ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

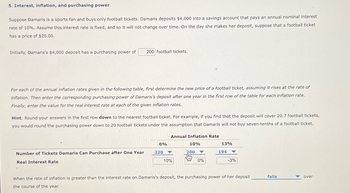

Transcribed Image Text:5. Interest, inflation, and purchasing power

Suppose Damaris is a sports fan and buys only football tickets. Damaris deposits $4,000 into a savings account that pays an annual nominal interest

rate of 10%. Assume this interest rate is fixed, and so it will not change over time. On the day she makes her deposit, suppose that a football ticket

has a price of $20.00.

Initially, Damaris's $4,000 deposit has a purchasing power of 200 football tickets.

For each of the annual inflation rates given in the following table, first determine the new price of a football ticket, assuming it rises at the rate of

inflation. Then enter the corresponding purchasing power of Damaris's deposit after one year in the first row of the table for each inflation rate.

Finally, enter the value for the real interest rate at each of the given inflation rates.

Hint: Round your answers in the first row down to the nearest football ticket. For example, if you find that the deposit will cover 20.7 football tickets,

you would round the purchasing power down to 20 football tickets under the assumption that Damaris will not buy seven-tenths of a football ticket.

Number of Tickets Damaris Can Purchase after One Year

Real Interest Rate

0%

220

Annual Inflation Rate

10%

10%

200

Imm

0%

13%

194

-3%

When the rate of inflation is greater than the interest rate on Damaris's deposit, the purchasing power of her deposit

the course of the year.

falls

over

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 13 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose you have $150,000 in a bank term account. You earn 5% interest per annum from this account. You anticipate that the inflation rate will be 3% during the year. However, the actual inflation rate for the year is 6%. Calculate the impact of inflation on the bank term deposit you have. ii. Examine the effects of inflation in your city of residence with attention to food and accommodation expenses. iii. The Australian Bureau of Statistics (ABS) reported in May 2016 that the civilian population in Australia over 15 years of age was 19.8 million. Of this population of 19.8 million Australians, 12.5 million were employed and 0.7 million were unemployed. Calculate Australia’s labor force and the number of people in the civilian population who were not in the labor force?arrow_forwardThe first two columns of the table below describe the goods and quantities included in your current monthly consumption. Suppose you have been able to use all of your monthly income (no savings) to afford this level of fixed consumption over the last few years despite the increase in the cost of living. • Round all expenditure calculations to the nearest dollar. • Round CPI and inflation (expressed as an integer) to 1 decimal place. • Carry your rounded figures throughout the rest of the problem. 2018 2019 2020 Basket Prices Prices Item Prices Quantities Meal Kit Delivery $106.00 8 $107.00 $110.25 $48.25 $50.00 $46.00 $53.00 Water 16 Hydro Electricity 14 $56.90 $58.75 Dry cleaning $62.00 10 $64.75 $68.00 Entertainment $26.00 17 $28.75 $32.80 Part (a): Using the quantities specified in the 2018 basket of goods, calculate the CPI for 2018, 2019 and 2020. Part (b): What is the inflation rate between 2018 and 2019? 2019 and 2020? Part (c): Suppose inflation is expected to remain constant…arrow_forward2. According to an old myth, native Americans sold the island of Manhattan about 400 years ago for $24. If they had invested this amount at an interest rate of 10% per year and average inflation rate of 2.5%, how much would they have today in real values?arrow_forward

- 5. Interest, inflation, and purchasing power Suppose Diamond is a fan of young-adult fiction and buys only young-adult books. Diamond deposits $2,000 into a savings account that pays an annual nominal interest rate of 10%. Assume this interest rate is fixed, and so it will not change over time. On the day she makes her deposit, suppose that a young-adult book has a price of $20.00. Initially, Diamond's $2,000 deposit has a purchasing power of young-adult books. For each of the annual inflation rates given in the following table, first determine the new price of a young-adult book, assuming it rises at the rate of inflation. Then enter the corresponding purchasing power of Diamond's deposit after one year in the first row of the table for each inflation rate. Finally, enter the value for the real interest rate at each of the given inflation rates. Hint: Round your answers in the first row down to the nearest young-adult book. For example, if you find that the deposit will cover 20.7…arrow_forward5. Interest, inflation, and purchasing power Suppose Amy is a cinephile and buys only movie tickets. Amy deposits $2,000 in a bank account that pays an annual nominal interest rate of 5%. Assume this interest rate is fixed-that is, it won't change over time. At the time of her deposit, a movie ticket is priced at $20.00. Initially, the purchasing power of Amy's $2,000 deposit is movie tickets. For each of the annual inflation rates given in the following table, first determine the new price of a movie ticket, assuming it rises at the rate of inflation. Then enter the corresponding purchasing power of Amy's deposit after one year in the first row of the table for each inflation rate. Finally, enter the value for the real interest rate at each of the given inflation rates. Hint: Round your answers in the first row down to the nearest movie ticket. For example, if you find that the deposit will cover 20.7 movie tickets, you would round the purchasing power down to 20 movie tickets under…arrow_forwardSuppose Damaris is a sports fan and buys only football tickets. Damaris deposits $2,000 into a savings account that pays an annual nominal interest rate of 10%. Assume this interest rate is fixed, and so it will not change over time. On the day she makes her deposit, suppose that a football ticket has a price of $10.00. Initially, Damaris's $2,000 deposit has a purchasing power of football tickets. For each of the annual inflation rates given in the following table, first determine the new price of a football ticket, assuming it rises at the rate of inflation. Then enter the corresponding purchasing power of Damaris's deposit after one year in the first row of the table for each inflation rate. Finally, enter the value for the real interest rate at each of the given inflation rates. Hint: Round your answers in the first row down to the nearest football ticket. For example, if you find that the deposit cover 20.7 football tickets, you would round the purchasing power down to 20 football…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education