FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

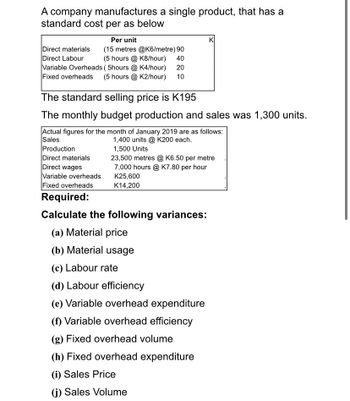

Transcribed Image Text:A company manufactures a single product, that has a

standard cost per as below

Direct materials

Direct Labour

Fixed overheads

Per unit

(15 metres @K6/metre) 90

(5 hours @K8/hour)

40

Variable Overheads (5hours @ K4/hour) 20

(5 hours @ K2/hour) 10

The standard selling price is K195

K

The monthly budget production and sales was 1,300 units.

Actual figures for the month of January 2019 are as follows:

Sales

Production

Direct materials

Direct wages

Variable overheads

Fixed overheads

Required:

1,400 units @ K200 each.

1,500 Units

23,500 metres @ K6.50 per metre

7,000 hours @ K7.80 per hour

K25,600

K14,200

Calculate the following variances:

(a) Material price

(b) Material usage

(c) Labour rate

(d) Labour efficiency

(e) Variable overhead expenditure

(f) Variable overhead efficiency

(g) Fixed overhead volume

(h) Fixed overhead expenditure

(i) Sales Price

(j) Sales Volume

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- At the end of November 2016, Caribbean Productions Ltd had 700 units of product BMR400 in store. For the month of December 2016, the company budgeted to produce 10,000 units of the product at a selling price of $2,500 each. Fixed administration and selling expenses were expected to be $1,500,000 and $1,000,000 respectively. During the month, the company produced 10,500 units of the product. On December 31, 2016, there were 1,100 units of the product on hand. The following cost information relating to the product was made available at the end of December 2016: Cost per unit Details $ Direct material 400 Direct labour 500 Variable production overheads 300 1,200 Fixed production overheads 150 Total 1,350 Required: (e) Explain to management the circumstance that would have to prevail for both methods to produce the same profit figures. (f) Reconcile the profits…arrow_forwardplease solve all requirementsarrow_forwardFor Rafael Inc. variable manufacturing overhead costs are expected to be $40,000 in the first quarter of 2020 with $4,000 increments in each of the remaining three quarters. Fixed overhead costs are estimated to be $35,000 in each quarter. Prepare the manufacturing overhead budget by quarters and in total for the year.arrow_forward

- To meet sales requirements and to have 2,500 units of finished goods on hand at December 31, 2020, the production budget shows 9,000 required units of output. The total unit cost of production is expected to be $18. Sandhill uses the first-in, first-out (FIFO) inventory costing method. Interest expense is expected to be $3,500 for the year. Income taxes are expected to be 40% of income before income taxes. In 2020, the company expects to declare and pay an $8,870 cash dividend. The company's cash budget shows an expected cash balance of $5,880 at December 31, 2020. All sales and purchases are on account. It is expected that 60% of quarterly sales are collected in cash within the quarter and the remainder is collected in the following quarter. Direct materials purchased from suppliers are paid 50% in the quarter incurred and the remainder in the following quarter. Purchases in the fourth quarter were the same as the materials used. In 2020, the company expects to purchase additional…arrow_forwardBexon company sells a product for RM730. Unit sales for May were 700 and each month's sales are expected to exceed the prior month's results by 3%. Compute the total sales amount to be reported on the sales budget for month ended June 30. 1.511,000 2.495,670 3.664,300 4.517,730 5.526,330arrow_forwardZed Inc., has the following details for the year ending 31st March, 2019 : Sales =24,000 units @ 200 per unit; P/V Ratio 25% and Break-even Point 50% of sales. Calculate: Fixed cost for the year Profit earned for the year Units to be sold to earn a target net profit of 11,00,000 for a yeararrow_forward

- Cap Incorporated manufactures ball point pens that sell at wholesale for $0.80 per unit. Budgeted production in both 2021 and 2022 was 13,000 units. There was no beginning inventory in 2021. The following data summarized the 2021 and 2022 operations: 2021 2022 Units sold 11,500 12,000 Units produced 13,000 13,000 Costs: Variable factory overhead per unit $ 0.15 $ 0.15 Fixed factory overhead $ 2,600 $ 2,600 Variable marketing per unit $ 0.30 $ 0.30 Fixed Selling and Administrative $ 320 $ 320 Full costing operating income for 2022 is calculated to be: (Do not round intermediate calculations. Round your final answers to whole dollar amounts.) Multiple Choice $1,480. $214. $2,150. $1,700. $1,518.arrow_forwardOn January 1, 2021 the Tata Steel Company budget committee has reached agreement on the following data for the 6 months ending June 30, 2021. Sales units: First quarter 25,000; second quarter 35,000; third quarter 30,000 Ending raw materials inventory 50% of the next quarter’s production requirements Ending finished goods inventory 20% of the next quarter’s expected sales units Direct Labor time per unit 1.6 hours per unit Direct labor rate per hour $12 per unit Three pounds of raw materials are required to make each unit of finished goods. Raw materials purchased are expected to cost $4 per pound. Instructions: Prepare a production budget by quarters for the 6-month period ended June 30, 2021. Prepare a direct materials budget quarter 1 ended March 30, 2021.…arrow_forwardThe production department of Zan Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year: Units to be produced 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 16,000 19,000 18,000 17,000 In addition, 16,000 grams of raw materials inventory is on hand at the start of the 1st Quarter and the beginning accounts payable for the 1st Quarter is $7,000. Each unit requires 4 grams of raw material that costs $1.80 per gram. Management desires to end each quarter with an inventory of raw materials equal to 25% of the following quarter's production needs. The desired ending inventory for the 4th Quarter is 5,000 grams. Management plans to pay for 60% of raw material purchases in the quarter acquired and 40% in the following quarter. Each unit requires 0.40 direct labor-hours and direct laborers are paid $12.50 per hour. Required: 1. and 2. Calculate the estimated grams of raw material that need to be purchased and the cost of raw material…arrow_forward

- Accounting This is the budget for the year ended 30 April 2021 for company XTZ Total production & sales = 2400units Selling price per unit = $1200 Variable manufacturing costs : Direct labour = $192 ; Direct material = $288 ; Overheads = $96 Fixed manufacture overheads = $216,960 Other : Fixed marketing & admin cost = $144,000 Sales commission = 5% 1) Calculate the total marginal income and net profit & loss if all units are sold 2) Use the marginal income ratio to work out the break even value 3) Calc the new total marginal income & net profit &loss if an increase of $50,000 in advertising costs increases sales by 200units 4) If the company earns a net profit of $298,920 ; How many units were sold 5) If expected sales volume is 2400units, what is the sales price per unit which will allow the company to break even?arrow_forwardGHI Company manufactures two products that sell to the same market. Its budget and operating results for 2021 are as follows: Budgeted Actual Unit sales Product A 30,000 35,000 Product B 60,000 65,000 Unit contribution margin Product A P 4.00 P 3.00 Product B PI0.00 P12.00 Unit selling price Product A PI0.00 P12.00 Product B P25.00 P24.00 Industry volume was estimated to be 1,500,000 units at the time the budget was prepared. Actual industry volume for the period was 2,000,000 units. The market size contribution margin variance is Select one: a. P240,000 U O b. P240,000 F c. P160,000 F d. PI60,000 Uarrow_forwardA e Y l 31% O 12:45 LTE abc SAVE Тext Pen Brush A company has a Deferred Tax Asset of $35,000. Now, the government has just changed the statutory tax rate from 35% to 30% effective immediately. What is the correct journal entry to record the impact of this tax rate change? Dr. Deferred Tax Assets 5000 Cr. Income Tax Payable 5000 Dr. Income Tax Payable 5000 Cr. Deferred Tax Assets 5000 Dr. Income Tax Expense 5000 Cr. Deferred Tax Assets 5000 Dr. Income Tax Expense 5000 Cr. Income Tax Payable 5000 Dr. Deferred Tax Assets 5000 Cr. Income Tax Expense 5000 В I U !!! !!!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education