sportswear Company had accounts receivable of $277,236,000 at January 1, 2022, and $237,235,000 at December 31, 2022. Assume sales revenue was $1,345,870,000 for the year 2022.What is the amount of cash receipts from customers in 2022?arrow_forward

- accarrow_forwardDuring 2020, A Company, a service organization, had P200,000 in cash sales and P3,000,000 in credit sales. The accounts receivable balances were P400,000 and P485,000 at December 31, 2019 and 2020, respectively. If A desires to prepare a cash basis income statement, how much should be reported as sales for 2020 on a cash basis?arrow_forwardBeyond Belief manufactures computer equipment and provides financing for purchases by its customers. Beyond Belief reported sales and interest revenues of $79,500 million for 2019. The balance sheet showed current and noncurrent receivables of $ 30,750 million at the beginning of 2019 and $ 26,900 million at the end of 2019. Compute the amount of cash collected from customers during 2019.arrow_forward

- Mahal Mo Co. reported revenue of P3,100,000 in its accrual basis income statement for the year ended December 31, 2020. Additional information are as follows: Accounts receivable, December 31, 2019, P700,000 and Accounts receivable, December 31, 2020, P1,100,000. Under the cash basis, how much should Mahal Mo Co. report as revenue for 2020? *arrow_forwardDuring August 2024, Helio Company recorded the following: • Sales of $91,400 ($77,000 on account, $14,400 for cash). Ignore Cost of Goods Sold • Collections on account, $63,700. • Write-offs of uncollectible receivables, $1,680. • Recovery of receivable previously written off, $700. Requirements Journalize Helio's transactions during August 2024, assuming Helio uses the direct write-off method. 1. 2. Journalize Helio's transactions during August 2024, assuming Helio uses the allowance method.arrow_forwardHamilton Company reported an increase of $400,000 in its accounts receivable during the year 2018. The company's statement of cash flows for 2018 reported $1.3 million of cash received from customers. What amount of net sales must Hamilton have recorded in 2018? 8 o11354 Multiple Cholce $900,000 $1700,000 $400.000 $1.300,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning