ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

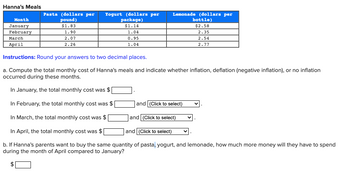

Transcribed Image Text:**Hanna's Meals**

| Month | Pasta (dollars per pound) | Yogurt (dollars per package) | Lemonade (dollars per bottle) |

|-----------|----------------------------|------------------------------|-------------------------------|

| January | $1.83 | $1.14 | $2.58 |

| February | 1.90 | 1.04 | 2.35 |

| March | 2.07 | 0.95 | 2.54 |

| April | 2.26 | 1.04 | 2.77 |

**Instructions**: Round your answers to two decimal places.

a. Compute the total monthly cost of Hanna's meals and indicate whether inflation, deflation (negative inflation), or no inflation occurred during these months.

- In January, the total monthly cost was $ _______ .

- In February, the total monthly cost was $ _______ and (Click to select) ___________.

- In March, the total monthly cost was $ _______ and (Click to select) ___________.

- In April, the total monthly cost was $ _______ and (Click to select) ___________.

b. If Hanna's parents want to buy the same quantity of pasta, yogurt, and lemonade, how much more money will they have to spend during the month of April compared to January?

$_______

![### Hanna's Meals Expense Calculation

Hanna, who is a 5-year-old girl, eats nothing but pasta, yogurt, and lemonade. Each month her parents buy 32 pounds of pasta, 79 packages of yogurt, and 22 bottles of lemonade. Hanna's parents have recorded the prices per unit of pasta, yogurt, and lemonade for the last four months, as shown in the table below.

#### Hanna's Meals

| Month | Pasta (dollars per pound) | Yogurt (dollars per package) | Lemonade (dollars per bottle) |

|----------|----------------------------|------------------------------|-------------------------------|

| January | $1.83 | $1.14 | $2.58 |

| February | 1.90 | 1.04 | 2.35 |

| March | 2.07 | 0.95 | 2.54 |

| April | 2.26 | 1.04 | 2.77 |

#### Instructions:

Round your answers to two decimal places.

a. Compute the total monthly cost of Hanna's meals and indicate whether inflation, deflation (negative inflation), or no inflation occurred during these months.

- In January, the total monthly cost was \$______ .

- In February, the total monthly cost was \$______ and [Click to select].

- In March, the total monthly cost was \$______ and [Click to select].

- In April, the total monthly cost was \$______ and [Click to select].

b. If Hanna's parents want to buy the same quantity of pasta, yogurt, and lemonade, how much more money will they have to spend during the month of April compared to January?

- \$______

### Detailed Explanation:

To solve these problems, follow these steps:

#### a. Calculate Monthly Costs:

1. **January:**

- Pasta: 32 pounds * $1.83 per pound

- Yogurt: 79 packages * $1.14 per package

- Lemonade: 22 bottles * $2.58 per bottle

2. **February:**

- Pasta: 32 pounds * $1.90 per pound

- Yogurt: 79 packages * $1.04 per package

- Lemonade: 22 bottles * $2.35 per bottle

3. **March:**

- Pasta: 32](https://content.bartleby.com/qna-images/question/8fd4da40-7187-46ad-a720-1a755a4a2f27/903436e4-07a8-4096-8a8b-3b7b9990c71f/k0zzwg_thumbnail.png)

Transcribed Image Text:### Hanna's Meals Expense Calculation

Hanna, who is a 5-year-old girl, eats nothing but pasta, yogurt, and lemonade. Each month her parents buy 32 pounds of pasta, 79 packages of yogurt, and 22 bottles of lemonade. Hanna's parents have recorded the prices per unit of pasta, yogurt, and lemonade for the last four months, as shown in the table below.

#### Hanna's Meals

| Month | Pasta (dollars per pound) | Yogurt (dollars per package) | Lemonade (dollars per bottle) |

|----------|----------------------------|------------------------------|-------------------------------|

| January | $1.83 | $1.14 | $2.58 |

| February | 1.90 | 1.04 | 2.35 |

| March | 2.07 | 0.95 | 2.54 |

| April | 2.26 | 1.04 | 2.77 |

#### Instructions:

Round your answers to two decimal places.

a. Compute the total monthly cost of Hanna's meals and indicate whether inflation, deflation (negative inflation), or no inflation occurred during these months.

- In January, the total monthly cost was \$______ .

- In February, the total monthly cost was \$______ and [Click to select].

- In March, the total monthly cost was \$______ and [Click to select].

- In April, the total monthly cost was \$______ and [Click to select].

b. If Hanna's parents want to buy the same quantity of pasta, yogurt, and lemonade, how much more money will they have to spend during the month of April compared to January?

- \$______

### Detailed Explanation:

To solve these problems, follow these steps:

#### a. Calculate Monthly Costs:

1. **January:**

- Pasta: 32 pounds * $1.83 per pound

- Yogurt: 79 packages * $1.14 per package

- Lemonade: 22 bottles * $2.58 per bottle

2. **February:**

- Pasta: 32 pounds * $1.90 per pound

- Yogurt: 79 packages * $1.04 per package

- Lemonade: 22 bottles * $2.35 per bottle

3. **March:**

- Pasta: 32

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Is Perform these same calculations for 2020 and 2021, and enter the results in the following table. Notebooks Calculators Large coffees Energy drinks Textbooks Total cost Price index Quantity in Basket 10 1 200 100 10 5 5 Suppose the base year for this price index is 2019. C Between 2019 and 2020, the CSPI increased by $ Price (Dollars) 2 50 1 2 100 5 5 2019 Cost (Dollars) 20 50 200 200 1,000 % 1,470 100 % Price (Dollars) 1 54 1 3 120 In the last row of the table, calculate and enter the value of the CSPI for the remaining years. 5 5 G Search or type URL 2020 Cost (Dollars) Between 2020 and 2021, the CSPI increased by Which of the following, if true, would illustrate why price indexes such as the CSPI might overstate inflation in the cost of going to colleg that apply. MacBook Pro & 7 A new mobile device for personal computing became available for purchase. Professors required each student to buy 10 textbooks, regardless of the price. As the price of calculators rose, fewer students…arrow_forwardIn 2000, the federal minimum hourly wage was $5.15. 2000 CPI=172.2 2016 CPI=240.0 (a) Find the inflation rate from 2000 to 2016 as measured by the CPI. (b) Complete the sentence: “If adjusted for inflation, the federal minimum hourly wage would increase from $5.15 to $_________________ in 2016.” Show how you got this. (c) The current federal minimum hourly wage is $7.25. As measured by the CPI, has the minimum wage kept up with inflation? Explain.arrow_forwardTyped plzarrow_forward

- Assume that the top 3 yearly purchases of the average college student are: Gel ink pens (10 pens), energy drinks (200 cans), and Hydro Flask water bottles (1). Calculate the cost of the basket in each year. Year Price of Price of Price of pens Hydro Flask 2015 $2.00 2016 $2.85 2017 $2.90 2018 $3.00 energy drinks Answer: 1.90 1.90 1.95 2.00 35 40 45 55 What is the cost of the basket in 2016? Cost of Basketarrow_forwardQUESTION 6 Price of Beni's house increased from S100,000 to $200,000 in the last decade. Cost of living quadrupled (increased 4 times as much). What can you say about Beni's house? O The house is cheaper now, because if it had appreciated at the same rate as all other goods as services, it should have been 4 times more ($400,000) but it is $200,000 instead. Nominal price has inereased but also nominal prices of other goods have increased. So, the price costs the same. The house is more expensive now, comparing $200,000 to $100,000 We do not have enough information to compare prices across time.arrow_forwardSuppose you lent money to a friend a few years ago at a nominal interest rate of 6%. At the time ot he loan, you expected the annual inflation rate to be 2%, but the actual annual inflation rate was 1.2%. When the loan originated, you expected to earn a real return of but due to unexpected disinflation, you earned an actual real return of A. 2%; 1.2% OB. 4.8%; 6% C. 6%; 4.8% D. 4%; 4.8%arrow_forward

- 5. Interest, inflation, and purchasing power Suppose Diamond is a sports fan and buys only football tickets. Diamond deposits $4,000 into a savings account that pays an annual nominal interest rate of 10%. Assume this interest rate is fixed, and so it will not change over time. On the day she makes her deposit, suppose that a football ticket has a price of $20.00. Initially, Diamond's $4,000 deposit has a purchasing power of football tickets. For each of the annual inflation rates given in the following table, first determine the new price of a football ticket, assuming it rises at the rate of inflation. Then enter the corresponding purchasing power of Diamond's deposit after one year in the first row of the table for each inflation rate. Finally, enter the value for the real interest rate at each of the given inflation rates. Hint: Round your answers in the first row down to the nearest football ticket. For example, if you find that the deposit will cover 20.7 football tickets, you…arrow_forward2a. Compute the price index for each year. Use the first year as the base year. What was the inflationrate between the two years.Item Quantity Unit Price-Last Year Unit Price-This YearCoffee 20 pounds $3.00 $4.00Tuition 1 year 4,000.00 7,000.00Pizza 100 pizzas 8.00 10.00VCR rental 75 days 15.00 10.00Vacation 2 weeks 300.00 500.00arrow_forwardYear Price of Pizza Price of Beer 2010 $10 $15 2011 $12 $16 2012 $14 $17 Table 2. Let 2010 be the base yearUse the following market basket: 100 pizzas 300 cases of beerRefer to Table 2. What is the rate of inflation between 2010 and 2011? Question 23 options: a) 12% b) 5% c) 100% d) 9%arrow_forward

- 8. Interest, inflation, and purchasing power Suppose Devon is an avid reader and buys only reusable tote bagses. Devon deposits $3,000 into a savings account that pays an annual nominal interest rate of 15%. Assume this interest rate is fixed, and so it will not change over time. On the day she makes her deposit, suppose that a reusable tote bags has a price of $15.00. Initially, Devon's $3,000 deposit has a purchasing power of 9 reusable tote bagses. For each of the annual inflation rates given in the following table, first determine the new price of a reusable tote bags, assuming it rises at the rate of inflation. Then enter the corresponding purchasing power of Devon's deposit after one year in the first row of the table for each inflation rate. Finally, enter the value for the real interest rate at each of the given inflation rates. Hint: Round your answers in the first row down to the nearest reusable tote bags. For example, if you find that the deposit will cover 20.7 reusable…arrow_forwardNo AI answershould not found plagiarism in your answerarrow_forwardOnly typed answer and don't use chat gptarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education